Dive in and learn how you can gain a competitive edge by maximizing your cash flow efficiency, reducing costs and increasing profitability in today's dynamic business environment.

The First Connected Finance Operations Platform

AI-powered tactical finance that connects order-to-invoice, A/R management, cash application, and A/P timing to a 13-week cash flow.

Cash Management For Workday

Upgrade your entire collections management process with the most powerful cash management platform. Tesorio's certified integration with Workday provides enhanced capabilities and automation to your finance team.

Increase collection team efficiency by 50%

Understand your entire collections situation in a single view

Reduce DSO & aging accounts

Reduce time to build cash flow forecasting from days or weeks to hours

Enable CFOs to make better working capital decision, faster

Features Columns - different layouts/and usage below

Allows you to place up to 4 columns

Select the Demo That's Right For You

-

Personalized 1:1 Demo

Schedule a customized walk-through of Tesorio's platform tailored to your organization. -

Group Demo

Join a live walkthrough by our Solution Consultants together with other financial professionals so you can learn from each other. -

Recorded Overview

Sit back, relax and watch a brief overview of Tesorio.

AR Forecast saves you time and helps you run more effectively.

-

Accounts Receivable Forecasting

Get rid of the time-consuming Excel spreadsheets you use to forecast, track and analyze collections. See all your current and future invoices in one place. Use AI powered predictions to provide accurate and automatic insights. -

Real-Time Cash Tracking

Start your day with a real-time view of where your collections stand. Track the progress of your collections against your forecast target. Identify problems earlier. Gain confidence in your forecast, and identify and follow up on risks. -

Direct your team better.

Track your forecast and collections across your team. Help them focus and prioritize. Keep on top of your team's progress; no more waiting for them to report on their collections. -

Enable your collectors.

Your team can see their assigned collections, prioritize their work, understand what's expected of them and track their performance.

A Complete and Accurate Picture of Financial Performance

-

Enhanced Collaboration

Enable cross-functional collaboration and streamlined information sharing via a single configurable dashboard. -

Better Collections Management

Streamline and automate collections by providing actionable insights to prioritize efforts, enabling businesses to reduce DSO, improve cash flow, and collect cash faster. -

Increase Efficiency

Automate tedious and time-consuming routine financial tasks like invoice tracking, predictions and cash collection -

Improve Cash Flow Predictability

Tesorio's AI-based predictions provide real-time insights into financial metrics like cash flow and revenue, so you get a clearer picture of when payments are coming.

We Keep It Simple for B2B Finance Teams

-

Intuitive Interfaces

When it comes to usability, Tesorio is second to none. -

Aggregated Data

Aggregate cash data from all disparate systems, including ERP, into a single, intuitive platform with our unified solution. -

Long-Term Optimization

Control your cash today to focus on longer-term objectives. -

ERP & Bank Integrations

Instantly connect to your financial systems of record.

Example of how tihs is used

-

Here is an example of what this text looks like Here is an example of what this text looks like Here is an example of what this text looks like

-

Here is an example of what this text looks like Here is an example of what this text looks like

-

Here is an example of what this text looks like Here is an example of what this text looks like

-

Here is an example of what this text looks like Here is an example of what this text looks like

FAQ

-

Can we connect Tesorio into our existing NetSuite Account?

Yes, Tesorio has a NetSuite integration using SuiteScript and SuiteTalk REST web services in combination with SuiteQL.

Connecting Tesorio to your NetSuite account requires a few easy steps to enable API and Tesorio Role access and install the Tesorio bundle with preconfigured permissions.

-

Is there any cost or license fees to integrate with Tesorio?

The Tesorio integration does not require any licensing or setup fees from NetSuite. Customers contract directly with Tesorio for access to Accounts Receivable Automation functionality.

-

How long does it take to connect my NetSuite account to Tesorio?

Tesorio’s instructions to connect and set up permissions within your NetSuite account are easy to follow and with Tesorio’s FASTconnect™ onboarding methodology, customers are up and running in days, if not hours.

-

How much historical data is available in Tesorio?

During your initial data sync, Tesorio pulls in 2 years of historical customer and invoice data.

Testimonial Layouts

A/R Platform Testimonials

-

Not having Tesorio would be like me not having my iPhone. It isn’t even a concept I would like to consider.

Greg Henry, CFO of Couchbase

-

Tesorio has reduced time spent on lower priority accounts from 25% of the week to less than two hours per week.

Michael Renner, Credit and Collections Leader at Veeva

-

At Slack we've needed only two people in collections as we scaled to thousands of customers because we use Tesorio.

Steven Odell, Credit & Collections Leader at Slack

-

I used to spend two days each week chasing money. Now I spend half a day focused solely on our high priority clients. I can't tell you how much easier Tesorio has made my life.

Victoria Vetrova, Finance Leader

-

I used to put off collections until last because it was so tedious. Tesorio has made it so easy that now it's the first thing I do every day. We even reduced our Average Days Delinquent by more than 30%

Tara Kelly, Order to Cash Operations Lead

-

That's the beauty of Tesorio— through the scalability of the software, we've had the opportunity to reach out to customers in a way we never had before, giving them 'white-glove' treatment in a stressful and uncertain time.

Kevin Beam, Credit & Collections Leader

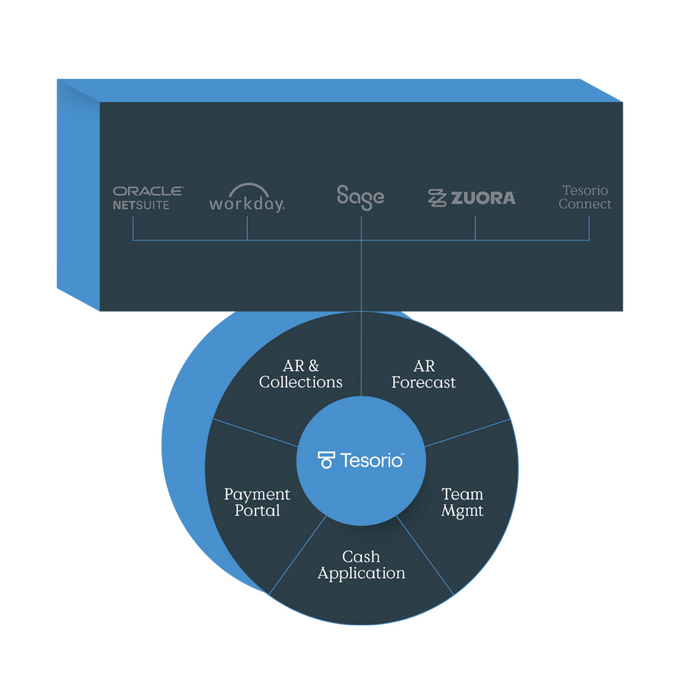

Supercharge your ERP investment

ERPs are invaluable tools for finance organizations to collect and store financial data. For many finance teams, they are one of their largest technology investments. Unfortunately, they just aren’t made with cash flow performance in mind. Tesorio helps you get more value out of your ERP by aggregating your cash data for a single actionable cash view of your business.

The numbers don’t lie.

33 days

3x

$200M

94%

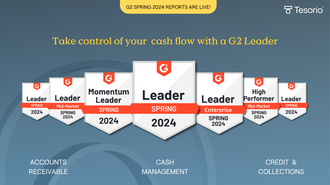

Badges & Logos

Curated by Tesorio A Brand Trusted By The Top B2B Finance Teams

Powering Cash Flow For Businesses to Process $47 Billion in AR

FORMS & CTAS

Complete this form to submit a job to our job board.

Get started with Tesorio now.

Take Your Finance Team to the Next Level

Unlock Oracle NetSuite ERP's Full Potential

Elevate Your NetSuite Game with Tesorio's Powerful Cash Flow Management Tool

Upgrade your entire collections management process with the most powerful AR automation platform. Tesorio's complete integration with NetSuite provides enhanced AR Capabilities and automation to your finance team.

- Increase collection team efficiency by 50%

- understand your entire collections situation in a single view

- Reduce DSO & aging accounts.

- Reduce Time to build cash flow forecasting from days or weeks to hours.

- Enable CFOs to make better working capital decision, faster.

There's no better way to understand Tesorio's capabilities than seeing for yourself. Discover firsthand how Tesorio can revolutionize your AR process. What are you waiting for? Schedule your free demo today.

Single View of All Your AR Data

Text Columns with Image

Examples

Here is an exmaple

Here is an Example

This is an Example

This is an example

AR Forecast saves you time and helps you run more effectively.

-

Accounts Receivable Forecasting

Get rid of the time-consuming Excel spreadsheets you use to forecast, track and analyze collections. See all your current and future invoices in one place. Use AI powered predictions to provide accurate and automatic insights. -

Real-Time Cash Tracking

Start your day with a real-time view of where your collections stand. Track the progress of your collections against your forecast target. Identify problems earlier. Gain confidence in your forecast, and identify and follow up on risks. -

Direct your team better.

Track your forecast and collections across your team. Help them focus and prioritize. Keep on top of your team's progress; no more waiting for them to report on their collections. -

Enable your collectors.

Your team can see their assigned collections, prioritize their work, understand what's expected of them and track their performance.

YOUR RETURN ON INVESTMENT WITH TESORIO

Calculation Confidence

This specific design has a clickable image. Code is in the Globals section and can only be used for this circle graph

Cash Flow Performance Suite

Revitalize and Streamline Your Order-to-Cash and Treasury Cash Management Processes. Take a Deeper Dive into Tesorio's Comprehensive Cash Flow Performance Suite to Determine Its Ideal Suitability for Your Needs.

19%

50%

2.25%

90%

Meet Tesorio

We’re a distributed team of data scientists, developers, and finance geeks who all love to make products that are easy to use and backed by cutting edge machine learning. We take a lot of pride in what we do, and we have fun while doing it.

-

Featured Article

Insights

Breaking Down the Reasons Your Customers Aren’t Paying You-

Insights

Collections is about Connections -

Insights, Blog

How to Make Your AR Recession-Proof -

Insights

Cash Inflows and Outflows: Is Your Company Vulnerable? -

Insights, Blog

Unlocking the Deeper Business Objectives Driving Financial Transformation -

Insights

On-Demand Cash View Uncovers Hidden Revenue Opportunities and More -

Insights

Customize Collection Email Campaigns to Enhance Your Cash Flow: Personalize Your Message -

Insights

Customize Collection Email Campaigns to Enhance Your Cash Flow: Categorize Your Audience -

Insights

Customize Collection Email Campaigns to Enhance Your Cash Flow: Analyze and Drive Results -

Insights

The True Costs of Relying on Manual Accounts Receivable -

Insights

COVID-19’s Lesson: Elevate Your Organization’s Liquidity IQ -

Insights

The CFO’s Strategic Framework for Digitizing Finance -

Insights

Is Your Customer a Credit Risk? Don’t Wait for the Collections Process to Find Out -

Insights

What Unfortunate Messages Do Your Invoices Send to Your Customers? -

Insights

The CFO’s Board Meeting Checklist -

Insights

The Potential Driving the Usage-Based Pricing Trend -

Insights

Want Customers to Pay Faster? Make Each Customer Touchpoint Count -

Insights

Your Customer Experience Plan is Incomplete -

Insights

Your Sales Department Benefits from On-Demand Cash View, Too -

Insights

Cash Flow Best Practices When Managing a Hybrid Workforce -

Insights

The 2021 Finance Organization -

Insights

Digital Prosperity Amid Global Uncertainty -

Insights

Amid Good Times and Uncertainty, CFOs Can Provide Insights Across The Business -

Insights

For CFOs, One Dollar in The Hand is Worth Two in The Valley -

Insights

Gain 3x More Time To Build Great Customer Relationships With Collections Automation -

Insights

5 Tips for Finance to Thrive While Working Remotely -

Insights

3 Lessons Today’s CFOs Can Learn From The 2007 Recession -

Insights

Strategies for Collections Teams in a Crisis—The Frontlines of Cash Flow Q&A -

Insights

Predicting Collections Activity -

Insights

Q&A with 3 CFOs: How to Guide Your Business Forward During Uncertainty

-

-

Featured Article

Cash Flow 101

Navigating Inflows and Outflows: Essential Strategies for Stable and Healthy Cash Flow-

Cash Flow 101

Maximizing Business Potential Through Expert Cash Flow Forecasting -

Cash Flow 101

Cash Flow Forecasting Made Easier? -

Cash Flow 101

Why Traditional Cash Forecasts Aren’t Sufficient -

Cash Flow 101, Blog

10 Effective Strategies and Techniques to Elevate Your Accounts Receivable Forecasting -

Cash Flow 101, Cash Management

The Modern CFO: Revolutionizing Cash Flow and Spend Management -

Cash Flow 101

What Collections and Accounts Receivable Teams Should Know About DSO -

Cash Flow 101, Blog

The Mysteries of Accounts Receivable: Is A/R a Liability or Asset? -

Cash Flow 101

A Guide to Calculating, Analyzing, and Optimizing AR Turnover -

Cash Flow 101

5 Ways Artificial Intelligence (AI) Can Revolutionize Cash Flow Management and Performance -

Cash Flow 101

What’s the Difference Between Indirect and Direct Cash Flow Forecasting? -

Cash Flow 101

Choosing Your Path to Profit: Demystifying the 3 Leading Revenue Models for Businesses -

Cash Flow 101, Blog

How to Maximize Real Estate Cash Flow -

Cash Flow 101, Blog

The Best Finance Excel Templates for the Office of the CFO -

Cash Flow 101, Blog

Efficient Cash Flow is Essential for Wholesale Distribution Companies -

Cash Flow 101, Blog

Calculating Accounts Receivable Turnover to Improve Your A/R Ratio -

Cash Flow 101

You Are Not Alone: Common Problems with Cash Flow Forecasting -

Cash Flow 101

Eight Steps to An Effective Collections Email Campaign -

Cash Flow 101

5 Major Growth Initiatives You Can Tackle When You’re Free Cash Flow Positive -

Cash Flow 101

Solving the Cash Flow Forecasting Problem -

Cash Flow 101

4 Innovative Ways to Cultivate Cash Flow Literacy in Your Organization -

Cash Flow 101

5 Cash Flow Best Practices When Preparing for Future Disruption -

Cash Flow 101

Tips for Dunning During COVID-19 -

Cash Flow 101

Four Collections Templates: A Starter Pack for Collections And AR Teams

-

Featured Article

Guest Posts

4 Steps to Proactively Forecast Bad Debt During Volatility-

Guest Posts

Three Tips for Collecting From Difficult Customers Faster -

Guest Posts

Why Finance and Collections Need Their Own CRM - Lessons from Icertis -

Guest Posts

A Treasurer’s Step-by-Step Guide to Adopting a Direct Cash Flow Forecast -

Guest Posts

Collaborate Across Teams Via AR Automation to Foster Stronger Customer Relationships -

Guest Posts

The CFO’s Recipe for a Successful Accounts Receivable Team -

Guest Posts

Five Clear Signs That It Is Time To Upgrade Your AR System -

Guest Posts

How Veeva Systems Used AR Technology From Tesorio To Improve Collections

-

Featured Article

Tesorio News

Stay Ahead with AP Portal Monitoring by Tesorio-

Tesorio News

Tesorio Celebrates Key Wins in G2's Summer 2024 Report: Leading the Way in Connected Finance Operations -

Tesorio News

Celebrating a Culture of Innovation: Tesorio Named a 2024 Inc. Best Workplace Winner -

Tesorio News

Tesorio's Product Highlights: AR Automation & Cash Flow Management Innovations -

Tesorio News

Tesorio: Leading the Way in Cash Flow Innovation and G2’s 2024 Spring Report -

Tesorio News

Cash Flow Excellence: Tesorio Wins Third G2 Best Software Award -

Tesorio News

A Year of Innovation: Tesorio’s 2023 Recap -

Tesorio News

Unveiling Tesorio's 2023 Wrapped: Our Customers' Year in Numbers -

Tesorio News

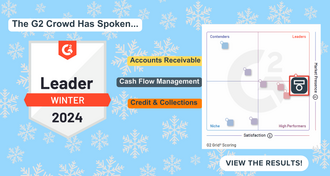

G2 Affirms Tesorio's Dominance in Cash Flow Management, Credit & Collections and Accounts Receivable with Winter Report -

Tesorio News

Tesorio Secures Its Place on the 2023 Deloitte Technology Fast 500™ List -

Tesorio News

Tesorio Completes Workday Certified Integration & Joins Workday Ventures Portfolio -

Tesorio News

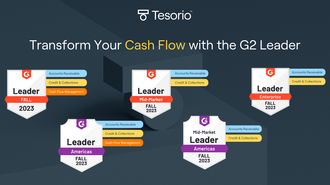

Redefining the Future of Cash Flow: Tesorio Tops G2's Fall 2023 Reports -

Tesorio News

Tesorio's Remarkable Growth Lands Them on the Inc. 5000 List -

Tesorio News

The San Francisco Chronicle Names Tesorio a Winner of the Top Workplace Award for 2023 -

Tesorio News

Empowering Finance Teams: Tesorio's Q2 Highlights -

Tesorio News

Driving Financial Success: Tesorio Continues to Be a Leader in G2's Summer 2023 Reports -

Tesorio News

Boost Your Collections Process with Tesorio's Latest Innovations and Features: Highlights from Q1 2023 -

Tesorio News

Tesorio Takes the Lead: Ranked #1 in 10 G2 Spring 2023 Reports -

Tesorio News, Blog

Secure Your Receivables During the SVB Shutdown -

Tesorio News, Blog

The Customer Reviews Are In: Tesorio Is a G2 2023 Best Software Winner -

Tesorio News

Tesorio Announces GPT-3 Based AI Email Assistant -

Tesorio News

Tesorio Ranks #1 In G2’s Mid-Market Accounts Receivable Automation Winter 2023 Reports -

Tesorio News

Tesorio's New Customer Collection Score -

Tesorio News

Q4 Highlights: Collections Process Tracking & Streamlined Manual Tasks -

Tesorio News, Blog

Tesorio AR Forecast Delivers Accurate, Real-time Predictability and Greater Confidence for AR Teams and Accounting Leadership -

Tesorio News

Q3 Highlights: New AR Features & Enhancements -

Tesorio News

Tesorio is (still) the “Easiest Company To Do Business With”, and we can prove it -

Tesorio News

Tesorio Ranks #1 for Accounts Receivable Automation in G2’s Fall 2022 Reports -

Tesorio News

Announcing Our Series B and the Future of Cash Flow Performance -

Tesorio News

Tesorio For All! -

Tesorio News

Something’s Different at Tesorio -

Tesorio News

Introducing Tesorio AR Essentials: Stop Dunning, Collect Better, Delight Customers -

Tesorio News

The Women of Tesorio -

Tesorio News

2020—A Look Inside Tesorio -

Tesorio News

Tesorio Leads The Way In Emerging Cash Flow Performance Space -

Tesorio News

A Year in Review -

Tesorio News

Tesorio Replaces Cash Flow Forecasting With the Launch of Cash Flow Direct -

Tesorio News

Tesorio Achieves Seamless Integration with Sage Intacct to Accelerate B2B Collections -

Tesorio News

Tesorio Launches AI-Driven Cash Flow Performance Platform for Finance Teams; Closes $10M Series A -

Tesorio News

Tesorio Named NetSuite SuiteCloud New Partner of the Year for 2019

-

Featured Article

Blog

The Current State of Cash Flow Forecasting: Insights from Tesorio’s Latest Survey-

Blog

Navigating Financial Strains: Insights from Tupperware's Accounting Challenges -

Blog

Max Dame on CFO Weekly: AI-Driven CFOs Are Optimizing Net Cash Flows -

Blog

The Cash Flow Disconnect: Why CFOs Say ‘No’ More Than They Say ‘Go’ -

Blog

The New CFO Swagger: Why CFOs Are Seeing Their Stock Rise -

Blog

Is the CFO's Grip on Excel Loosening? -

Blog

Tesorio Makes IA40 List as the #2 Early-Stage Intelligent Application -

Blog

Driving Business Growth Through Proactive Cash Flow Management -

Blog

The Impact of Accounts Receivable Automation on Business Performance -

Cash Flow 101, Blog

10 Effective Strategies and Techniques to Elevate Your Accounts Receivable Forecasting -

Blog

How Much Can Your Business Save With A/R Automation? -

Insights, Blog

How to Make Your AR Recession-Proof -

Blog

6 Key Considerations for Scaling Accounts Receivable Management -

Blog

Cash Flow Performance is the Key to Capital Decision-Making -

Blog

Invest in an Automated AR Solution to Solve Operational, Financial and Professional Pain -

Blog

Are You a CFNo Or a CFGo? -

Blog

5 Tips to Better Cash Flow for Marketing Businesses -

Blog

What’s Next for Cash Flow Management: 6 Trends to Watch -

Insights, Blog

Unlocking the Deeper Business Objectives Driving Financial Transformation -

Blog

Best Practices for Managing Cash Flow with Collections Automation in Accounting -

Blog

Integrating Cash Flow Management with Your Overall Financial Management Systems -

Blog

What Are Some Tips For Managing Monthly Cash Flow? -

Blog

Enhancing Customer Experience with Automated Collections Processes in Accounting -

Blog

Evaluating Return on Investment (ROI) for Collections Automation in Accounting -

Blog

Understanding the Role of Corporate Treasury and Cash Management -

Blog

The Power of AI for Finance Teams: Leveraging Data Analytics for Effective Collections Automation in Accounting -

Blog

Streamlining Financial Operations: A Detailed Guide to the Automated AR Closing Process -

Blog

The Importance of Accurate Cash Application Process: Exploring the Risks and Consequences of Inaccurate Payment Posting -

Blog

Designing and Streamlining an Efficient A/R Department -

Blog

3 Ways to Achieve a Positive Free Cash State of Flow -

Blog

Accounts Payable vs Accounts Receivable: Understanding the Yin and Yang of Business Finance -

Blog

The Power of AR Automation for SaaS Companies -

Blog

7 Tips to Improve Your Accounts Receivable Collection -

Cash Flow 101, Blog

The Mysteries of Accounts Receivable: Is A/R a Liability or Asset? -

Blog

Remote Work Revolution: Streamlining Accounts Receivable for Distributed Teams -

Blog

CFOs Can Elevate Board Communications by Using AI-Driven Cash Flow Performance Platform -

Blog

4 Methods to Achieving an Accurate DSO Calculation -

Cash Flow 101, Blog

How to Maximize Real Estate Cash Flow -

Cash Flow 101, Blog

The Best Finance Excel Templates for the Office of the CFO -

Blog

How Transportation & Logistics Businesses Can Improve Cash Flow -

Cash Flow 101, Blog

Efficient Cash Flow is Essential for Wholesale Distribution Companies -

Blog

Accounts Receivable Software on the Rise with Manufacturing Companies -

Blog

Too Many Invoices? Obstacles That Keep You From Benefiting From Rapid Growth & Efficiency -

Blog

Automating the Cash Application Process for Real-time Visibility and Improved Cash Management Performance -

Tesorio News, Blog

Secure Your Receivables During the SVB Shutdown -

Blog

Women of Tesorio 2023 -

Blog

CFO Dive Webinar Recap: Keys to Future-Proofing the Finance Function -

Tesorio News, Blog

The Customer Reviews Are In: Tesorio Is a G2 2023 Best Software Winner -

Cash Flow 101, Blog

Calculating Accounts Receivable Turnover to Improve Your A/R Ratio -

Blog

A Positive DSO-to-DPO Ratio Is Cash Nirvana -

Blog

Sales, To Whom, Should We Send The Invoice -

Blog

Getting Paid First -

Blog

5 Signs To Modernize Your AR Processes in 2023 -

Tesorio News, Blog

Tesorio AR Forecast Delivers Accurate, Real-time Predictability and Greater Confidence for AR Teams and Accounting Leadership -

Blog

A/R Automation Just Makes Sense -

Blog

Detailed Metrics, Customizable Automation, and Enhanced Communication Are on the Menu as ChowNow Enjoys Improved Collection of Aging Accounts -

Blog

What a Culture of Cash Flow Performance Looks Like in Action -

Blog

CFO Guide to Hiring Top Finance Talent: 4 Critical Non-Financial Skills -

Blog

Lessons in Building a Highly Effective Collections Team From the Ground Up -

Blog

What Is the Role of the Finance Business Systems Team? -

Blog

Technology and Structure: The Keys to Optimizing Billing and AR Teams -

Blog

The Strategic CFO’s Technology Strategy for Finance Goes Beyond Workflow Automation -

Blog

Hiring Finance Talent: Why the Work Environment Needs to Mirror the Personal Environment -

Blog

How to Be a Successful Controller with a Lean Crew -

Blog

6 Tips to Help You Navigate Your Finance Automation Journey -

Blog

2021: The Year in Review -

Blog

The CFO’s Top Priorities List for the Next Six to 12 Months -

Blog

8 Mindful Habits That Create a More Productive AR Environment -

Blog

The Post-Modern CFO’s Secret Weapon: A Business Systems Team -

Blog

Collaboration: The Finance Organization’s Most Valuable Low-Tech, High-Impact Business Tool -

Blog

Understanding the Crucial Difference Between Workflow Automation and Outcome Automation -

Blog

A Positive DSO-to-DPO Ratio Is Cash Nirvana -

Blog

(Re)connect with Tesorio at SuiteWorld -

Blog

The Problem with Treating All Invoices Equally -

Blog

AI Improves Customer Payment Prediction

-

-

Cash Management

Why Traditional Cash Flow Tools Fall Short and How Tech Is Bridging the Gap -

Cash Flow 101, Cash Management

The Modern CFO: Revolutionizing Cash Flow and Spend Management -

Cash Management

Simplifying Treasury Liquidity Risk Management -

Cash Management

Unlocking the Significance of Cash Conversion Cycle (CCC) in Business -

Cash Management

Understanding Treasury Management & Advantages of Using Software

-