WHY CASH FLOW PERFORMANCE?

command

of

your

cash flow.

Finance teams are stuck in a rut. It’s called the cash flow disconnect.

It’s no secret that cash is the lifeblood of any company. And to truly thrive, you need your cash in a state of flow—moving in and out, adding value along the way and helping you grow. But for some crazy reason, most finance teams are stuck managing their cash flow with a hodgepodge of spreadsheets that deliver outdated, incomplete (or flatout incorrect) data, and they don’t have the tools they need to take action to improve their position. That leads to tedious manual effort, inaccurate forecasts, bad decisions and vulnerable cash positions—an ugly state we call the Cash Flow Disconnect.

Enter the cash flow performance platform.

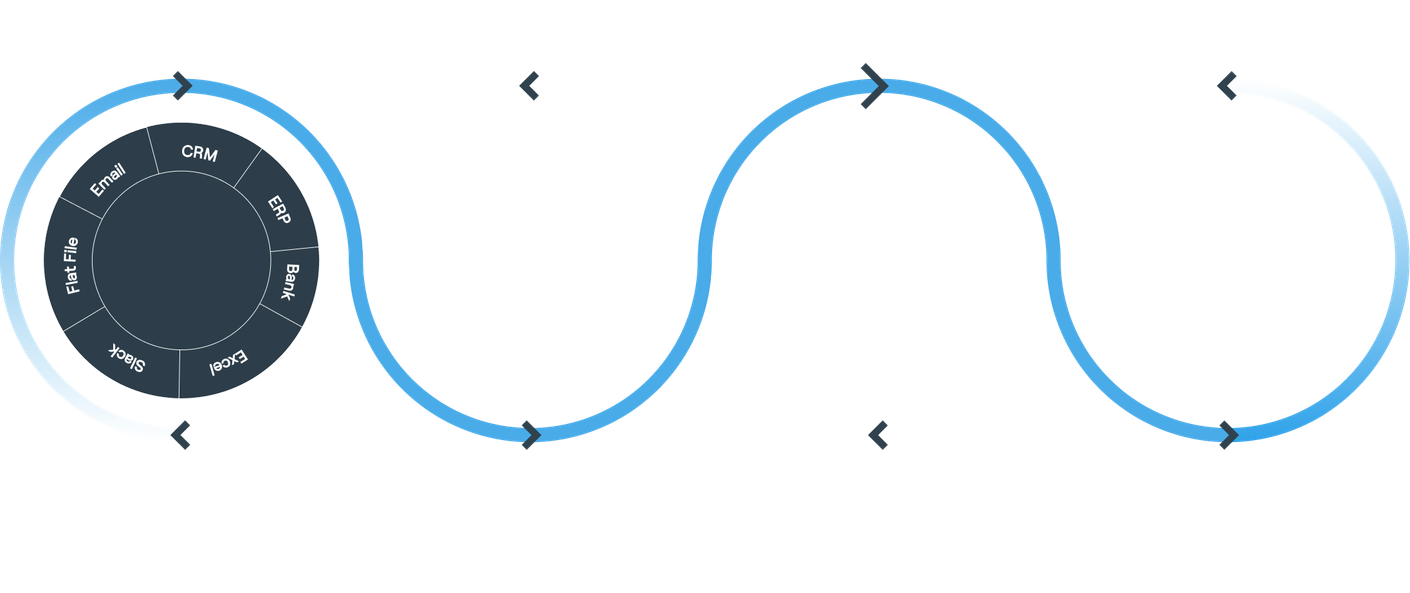

It works like this: the Total Cash Flow Dashboard shows you everything you need to know about your cash flow performance—past, present and future. You get instantly actionable insights based on live data integration from your bank, ERP, CRM and more, so you’re acting based on the latest numbers. Tesorio's machine learning identifies cash flow patterns that impact your business and autonomously takes action on your behalf, so you can focus on what matters most.

Using the Cash Flow Performance Platform for a few months creates a virtuous cycle, creating new and better financial insights, linking real-time forecasts to actions across the company, removing incentives for bad behavior and creating a state of cash flow harmony with customers and vendors.

All so finance teams can control their cash flow, not the other way around.

Cash flow performance platform overview

Outcomes

-

Company Financial Performance

-

Capital Utilization

-

Customer & Vendor Partnership

-

Optimized Free Cash Flow

One platform. Three ways to flow.

-

Cash Flow Management

Create direct method forecasts at the push of a button. -

Accounts Receivable

Collect cash faster, more efficiently and with less risk. -

Payment Portal

Don’t just collect—create great customer experiences.