Accounts Payable vs Accounts Receivable: Understanding the Yin and Yang of Business Finance

Accounts payable (AP) and accounts receivable (AR) are two sides of the same coin. They represent the balance of money flowing in and out of a company.

Both are equally important and essential for healthy business operations, cash flow, and maintaining stable relationships with customers and suppliers. However, it’s easy to confuse them. In this article, we’ll list the key differences and share some examples that will help you remember the difference for life.

Accounts Receivable (AR): Ensuring Healthy Cash Flow

The essence of the AR process begins with understanding its definition. Accounts receivable (AR), in a nutshell, pertains to the outstanding invoices that customers owe to your business. It is a line of credit that a business extends to its customers after providing goods or services and before receiving payment.

Let's say your business provides consulting services. After performing the service, you invoice the client for $5,000. Until the client pays that invoice, the $5,000 is considered accounts receivable. It's money owed to you for services rendered.

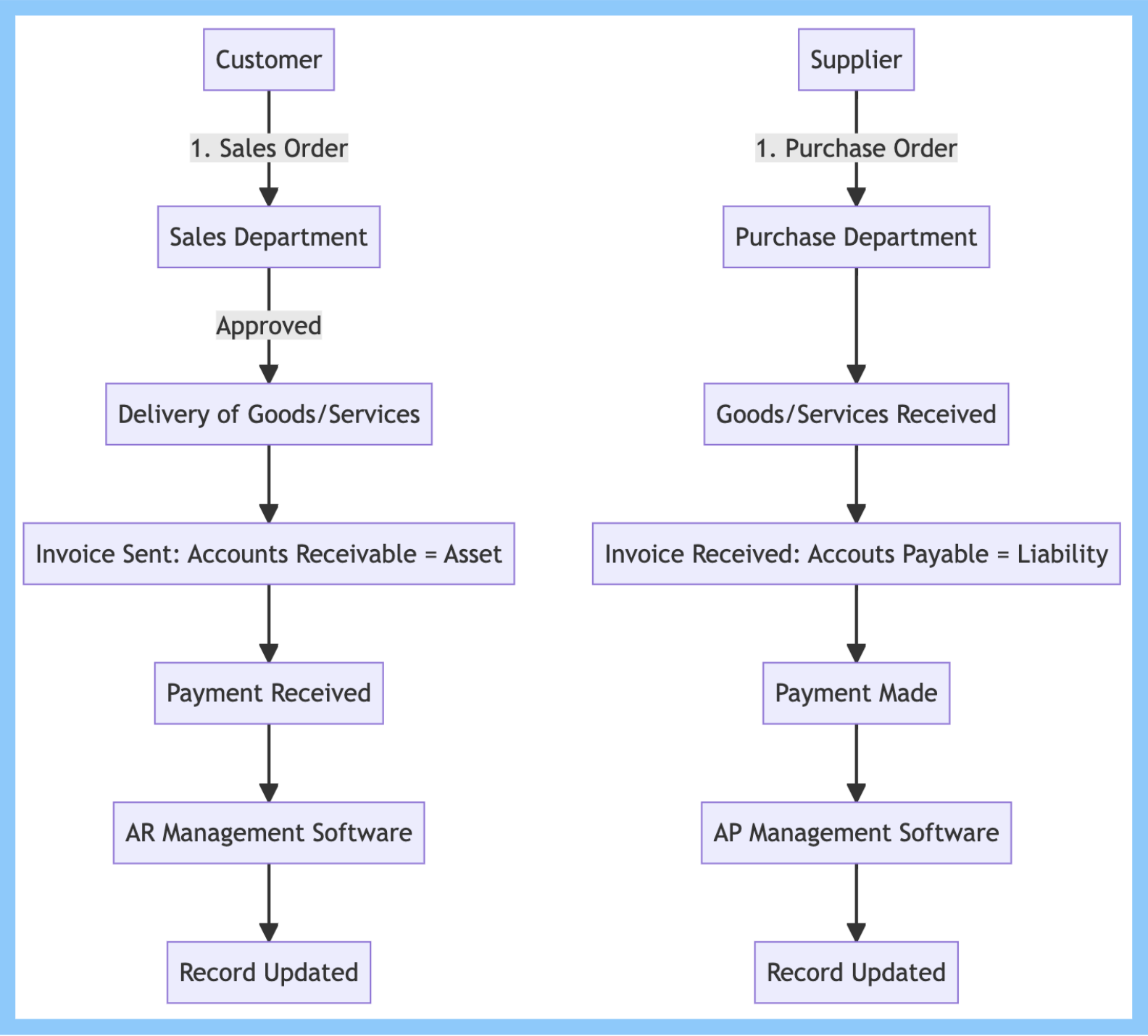

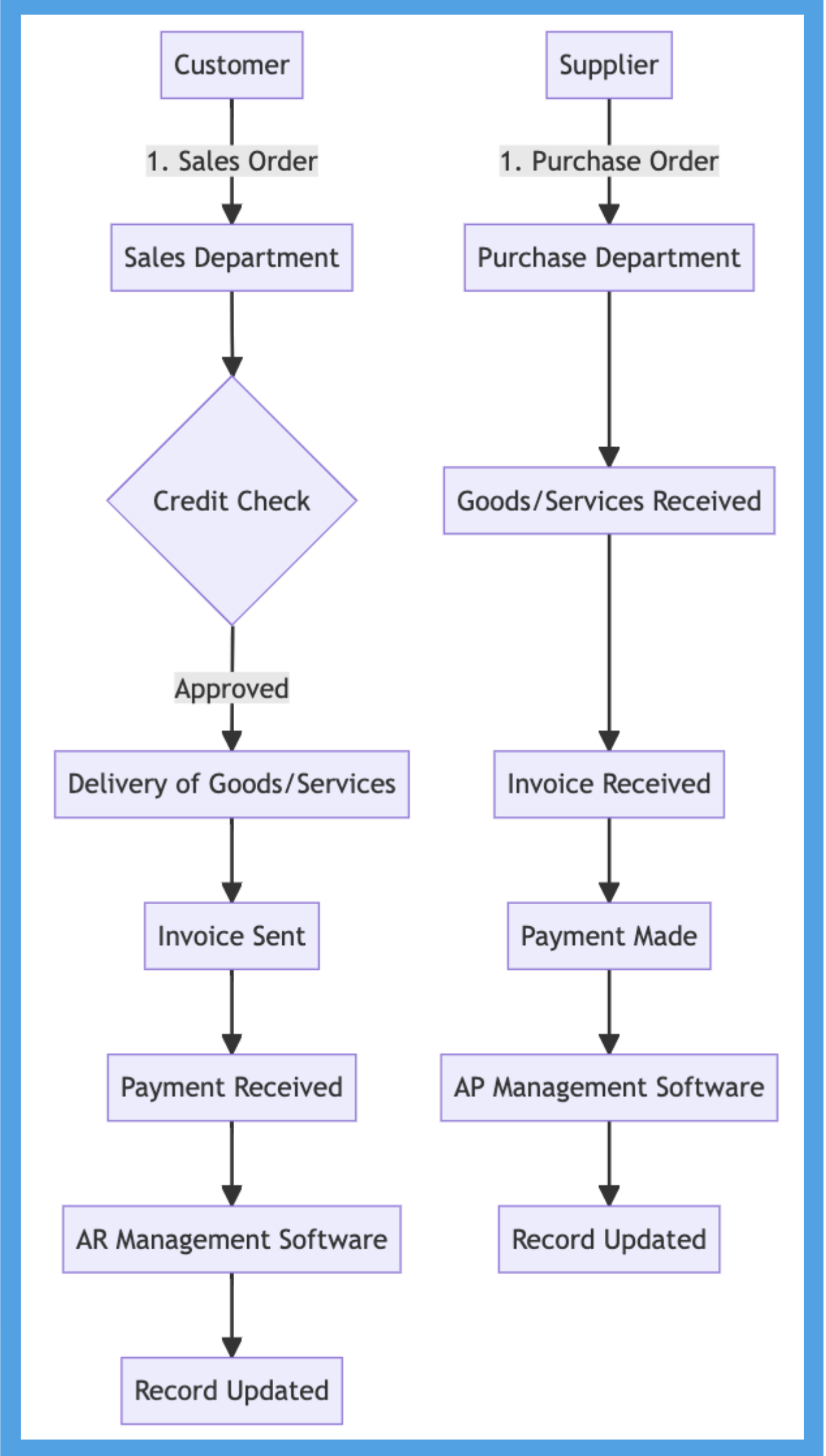

The AR process is not just about selling and waiting for payment, it encompasses a wide range of activities, from providing credit terms to invoicing, recognizing revenue, receiving payment, and maintaining relevant records. Efficient AR management is essential to maintaining healthy cash flow and ensuring business growth.

DSO = Days Outstanding

An important aspect of managing Accounts Receivable (AR) is understanding the concept of Days Sales Outstanding (DSO). DSO measures the average number of days it takes a company to collect payment after a sale has been made. A low DSO value means that it takes a company fewer days to collect its accounts receivable. A high DSO number shows that a company is selling its product to customers on credit and is taking longer to collect money. Here’s further information on how to calculate it.

When it comes to AR, there's a fine line between an account being receivable and turning into a debt that needs to be collected. This is where the role of collections comes into play. If an account has been receivable for an extended period, it may be time to involve a collection agency to recover the funds. The decision to move to collections should be based on a set of predetermined criteria, such as the age of the debt, the amount of the debt, and the customer's payment history.

Accounts Payable (AP): More Than Just a Cost Center

Accounts payable (AP), on the other hand, signifies the money that your business owes to suppliers or creditors. It's a record in your company's general ledger that reflects the company's obligation to pay off short-term debts.

Imagine your business orders office supplies from a vendor and receives an invoice for $1,000. Until you pay that invoice, the $1,000 is considered accounts payable. It's money you owe to the vendor for goods received.

The AP process includes receiving the bill, verifying invoice details, approving payment, and finally paying the supplier or creditor. However, AP is more than just a cost center. A well-managed AP department can save the company money by taking full advantage of favorable payment terms and available discounts. For instance, instead of adhering to a standard 30-day payment term, a business might negotiate a 60-day term. This provides the business with an additional 30 days to utilize that cash within their operations before it must be paid out. However, consistently delaying payments beyond the agreed terms can harm supplier relationships, damage the business's reputation, and potentially lead to legal repercussions.

Managing AP contributes to business success by ensuring cash forecasts stay accurate, minimizing mistakes and fraud, and generating reports for business leaders and third parties.

Differences between Accounts Receivable and Accounts Payable

AR and AP might appear as two sides of the same coin; however, they have distinct implications for your business. Accounts payable, on the one hand, represent your business's financial obligations towards suppliers or creditors (aka a liability). On the other hand, accounts receivable refers to the money that your customers owe your company (also known as an asset).

An analysis of AR and AP uncovers their complementary nature. While AR boosts your cash flow by bringing in money, AP indicates cash outflows. They are crucial elements that shape a company's liquidity, profitability, and overall financial health.

Here is a quick comparison showing easy-to-remember differences:

Accounts Receivable (AR) | Accounts Payable (AP) | |

Definition | The outstanding invoices that customers owe to your business. | The money that your business owes to suppliers or creditors. |

Considered as | An Asset | A Liability |

Process | Involves providing credit terms, invoicing, recognizing revenue, receiving payment, and maintaining relevant records. | Includes receiving the bill, verifying invoice details, approving payment, and finally paying the supplier or creditor. |

Effect on Cash Flow | Boosts your cash flow by bringing in the money. | Indicates the cash outflows. |

Management | Efficient AR management is essential to maintain healthy cash flow and ensure business growth. | A well-managed AP department can save the company money by taking full advantage of favorable payment terms and available discounts |

The Importance of AR and AP Management

It's reported that almost half of small to medium-sized businesses experience delayed payments, leading to severe cash flow problems and operational hurdles. Late payments are more common and a bigger problem than you may think.

Efficient management of AR and AP significantly influences the cash flow of a business. While a solid process can be set up using Excel and competent team members, technology has made it considerably easier over the last few years to automate A/R and A/P management. These days, AI can also be deployed to “simulate through your data” and handle processes that were tedious before automatically.

With unique features like AI-powered automation, Tesorio streamlines AR management, ensuring a steady cash flow. The software eliminates common invoicing errors, enhancing the likelihood of timely payments. It not only improves your cash inflow but also predicts it, enabling you to make informed business decisions.

Tips for Effective AR and AP Management

Automate AR management with Tesorio: Leverage the power of AI and automation to manage your receivables, ensuring prompt collections and improved cash flow.

Streamline invoicing: Tesorio helps in creating error-free invoices, reducing the chances of delays in payment. Accurate and prompt invoicing leads to faster payments.

Optimize AP: Negotiate favorable payment terms with your suppliers. Long credit periods allow you to manage your cash effectively, ensuring that your operations run smoothly.

In summary, A/R and A/P are different in the sense that accounts receivable are the money owed to you as a company by customers, whereas accounts payable are the money you owe other businesses and suppliers.

Understanding and effectively managing AR and AP is crucial for the success of your business. A robust system not only maintains a healthy cash flow but also enables growth and stability.

Tesorio’s AI-powered Accounts Receivable Management Software offers a one-stop solution for your AR and AP management challenges, fostering operational efficiency and financial health. Discover how you can harness the power of Tesorio and steer your business toward a prosperous future.