Something’s Different at Tesorio

Tesorio launched our new brand today, so you may have noticed that we look a little different. Not just different from how we used to look, but different from how most Fintech companies look. More on that in a bit.

Honestly, it feels a bit strange to be writing a blog post about our brand launch because it’s not the kind of thing I think a lot of people are going to care about. I mean, we at Tesorio definitely care, our customers and friends hopefully care, and my family is excited about it. Beyond that, I don’t think it’ll be making headlines around the world.

In my opinion, what people really care about is authenticity, and when companies live up to their mission and brand promise, but not so much when they launch a brand (unless it’s one of those giant brands everyone recognizes anyway).

Don’t get me wrong - I LOVE our new brand. I think it’s bold, smart, balanced, clean, and pretty.

Most important to me though, is that it’s different. No cartoons of nondescript, bendy-armed people doing stuff on flat color, geometric backgrounds. No website home page with a headline and bit of copy to the left and hero image to the right. There’s nothing wrong with the style I’m describing, but I wanted something different for Tesorio because we’re trying to do something different at Tesorio.

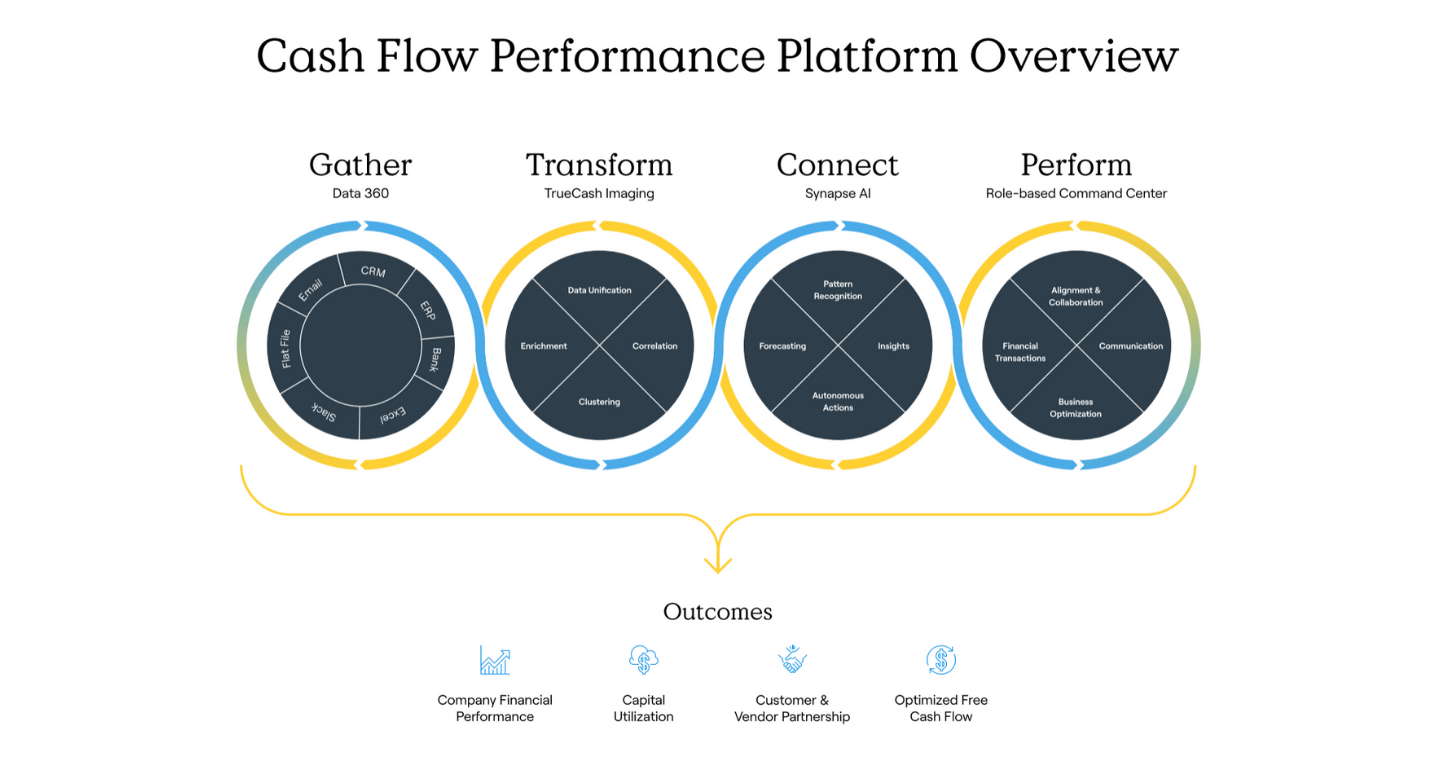

When I introduce Tesorio to people who don’t know us I tell them that we’re a cash flow performance platform for connected finance teams. That introduction usually elicits a response along the lines of “Cool. What do you do and why did you start a company in this space?”

This response gives me an opportunity to briefly explain. So I do.

My first company was a factoring business helping SMBs in Panama. I got an upfront look at folks pushing the limits to keep their companies alive while my full-time job was in investment banking at Lazard creating discounted cash flow models for multinational companies. I realized that every company starts with a dream for change. To bring about that change you have to think and act differently, not just better. I know, it’s a bit cheesy, but even sandwich shops have a belief that their secret sauce is, well, secret and unique. At the same time, companies with strong cash flow control their own direction, they can place long-term bets that at the time only make sense if you get their vision of how things will be in the future. So cash flow is freedom to affect change in the world, despite what creditors or investors might otherwise optimize for in the short-term.

You may not know this, but Tesorio pivoted to what we do today. When I first met my co-founder, Fabio, we set out to modernize what I had seen in factoring to help companies get paid faster in exchange for small discounts on their invoices. But we quickly realized that we had to go further up the decision making, to where people understood their cash flow, took actions to manage it, and then eventually they could change it.

And so we set out on our mission, to connect people and data to make cash flow predictable so companies can change the world. We call this Connected Finance, and connected finance teams need a platform for cash flow performance.

Simply put, Tesorio gives the business a single view of cash so the organization and people within it can make real-time decisions with greater confidence and control which is the point of connected finance.

Importantly, I also believe it empowers businesses to make more ethical decisions across how they treat stakeholders (employees, customers, vendors) to how they acquire and leverage resources.

This all matters for a lot of reasons, but ultimately it comes down to a few simple truths:

Cash is the beating heart of every business. Whether you’re for-profit, non-profit, cash-rich, or cash-poor. It’s not only about making sure you don’t run out of cash, it’s about leveraging capital as effectively as possible.

Business is agile and a new type of financial insight that goes well beyond traditional budgets and forecasts is needed to fuel better decisions, compete and grow effectively.

Cash flow is the best financial context - especially for subscription-based, and usage-based business models.

Better cash flow performance drives outcomes that are key to any organization’s success, including optimized free cash flow, better capital utilization, stronger financial performance, and improved customer and vendor relationships.

For a more concise and evocative explanation, I suggest you watch the video below.

The point is that Tesorio is the first cash flow performance platform which means it’s not a better version of something else. It’s different.

So, my hope for the new brand is that people will notice it, have some kind of reaction to it (good or bad), and become a bit curious about what we’re up to at Tesorio.

Please reach out to me at carlos.vega@tesorio.com and let me know what you think of our new brand, connected finance, or cash flow performance!