NetSuite Invoice Automation: How Customer Invoices Actually Turn Into Cash

TL;DR (what you’re actually trying to fix)

Teams usually look into NetSuite invoice automation because cash timing has become difficult to explain.

Invoices are being generated, but approvals slow them down. Invoices are sent, but customers reject them or require resubmission. Payments arrive, but cash application lags, so AR aging and forecasts become unreliable.

At close, finance teams often have to reconcile NetSuite data with email threads, customer portals, and spreadsheets just to understand what is actually outstanding.

Most content on NetSuite invoice automation focuses on invoice creation or approval workflows. That addresses part of the problem, but not the full invoice-to-cash cycle. Automation only changes outcomes when invoices are generated correctly, delivered in the format customers require, paid through a clear process, and matched to cash with minimal manual intervention.

This guide outlines a practical invoice-to-cash automation model in NetSuite. It covers customer invoicing, approvals, delivery, payment experience, and cash application, so AR metrics, aging, and forecasts stay consistent throughout the month, not just at close.

NetSuite invoice automation is two things (AP vs AR)

This guide covers both, but it leans into the downstream steps that make automation “real” (payment + cash application).

What is NetSuite invoice automation? (definition you can operationalize)

NetSuite invoice automation is the set of workflows that reduces manual work and reduce breakpoints across invoice lifecycles.

For AP, it’s turning vendor invoices into validated, approved, payable records with controls. NetSuite’s own coverage emphasizes invoice automation in that direction (capture, matching, approvals).

For AR/customer invoices, it’s turning “we should bill” into “the customer received, accepted, paid, and we accurately applied cash” at month-end. SuiteFlow can support the approval and routing logic, but outcomes come from the end-to-end system design.

The NetSuite customer invoice automation blueprint (end-to-end)

Step 1: Automate invoice generation (but start with triggers + checks)

NetSuite supports invoice creation mechanics, but automation only works when triggers are consistent, and validation happens before invoices go out.

Common automated triggers (choose what fits your model):

- Sales order approved → fulfillment complete → invoice created

- Project/time approval → invoice created

- Subscription renewal cycle → invoice created

Pre-send validation checks (turn these into rules):

- Bill-to and sold-to contacts present

- PO requirements satisfied (or routed to exception queue)

- Tax/terms fields valid

- Customer-specific delivery requirements known (email vs portal)

Outcome: You stop sending “technically correct” invoices that still won’t get paid.

Step 2: Build an invoice approval workflow that protects controls without slowing cash

Most teams break here. They either approve everything (slow) or approve nothing (risky). NetSuite SuiteFlow supports conditional approval routing and actions like automated emails. Use it to build a workflow that accelerates clean invoices and isolates exceptions.

A simple approval model that scales:

- Auto-approve low-risk invoices (repeat customers + standard terms + low dollar thresholds)

- Route exceptions into a single queue with an SLA and owner

- Escalate by time, not by emotion (48 hours idle → re-route)

What to automate inside the exception queue:

- “Missing PO” outreach tasks

- Customer credit hold review tasks

- Billing contact confirmation tasks

Step 3: Make invoice delivery deterministic (customers can’t pay what they can’t process)

Invoice automation isn’t “sent.” It’s “received and accepted.”

Your delivery model should be explicit for each customer segment:

- Email delivery customers: verified invoice email contact, standardized subject lines, consistent attachments

- Portal-required customers: portal submission workflow and status tracking

- Consolidated invoicing customers: batching + approval logic

Step 4: Add a NetSuite customer payment portal experience (reduce friction)

If paying is hard, your “automation” becomes a reminder treadmill.

Stripe is a useful reference model here: it emphasizes a customer-friendly invoice payment experience and reports that a large share of invoices in its system are paid quickly after issuance.

What your portal experience should accomplish:

- One place to pay and view status

- Clear remittance instructions (so cash application doesn’t become archaeology)

- Automated reminders aligned to policy (not aggressive noise)

Step 5: Automate cash application (or your forecasting and AR aging will drift)

Cash application is where “revenue isn’t real” becomes “cash is real.”

NetSuite and other finance systems emphasize matching and controls in invoice processing, and the same principle applies here: automate matching where confidence is high and route exceptions where context is needed.

If cash application stays manual, you’ll see:

- Wrong customer balances

- Misleading aging buckets

- Forecasts that look precise but aren’t dependable

This is why invoice automation without cash application is only half the job.

NetSuite invoice automation for SaaS (subscriptions, usage billing, renewals)

If you’re a SaaS finance team on NetSuite, invoice automation breaks in predictable places. SaaS billing has more moving parts: subscription changes mid-cycle, usage rollups, proration, credits, renewals, and enterprise customers who treat invoicing as a compliance workflow.

At a glance: what “best” looks like for SaaS

The best NetSuite invoice automation for SaaS is the setup that:

- Generates invoices consistently from subscription and usage events (and doesn’t rely on end-of-month heroics)

- Routes exceptions (PO, contract mismatch, tax/terms issues) instead of blocking every invoice behind approvals

- Makes it easy for customers to pay (and easy for you to reconcile)

- Applies cash accurately so AR aging and forecasts stay believable (not a weekly debate)

SaaS automation map (what to automate first, by failure mode)

SaaS blueprint: invoice-to-cash workflow (7 steps)

Use this as a clean, extractable “how-to” block:

- Define billing triggers (what event means “we should bill”) and document them by revenue type: subscription, usage, services.

- Run pre-send checks (PO presence, bill-to, tax/terms, required attachments, customer delivery rules).

- Auto-approve the happy path (low-risk invoices) and route exceptions to a queue with an SLA. SuiteFlow supports conditional routing logic.

- Deliver invoices deterministically (email vs portal vs consolidated invoicing), tracked by customer requirement.

- Offer a customer payment portal experience where appropriate, so paying is straightforward and remittance is structured.

- Apply cash with rules first, humans second (match where confidence is high; route exceptions with context).

- Close the loop with metrics that tie workflow improvements to overdue and severe aging, not just “emails sent.”

Exception library (SaaS-specific): what to route, not block

For SaaS, the key is resisting the urge to “slow everything down to prevent errors.” You want a fast lane and an exception lane.

Route into an exception queue when:

- PO is required and missing

- Contract terms do not match invoice terms

- Bill-to contact is missing or invalid

- Customer requires a portal submission or special format

- Credit hold is triggered

- Unusual amounts or unusual line items show up (especially around renewals)

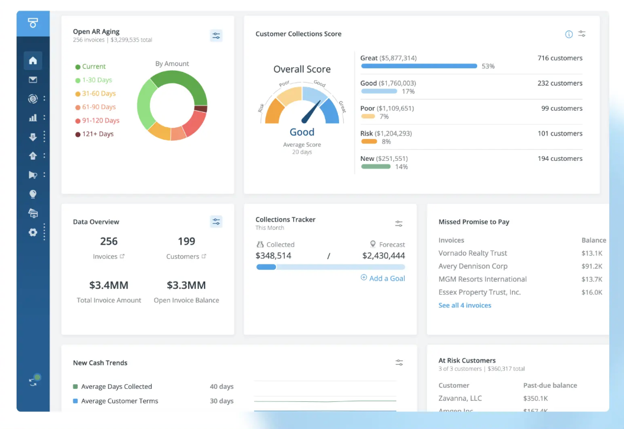

SaaS metrics that prove automation is working

Keep your KPI set small and hard to argue with:

- Time-to-send (period close → invoice sent)

- Acceptance time (sent → accepted, especially for portal customers)

- Dispute rate/reissue rate (invoice corrections)

- Percent overdue + severe aging share (risk indicator)

- Cash application hygiene (unapplied cash aging, exception queue SLA)

NetSuite AR automation software: when NetSuite-native workflows are not enough

You typically consider NetSuite AR automation software when you need one or more of the following:

Decision rule: If your biggest bottleneck is internal approvals, start with SuiteFlow. If your biggest bottleneck is cross-system execution (portals, email, remittance, status), you likely need an orchestration layer.

The scorecard: how to evaluate invoice automation readiness (10 questions)

Use this as an internal assessment, then benchmark the results against market peers.

- Do we have standardized invoice triggers by business model (SO/project/subscription)?

- Can we explain the top 5 reasons invoices go out late?

- Do we track invoice rejection reasons (missing PO, wrong bill-to, wrong tax, portal requirement)?

- Do we have an approval workflow that fast-tracks low-risk invoices?

- Do exceptions have an owner + SLA (not “whoever notices first”)?

- Do we know which customers require portals and how we track submission status?

- Do customers have a clean path to pay (portal/links/remittance clarity)?

- Is cash application mostly automated, with exceptions routed consistently?

- Are AR aging and overdue dashboards trusted (or debated every close)?

- Can we tie workflow changes to measurable improvements in overdue and severe aging?

Before you change tooling or workflows, define the baseline. Use a simple, defensible scoreboard:

- Collection speed (how long it takes to collect)

- Percent of open AR overdue

- Severity of overdue aging (how much is deeply overdue)

For benchmarking context, the 2025 AR Benchmark framework measures collection speed, percent overdue, and severity of aging. Use it to pressure-test what “good” looks like in your industry.

30/60/90-day rollout plan

First 30 days: stop preventable leakage

- Standardize invoice triggers and validation checks

- Implement a basic SuiteFlow approval model (fast-track + exception queue)

- Clean invoice delivery governance (contacts, routing rules, portal list)

Days 31–60: make payment friction visible

- Segment customers by payment behavior and delivery requirements

- Add a customer payment experience strategy (portal/links + reminders)

- Define dispute intake and resolution SLAs

Days 61–90: close the loop with cash application

- Automate cash matching rules and exception queues

- Tie exceptions to root causes (delivery errors, PO issues, remittance gaps)

- Update forecasting inputs to reflect cleaner cash application

Closing the gap between invoices and cash

NetSuite invoice automation only delivers real value when it’s treated as an invoice-to-cash system, not a set of disconnected features.

Generating invoices faster doesn’t help if approvals stall. Sending invoices doesn’t matter if customers reject the format or can’t pay cleanly. And none of it holds up if cash application lags, aging drifts, and forecasts become a reconciliation exercise at close.

The teams that get this right don’t try to eliminate exceptions. They design for them. Clean invoices move quickly. Edge cases are routed, owned, and resolved early. Cash is applied continuously, so AR aging and forecasts stay credible throughout the month, not just after cleanup.

If you’re evaluating whether your current NetSuite setup actually supports that operating model, or where it breaks, the fastest way to pressure-test it is to look at real workflows, benchmarks, and outcomes:

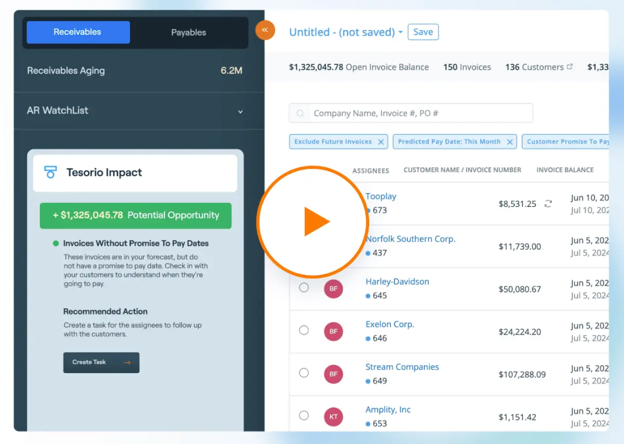

Interactive Product Demo

See how customer invoicing, collections, payment handling, and cash application operate together inside a NetSuite-connected workflow end to end, not as isolated modules.

Book a Call

Talk through your invoice-to-cash setup with specialists who understand NetSuite realities: approval bottlenecks, portal requirements, remittance noise, and close pressure.

Download: 2025 AR Benchmark Report

Compare DSO, overdue exposure, and deep-aging risk across 10 industries to see where invoice automation actually changes outcomes and where it doesn’t.

Calculate ROI

Use your invoice volume, DSO, and team size to quantify how much working capital and time are tied up in manual invoice handling and cash application today.

Once you can clearly see where invoices slow down, where cash gets stuck, and what those gaps cost over a quarter, the right next step usually becomes obvious.

Frequently Asked Questions

How do you automate customer invoicing in NetSuite?

Standardize invoice generation triggers (sales/project/subscription), add pre-send validation checks, then use a workflow to fast-track clean invoices and route exceptions to an owned queue.

Why does cash application matter for NetSuite invoice automation?

Inaccurate or delayed cash application distorts AR aging and undermines forecast reliability. Automating matching and routing exceptions keeps the cash picture trustworthy.

Do I need NetSuite AR automation software if I already use NetSuite?

If your constraints are internal approvals and routing, NetSuite workflows may be sufficient. If the breakdown is cross-system execution (portals, email threads, remittance data, payment experience), AR automation software can add orchestration and exception handling that NetSuite alone doesn’t typically provide.

What’s the best NetSuite invoice automation for SaaS?

The best setup is the one that standardizes billing triggers, fast-tracks clean invoices, routes exceptions into an owned queue, and connects payment experience to a clean cash application so AR metrics stay trustworthy.

How do SaaS teams reduce disputes with NetSuite customer invoice automation?

Reduce disputes by enforcing pre-send validation (PO, bill-to, terms, tax), routing mismatches into an exception queue instead of delaying everything, and standardizing delivery requirements for enterprise customers who use portals or special formats.