Best NetSuite AR Automation Software for SaaS: 2026 Complete Guide

TL;DR: Quick Guide to NetSuite AR Automation for SaaS

Best Overall for SaaS: Tesorio leads with 90%+ payment prediction accuracy, 30-day implementation, and proven results from GitLab (30% DSO reduction), Box (operationalized collections at $850M ARR scale), and Couchbase (10-day DSO reduction, doubled collections productivity, financial independence through cash flow optimization).

Other Top Solutions:

- Mid-Market SaaS ($10M-$50M ARR): Centime, Versapay

- Enterprise SaaS ($200M+ ARR): HighRadius

- Early-Stage SaaS (<$10M ARR): BILL, NetSuite Native

- Contract-to-Cash Focus: LedgerUp

Key Decision Factors: Subscription billing support, MRR/ARR forecasting capabilities, NetSuite SuiteBilling integration depth, AI-powered payment prediction, and implementation timeline (30 days vs. 3-6 months).

Read on for detailed comparisons, real SaaS company results, and implementation guidance.

Why SaaS Finance Leaders Are Rethinking AR Operations

AR rarely fails all at once in SaaS companies on NetSuite. It degrades quietly as subscriptions scale, billing models multiply, and payment timing grows harder to predict.

For SaaS finance leaders running NetSuite, accounts receivable has moved far beyond traditional invoice tracking. AR teams now manage subscription and usage-based billing, monitor monthly recurring revenue health, estimate payment timing across hundreds of customers with different billing cycles, and recover failed credit card charges before they turn into churn.

The financial stakes are uniquely high. According to benchmarking data from the American Productivity and Quality Center published by CFO.com, small to mid-sized organizations (under $100M in revenue) at the median spend $0.77 per $1,000 in revenue on AR management, which is nearly 3x higher than top-performing companies at $0.28 per $1,000.

For a $50 million ARR SaaS company operating at the median, that translates to $38,500 in AR costs annually versus just $14,000 for top performers: a $24,500+ efficiency gap that could be redirected toward product development or customer acquisition.

This is the point where companies like GitLab, Box, and Couchbase began reassessing their AR setup. As GitLab optimized collections at scale, Box streamlined AR operations across thousands of enterprise accounts, and Couchbase pursued financial independence without additional fundraising, they reached the same conclusion: NetSuite’s native AR functionality no longer reflected how subscription revenue behaves in practice.

This guide examines how leading SaaS companies transformed their AR operations, which capabilities separate generic automation from SaaS-optimized solutions, and how to evaluate and implement the right platform for your growth stage, whether you’re managing $10 million or $200 million in ARR.

Essential Features SaaS Companies Need Beyond Native NetSuite

The results GitLab, Box, and Couchbase achieved weren't possible through NetSuite's native AR functionality or generic automation tools. Three specific capabilities separate SaaS-optimized platforms from traditional approaches:

Subscription-Aware Payment Prediction: From Guesswork to 90%+ Accuracy

The difference between accurate and inaccurate cash flow forecasting can determine whether your company hits quarterly targets, makes strategic hires, or maintains sufficient runway. Generic AR systems predict payment dates using simple historical averages: if customers typically pay in 35 days, the system forecasts 35 days for all future invoices.

Subscription businesses require substantially more sophisticated forecasting that accounts for multiple variables:

Billing cycle patterns: Annual contracts often receive payment faster than monthly subscriptions because customers budget for larger commitments differently. Usage-based invoices with variable amounts may experience payment delays when charges unexpectedly exceed customer expectations.

Contract milestone positioning: First invoices in a new customer relationship typically take longer to process as procurement teams complete vendor setup and approval workflows. Renewal invoices from established customers generally arrive faster due to pre-established payment automation.

Seasonal business rhythms: Enterprise SaaS companies observe distinct patterns around fiscal year ends (Q4 enterprise deal acceleration), holiday periods (payment processing slowdowns), and quarter-end timing (rush to recognize revenue).

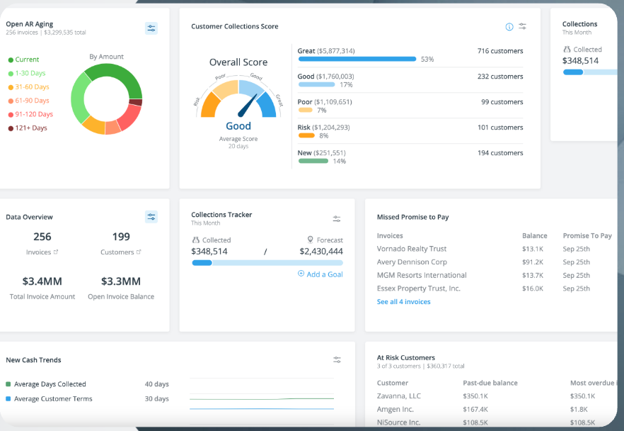

The best NetSuite AR Automation Software for SaaS companies employs machine learning models trained on millions of subscription payment transactions to achieve prediction accuracy exceeding 90 percent. This precision transforms cash flow forecasting from educated guesswork into reliable financial planning: the foundation enabling Couchbase to operate three years without additional fundraising.

Intelligent Dunning That Recovers Revenue Without Damaging Relationships

Failed subscription payments are among one of the most damaging yet preventable sources of SaaS revenue leakage. Research from payment infrastructure provider Stripe found that involuntary churn are caused by payment failures like credit card expirations, insufficient funds, and fraud holds. However, their data shows that implementing smart payment recovery can save 57% of failed payments, recovering what would otherwise be lost revenue.

Smart dunning systems built for SaaS operate fundamentally differently through three mechanisms:

Progressive communication escalation: Initial automated reminders use friendly, helpful language focused on payment method updates rather than collection threats. Only after multiple failed attempts does communication shift tone, and even then, it maintains the customer relationship as paramount.

Channel optimization: Email reminders may receive low open rates from customers who prefer in-app notifications or text messages. Effective systems test multiple channels and learn each customer's preferred communication method.

Customer success integration: When payment issues persist beyond initial automated recovery attempts, the system alerts customer success managers who can address underlying satisfaction or usage concerns that may be driving involuntary churn.

This capability directly addresses the revenue leakage challenge identified earlier while maintaining the customer relationships essential to subscription business models.

Deep NetSuite SuiteBilling Integration: Creating a Unified Revenue Operations Platform

For SaaS companies using NetSuite's SuiteBilling module to manage subscription billing, seamless integration with AR automation tools is non-negotiable. The data must flow bidirectionally in real-time to maintain accuracy across three critical workflows:

Subscription creation triggers AR setup: When a new subscription is established in SuiteBilling, the AR automation system immediately begins tracking expected invoice dates, monitoring payment method validity, and establishing communication preferences.

Invoice generation synchronizes instantly: As SuiteBilling creates recurring invoices, subscription upgrades, or usage overage charges, the AR system receives complete invoice details, including line items, payment terms, and customer contact information without manual data entry.

Payment application updates both systems: Customer payments recorded in the AR automation platform automatically flow back to NetSuite, updating invoice status, reducing aged receivables, and maintaining accurate financial records for month-end close.

The most sophisticated AR software for NetSuite doesn't merely integrate with SuiteBilling. It enhances it by adding AI-powered capabilities that SuiteBilling lacks natively, creating a unified subscription billing and collections environment.

These three capabilities: subscription-aware prediction, intelligent dunning, and deep SuiteBilling integration aren't unique to a single vendor. The market offers multiple solutions optimized for different company profiles and use cases.

NetSuite AR Automation Solutions: Comparison at a Glance

This comparison table provides a quick reference, but selecting the right solution requires understanding the nuanced tradeoffs between approaches. Two fundamental paths exist: continuing with NetSuite's native capabilities or investing in specialized automation. Each serves different company profiles.

Native NetSuite Capabilities: When They're Sufficient (And When They're Not)

NetSuite's included AR functionality serves early-stage SaaS companies well under specific conditions. If your business meets all of these criteria, you may not yet need specialized automation:

- Simple subscription model: All customers pay the same monthly or annual fee with no usage-based components, tiered pricing, or complex contract terms

- Low transaction volume: Fewer than 100 active subscriptions with manageable manual follow-up requirements

- Longer sales cycles: Enterprise SaaS with six to twelve-month sales cycles and correspondingly longer acceptance of 60-90 day payment terms

- Sufficient finance team capacity: AR staff have available time to manually prioritize collections and generate forecasts

For a $5 million ARR startup with 50 customers all on annual plans, native NetSuite combined with spreadsheet tracking might provide adequate functionality for 12-18 months.

However, the transition point typically occurs between $10-20 million ARR when finance leaders face a choice: add headcount to manage growing AR complexity, or implement automation that scales without proportional cost increases. As complexity grows: multiple pricing tiers, usage-based billing, hundreds of active subscriptions, or constrained finance team resources, manual processes become unsustainable.

Decision Framework: Matching Solutions to Your Growth Stage

SaaS finance leaders can evaluate their readiness for AR automation investment using this framework aligned with typical ARR milestones:

Early Stage ($1M-$10M ARR): Focus on establishing foundational processes with native NetSuite plus selective automation for the highest-pain tasks. Invest in billing platform integration before full AR automation. Solutions like BILL or NetSuite Native provide adequate functionality while you validate product-market fit.

Growth Stage ($10M-$50M ARR): The critical inflection point: manual AR processes begin breaking under transaction volume. Implement the best AR automation for NetSuite before adding headcount to manage growth. ROI analysis should demonstrate automation costs lower than equivalent full-time employee expenses. Solutions like Tesorio, Centime, or LedgerUp offer the right balance of capability and implementation speed.

Scale Stage ($50M-$200M ARR): AR automation transitions from efficiency tool to strategic advantage. Advanced forecasting capabilities directly impact financial planning, investor reporting, and strategic decision-making. The focus shifts from "Can we afford automation?" to "Which advanced capabilities create competitive advantage?"

Enterprise ($200M+ ARR): Multiple specialized AR automation tools may be necessary for different use cases (enterprise collections versus SMB automation). Integration complexity increases, but ROI scales with transaction volume.

Implementing AR Automation: Timeline, Team, and Tactics

Understanding which solution fits your needs is only half the equation. Successful implementation requires realistic timeline expectations, effective change management, and avoiding common pitfalls that derail projects.

Timeline Expectations: 30 Days to Production Value

One of the most common concerns finance leaders express about AR automation is the implementation timeline and potential disruption. Past experiences with lengthy ERP implementations or failed software projects create reasonable caution. However, modern cloud-based AR automation designed specifically for NetSuite deploys far faster than legacy enterprise software:

Week 1-2: Discovery and Configuration

- System access provisioning and API connection establishment

- Historical payment data analysis to train AI models

- Workflow design based on current AR processes and improvement opportunities

- Customer segmentation strategy for tiered communication approaches

Week 3: Integration and Testing

- NetSuite data synchronization verification

- SuiteBilling integration confirmation for subscription billing

- Test payment prediction accuracy against known outcomes

- Staging environment testing with sample customer scenarios

Week 4: Training and Go-Live

- Finance team training on new workflows and dashboards

- Customer success team briefing on payment alerts and collection support

- Soft launch with 20 percent of the customer base to validate processes

- Full production rollout with monitoring for the first month

Leading SaaS companies report 30-day implementations from contract signature to full production use, which is dramatically faster than the 3-6 month timelines common with enterprise-grade alternatives. This speed-to-value matters when AR inefficiencies cost thousands of dollars monthly in delayed cash flow.

Change Management: Getting Finance and Customer Success Aligned

Technology implementation succeeds or fails based on user adoption. Finance teams accustomed to manual processes may initially resist automation, they perceive as replacing their expertise rather than enhancing it. Effective change management addresses these concerns directly through three approaches:

Frame automation as capacity creation: Instead of "the system will do your job," position automation as "the system handles repetitive tasks so you can focus on complex accounts requiring human judgment." Show analysts how AI-powered prioritization helps them collect more effectively, rather than replacing their customer relationships.

Involve the team in configuration decisions: Finance staff possess deep knowledge about which customers require white-glove treatment versus automated workflows. Incorporate their expertise into segmentation strategies and communication templates.

Measure and celebrate wins: Share weekly metrics showing DSO improvement, cash collected, and time saved. Recognition of team members who effectively leverage automation drives broader adoption.

Customer success teams represent another critical stakeholder group. When AR automation identifies customers with persistent payment issues, customer success managers need context about whether the concern is financial (budget constraints, layoffs) or operational (technical issues preventing value realization). Integration between AR automation and customer health scoring platforms creates alignment between collections and retention strategies.

Three Implementation Pitfalls to Avoid

Even well-planned implementations encounter predictable challenges. Anticipating these three common pitfalls increases success probability:

Pitfall #1: Insufficient Billing Platform Integration Planning

Many SaaS companies select NetSuite AR automation solutions that integrate beautifully with NetSuite but fail to connect with their billing platforms (Zuora, Stripe, Chargebee). This creates a disconnect: subscription data lives in the billing system, invoice records are populated in NetSuite, and AR automation can only optimize collections based on NetSuite data without full subscription context.

Successful implementations establish three-way integration: Billing Platform → NetSuite → AR Automation, with subscription health data flowing through all systems. Before selecting an AR automation vendor, confirm they have pre-built integrations or API capabilities for your specific billing platform.

Pitfall #2: Over-Automation Without Human Oversight

While automation delivers tremendous efficiency gains, completely removing human judgment creates risk. High-value enterprise accounts, strategic partnerships, or customers showing signs of distress require nuanced handling that AI cannot fully replicate.

Best practice: Configure automated workflows for the 80 percent of customers representing 20 percent of ARR (long-tail SMB accounts), while maintaining human-in-the-loop processes for strategic accounts. The best NetSuite AR Automation Software for SaaS companies provides flexible configuration allowing different treatment tiers.

Pitfall #3: Neglecting Customer Communication Testing

Automated dunning workflows can damage customer relationships if communications lack appropriate context or tone. Before enabling automated customer outreach:

- Test message templates with your customer success team

- Pilot automated communications with internal team members to evaluate tone and clarity

- Start with friendly payment reminders for customers with historically good payment behavior before deploying dunning for seriously delinquent accounts

- Monitor customer satisfaction scores and support ticket volume during initial rollout

These implementation considerations explain why vendor selection extends beyond feature comparison. The next section examines specific evaluation criteria and questions to ask during the selection process.

Selecting the Right AR Automation Partner: Evaluation Framework

Three Evaluation Criteria That Matter More Than Feature Lists

When comparing AR software for NetSuite, resist the temptation to create extensive feature comparison spreadsheets. Most enterprise-grade solutions offer similar core capabilities (automated invoicing, payment reminders, dashboard reporting). Differentiation emerges in three critical areas:

SaaS-specific expertise and intelligence: Does the vendor truly understand subscription billing complexities, or are they applying generic AR automation to all industries? Review their customer base: if you don't see other B2B SaaS companies, their system likely lacks subscription-specific capabilities regardless of marketing claims.

NetSuite integration depth: Surface-level API connections provide basic data exchange. Deep integrations offer real-time bidirectional sync, custom NetSuite field mapping, SuiteBilling awareness, and multi-subsidiary support. Ask for technical architecture documentation and reference customers with similar NetSuite configurations.

Implementation and support model: Vendor-led implementations with dedicated SaaS finance experts dramatically increase success rates compared to self-service onboarding. Post-implementation support should include proactive optimization recommendations, not just reactive break-fix assistance.

Critical Questions to Ask During Vendor Evaluation

Technical Questions:

- How does your payment prediction algorithm specifically account for subscription billing patterns versus one-time invoices?

- What data sources does your AI model use for payment forecasting, and how frequently is it retrained?

- Describe your NetSuite SuiteBilling integration architecture: what data flows in real-time versus batch updates?

- How do you handle multi-year contracts with monthly billing in your forecasting?

Results-Based Questions:

- What average DSO improvement do SaaS customers in our ARR range achieve within the first 6 months?

- How many of your customers are B2B SaaS companies using NetSuite SuiteBilling?

- Can you share a case study from a SaaS company with similar billing complexity to ours?

- What percentage of your SaaS customers achieve 90+ percent payment prediction accuracy?

Implementation Questions:

- What is your typical implementation timeline for a SaaS company with [X] customers on NetSuite?

- Which team members from our organization need to be involved in implementation?

- What's your change management approach for finance teams transitioning from manual processes?

- How do you measure implementation success beyond technical go-live?

Taking the Next Step: Transforming Your SaaS AR Operations

For SaaS finance leaders managing NetSuite, the decision to implement specialized AR automation represents an inflection point. You can continue scaling manually: adding headcount proportionally with revenue growth, maintaining spreadsheet-based cash flow forecasts, and accepting DSO in the 45-60 day range as industry standard. Or you can follow the path that GitLab, Box, and Couchbase chose: implementing best NetSuite AR Automation Software for SaaS companies to achieve 30 percent DSO reductions, maintain lean finance teams despite revenue doubling, and gain cash flow visibility that transforms financial planning.

The companies achieving these results share common characteristics: they recognized that subscription billing complexity requires specialized tools beyond generic ERP functionality, they prioritized AI-powered intelligence over rules-based automation, and they selected vendors with deep SaaS expertise rather than generalist AR solutions. Most importantly, they viewed AR automation not as a cost-center efficiency project but as a strategic investment that enables faster growth with better capital efficiency.

Whether you’re at $20M ARR planning your next raise, $75M ARR preparing for public-market scrutiny, or $150M ARR focused on capital efficiency, the way your AR function scales will shape how confidently you plan and deploy cash.

If you want to explore what that shift looks like in practice:

Request a SaaS Finance Demo

See how collections, renewals, and cash forecasting work when NetSuite and subscription billing are fully connected.

Access the 2025 SaaS AR Benchmark Report

Compare your DSO, collection efficiency, and forecasting accuracy against hundreds of SaaS companies.

Run Your Cash Impact Model

Estimate potential DSO reduction, working capital unlocked, and productivity gains based on your current metrics.

You can also see how this plays out across real finance teams. Across 200+ verified G2 reviews (4.7/5), SaaS users consistently point to clearer cash visibility, fewer surprises, and significantly less manual follow-up as outcomes of adopting specialized AR automation.

Frequently Asked Questions

How long does AR automation implementation typically take for a SaaS company on NetSuite?

Implementation timelines range from 30 days to 6 months depending on solution complexity and integration requirements. Leading NetSuite AR Automation Software for SaaS companies achieve production deployment in 30 days through pre-built NetSuite connectors, AI models pre-trained on SaaS payment patterns, and streamlined configuration processes. Enterprise-grade alternatives with extensive customization may require 3-6 months. Evaluate vendor implementation methodology and request timeline estimates based on your specific NetSuite configuration.

What's the difference between NetSuite SuiteBilling and third-party AR automation?

SuiteBilling handles subscription billing: creating recurring invoices, managing subscription terms, processing upgrades/downgrades, and calculating prorations. AR automation optimizes collections after invoices are generated: predicting payment dates, prioritizing collection outreach, automating dunning workflows, and forecasting cash flow. They serve complementary functions: SuiteBilling creates invoices; AR automation ensures they get paid quickly. The best AR automation for NetSuite integrates seamlessly with SuiteBilling to provide end-to-end subscription revenue management.

How accurate is AI-powered payment prediction for subscription payments?

Leading solutions achieve 90+ percent accuracy in payment date prediction for subscription businesses when trained on sufficient historical data. Accuracy improves over time as the machine learning model analyzes more of your specific customer payment patterns. Factors impacting accuracy include customer payment history volume (more history enables better predictions), billing cycle complexity (simple monthly subscriptions are easier to predict than usage-based variable billing), and subscription maturity (established multi-year customers are more predictable than recently acquired accounts).

Can AR automation track MRR and ARR in NetSuite?

Yes, advanced AR automation platforms designed for SaaS track MRR and ARR metrics alongside traditional accounts receivable data. These systems connect billing platform data (from Stripe, Zuora, or Chargebee) with NetSuite AR records to provide unified visibility. Dashboards display not just invoice aging but also recurring revenue trends, churn impact on collections, and subscription cohort performance. This allows CFOs to understand how payment timing affects monthly recurring revenue recognition and annual recurring revenue forecasts.

Can AR automation track how churn affects my collections?

Yes, sophisticated AR automation platforms correlate payment behavior with churn risk. The system monitors payment timing changes (e.g., customer shifts from paying immediately to consistently reaching day 45), declining payment reliability scores, increased support tickets or failed payment attempts, and usage pattern changes indicating reduced product engagement. When these signals appear, the system alerts customer success teams to intervene before payment issues escalate to subscription cancellation. This turns AR from a reactive collections function into a proactive retention tool.