NetSuite Cash Application Automation: A Practical Playbook for Faster Matching, Fewer Exceptions, and Cleaner Reconciliation (Built for SaaS Reality)

TL;DR

If cash application feels harder than it should in NetSuite, you’re not imagining it. Most teams struggle because payments arrive in ways the system can’t confidently interpret.

ACHs come from parent entities. Lockbox remittance lives in PDFs. Memo fields are inconsistent or missing. Partial payments and deductions require judgment, not rules.

Because of this cash posts late, unapplied balances grow, and reconciliation becomes a monthly cleanup exercise instead of a control point.

When teams say “NetSuite didn’t match it,” what they usually mean is:

- The payer couldn’t be identified with confidence

- The remittance wasn’t usable

- Or no one owned the exception early enough

Turning on automated cash application helps, but it doesn’t solve those problems by itself.

That’s because NetSuite cash application automation isn’t a single feature. It’s a workflow that spans payment intake, payer identity, invoice matching, exception handling, and reconciliation, which only works as well as the operating model around it.

This guide is written for finance teams who already understand AR mechanics and want fewer surprises, less manual cleanup, and a close process they can actually trust.

What this playbook covers (and why it’s practical)

Instead of rehashing definitions, this guide focuses on the decisions that determine outcomes:

- What NetSuite cash application automation actually does

And where responsibility shifts from the system to your team.

- Why does cash application become the bottleneck

Even when collections performance looks strong.

- How to design a scalable operating model

Automate high-confidence matches, and control everything else with clear ownership.

- Where lockbox and remittance quality change the math

And why rule-tuning fails when inputs are unstructured.

- What’s different for SaaS teams

High volume, parent payers, credits, and cross-functional dependencies.

- Which KPIs prove the system is working

Beyond “DSO looks okay.”

If your goal is to reduce unapplied cash, shorten reconciliation cycles, and stop absorbing exceptions at month-end, this guide walks through how teams actually get there step by step.

Why does cash application become the bottleneck in NetSuite

Cash application is where the business’s story gets tested. You can have clean revenue reporting and still be flying blind if payments arrive without usable remittance, get stuck in unapplied cash, or require heroic month-end cleanups. The symptom looks like “NetSuite didn’t match it.” The root cause is usually broader: inconsistent identifiers, messy lockbox inputs, unclear ownership, and exceptions that pile up until reconciliation absorbs the debt.

That’s why the right goal for NetSuite cash application automation isn’t “zero exceptions.” It’s high-confidence matching plus disciplined exception handling that keeps AR accurate and close to predictable.

What NetSuite cash application automation actually means

At its core, NetSuite cash application automation is the repeatable process that moves you from “cash arrived” to “invoice cleared” with minimal manual touches and a reliable audit trail.

In practice, that includes five connected pieces:

- Payment intake (bank imports, lockbox deposits, ACH/wires, checks, remittance emails/PDFs)

- Payer identification (who sent the money, and which customer it belongs to)

- Invoice matching and application (what the payment should close out)

- Exception handling (everything that’s missing, ambiguous, partial, or disputed)

- Cash reconciliation (tying bank activity to what’s recorded so you can close)

NetSuite provides native building blocks for this flow, including automated cash application and a banking workflow that supports matching and reconciliation.

That’s the foundation. The rest of this guide is about making that foundation work in the real world.

The first fork in the road: “payment matching” vs “cash reconciliation.”

Before you change anything, clarify what your team means by “payment matching.”

Most teams use NetSuite payment matching to mean one of two workflows:

- Cash application matching: applying customer payments to invoices so AR reflects reality

- Bank matching and reconciliation: matching imported bank activity to recorded transactions so you can reconcile statements and close cleanly

NetSuite’s banking workflow expects rules-driven matching and then review for whatever doesn’t match automatically.

This matters because if unapplied cash is your day-to-day pain, you can’t fix it by optimizing reconciliation alone. Reconciliation is the checkpoint. Cash application is what makes the checkpoint easy.

How the native NetSuite flow works (and where reality intrudes)

In the cleanest version of the world, the flow looks like this:

- Import bank activity or receive lockbox inputs

- Create/record customer payments

- Apply payments to open invoices

- Match and clear transactions in the banking workflow

- Reconcile statements with a short review list

NetSuite’s Automated Cash Application is intended to help reduce the manual effort of generating and applying payments from imported bank data when the data supports it. And when things don’t match cleanly, the banking workflow provides a structured way to review and resolve remaining items.

In other words, the system isn’t “broken.” The inputs and ownership model are. So instead of treating this like “tune the matching rules,” treat it like a workflow design problem.

The operating model that actually scales (the playbook’s core)

A scalable cash application system has one guiding principle:

Automate what’s high-confidence. Operationalize everything else.

Here’s how that breaks down into a practical operating model.

1) Decide your matching hierarchy

Start with what you trust most (invoice references, known payer mappings), then use secondary signals (memo patterns, known remittance formats). Anything uncertain goes to exceptions by design.

This reduces the worst kind of work: manual rework caused by a system “guessing” incorrectly.

2) Treat payer mapping like master data, not a cleanup

Most “matching failures” are identity failures. The long-term unlock is a consistent program for payer-to-customer mapping (with a short weekly cadence to clean up the unknowns).

The goal isn’t to fix every odd payment, but reduce recurring ambiguity.

3) Build an exception queue with owners and SLAs

Exceptions will always exist. The question is whether they become a backlog or a controlled queue.

Define exception types that match reality:

- missing remittance

- ambiguous payer (parent entity, naming mismatch)

- multi-invoice ambiguity

- partial payment / short pay

- deductions/disputes

Then assign owners and SLAs. This is the moment the work becomes predictable instead of reactive.

4) Reconcile continuously, not monthly

If month-end reconciliation feels painful, it’s usually because reconciliation is absorbing the entire month’s exception debt. NetSuite’s workflow supports rules-based matching, but it still requires review for what doesn’t match automatically, so the sustainable fix is shrinking the review list throughout the month. This is how you get to cleaner NetSuite cash reconciliation.

Where lockbox changes everything (and why teams buy a lockbox solution)

If you’re evaluating NetSuite lockbox automation or a NetSuite lockbox solution, you’re usually dealing with one reality: the “data you need to match” is trapped in unstructured remittance.

That changes the game because you can’t automate matching well without first making remittance usable. Many teams spend months tuning rules when the upstream problem is that invoice references are missing, fragmented, or locked in PDFs.

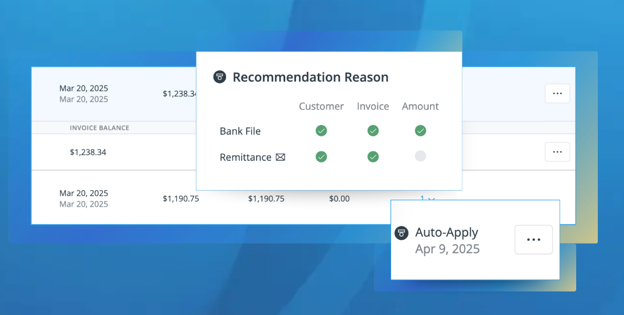

This is where a remittance capture layer can matter. A Cash Application Agent for example, emphasizes extracting payment detail from remittance sources like lockbox PDFs and remittance emails to reduce exception volume and speed application.

The key is the capability: turn messy remittance into matchable information and route the rest into exceptions immediately.

If you’re SaaS: what’s different (and what to fix first)

SaaS teams hit the same fundamentals as everyone else, but at higher volume and with more variability. That changes what “good” looks like.

What tends to be different for SaaS finance teams:

- Higher invoice volume means exception work must be throughput-optimized

- Parent payer behavior is common, so payer identity issues repeat

- Credits/adjustments are frequent, so partial pays and short pays are “normal”

- Cross-functional context matters: disputes and timing often require Sales/CS alignment

The SaaS-first fix:

Start with payer identity and exception ownership. If your exceptions are well-categorized and assigned, you can scale. If they’re ad hoc, no amount of automation will keep up.

Only after that should you evaluate NetSuite cash application software as leverage, especially if lockbox/remittance inputs are inherently unstructured and the team is paying a constant “interpretation tax.”

A troubleshooting playbook (so your team can diagnose issues fast)

Once you have the operating model, troubleshooting becomes straightforward: you’re always asking “is this identity, remittance, allocation, or governance?”

When NetSuite doesn’t match a payment to the right customer

That’s usually payer identity. Fix it with payer mapping discipline and a weekly review of unknown payers. This is the highest ROI “boring work” in cash application.

When lockbox deposits don’t include usable invoice references

That’s remittance capture. Solve it upstream (extract/normalize remittance), then let your matching workflow do its job.

When unapplied cash keeps growing

That’s almost always an exception backlog or unclear ownership. Treat unapplied cash like a production queue: categorize, assign, and resolve to SLA.

When reconciliation is slow and full of surprises

That’s exception debt. Shrink it throughout the month. NetSuite supports rules-based matching plus review for the remainder, so the practical goal is to keep the remainder small and recent.

This troubleshooting lens keeps your team out of the “random fixes” cycle that creates rework and audit risk.

Do you need NetSuite cash application software, or is native NetSuite enough?

At this point in the playbook, the decision is clearer because you’re no longer buying hope. You’re buying capacity.

Native NetSuite is often enough when:

- Most payments arrive with reliable invoice references

- Lockbox is low volume, or remittance is already structured

- Exceptions are manageable and clearly owned

You should consider NetSuite cash application software (or a lockbox solution) when:

- Remittance arrives via PDFs/emails and requires human interpretation

- Exception volume is predictable, but too high for the team to sustainably keep up

- Month-end close is repeatedly slowed by unapplied cash and matching backlogs

The goal isn’t to “add a tool.” It’s to reduce manual touches while increasing control.

What to measure so you know it’s working (KPIs + benchmarks)

Cash application automation succeeds when your work becomes more predictable and less manual. Track a small KPI pack that tells you whether you’re moving in the right direction:

- auto-apply / auto-match rate

- time-to-apply (cash received → applied)

- exception volume by category

- unapplied cash balance and aging

- reconciliation cycle time and rework

How to use your benchmark report visuals without breaking the flow

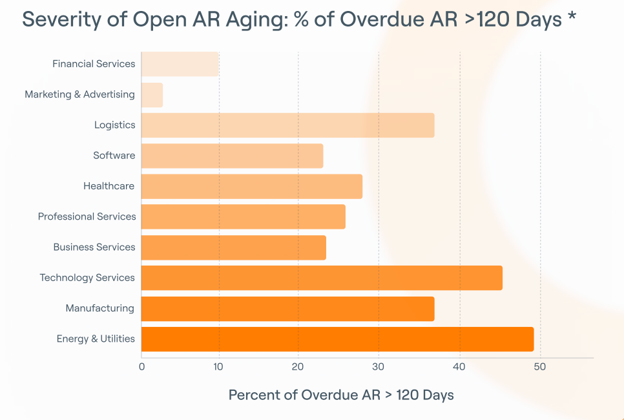

Benchmark data from 2025 is useful in cash application, but only when it shows up at the moment a decision needs context.

Early in the guide, an industry comparison benchmark does one job. It answers, “Is this just us?” and “How far off are we, really?”

Midway through, when the guide shifts into exception handling and unapplied cash, an aging or severity distribution visual becomes useful. This is where benchmarks connect operational behavior to risk. At this point, the data supports why ownership, SLAs, and routing matter more than additional matching rules.

Late in the guide, a scorecard or health index benchmark helps translate insight into action. This is where you want to know what “good” actually looks like in practice. The benchmark anchors expectations and turns measurement into a management tool instead of a reporting exercise.

Placed this way, the benchmark reinforces why each design choice matters and how other teams are measuring success in the same moments of the workflow.

Proof that the workflow approach drives outcomes

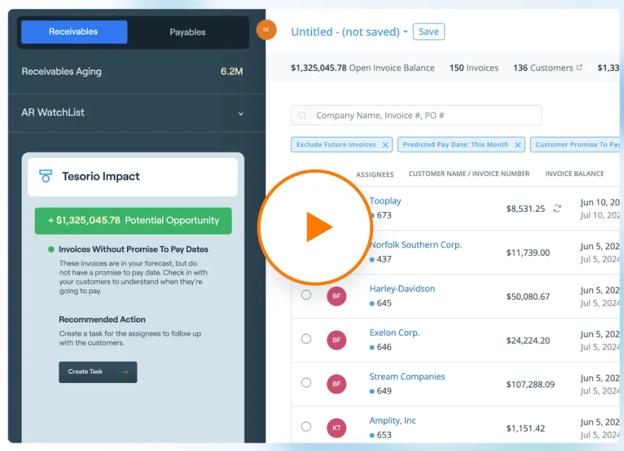

When teams connect workflow, ownership, and visibility, results follow:

- Couchbase (NetSuite ERP): After connecting AR workflows directly to NetSuite and operationalizing prioritization and forecasting, Couchbase reduced DSO by 10 days, doubled collections per analyst without adding headcount, and cut the cash-flow forecast build time from ~10 days to a few hours. The key shift wasn’t more reminders. It was turning collections and cash visibility into a system the CFO could actively manage in-quarter, not retroactively explain.

- Discovery Education: After implementing workflow-driven automation with clear segmentation and governance, their DSO in the largest business segment improved by 66% in one year, the average collection period dropped from ~97 days to ~59 days, and AR review time shrank from hours to minutes. The critical shift was that centralized visibility allowed the team to route messages to the right contacts, pause outreach where needed, and prevent duplicate or inappropriate communication. As a result, leadership could review aging trends, workload distribution, and cash performance in real time and consistently show improvement quarter over quarter.

- Veeva: After implementing workflow-driven collections automation with segmentation and team-level visibility, Veeva saw measurable, sustained impact with a 50% reduction in 90-day aged receivables, 75% reduction in bad-debt write-offs, and 2× improvement in collections team efficiency. The operational shift was driven by two changes. First, low-balance accounts (under $1,500) were fully automated, immediately removing a large volume of low-ROI manual work. Second, higher-value accounts were placed into segmented, stage-specific dunning campaigns, with different messaging at 30, 60, 90, and 120 days past due. This allowed the team to escalate large balances earlier without damaging customer relationships.

A 30-day implementation plan your team can actually run

If you want to move quickly without creating reconciliation risk, sequence your work like this:

Days 1–7: Baseline and scope

Map payment sources and measure: exception categories, unapplied cash aging, time-to-apply, and reconciliation effort.

Days 8–14: Fix ownership and identity

Assign unapplied cash ownership, create a weekly payer mapping review, and define exception categories and SLAs.

Days 15–21: Automate the repeatable

Standardize invoice reference expectations for key segments, automate high-confidence matches, and document what routes to exceptions.

Days 22–30: Operationalize exceptions + continuous reconciliation

Stand up the queue, review KPIs weekly, and reconcile weekly so the month-end becomes verification, not cleanup.

By the end of 30 days, you should see fewer unknowns, a smaller exception backlog, and a close process that feels more controlled.

What this all comes down to is execution discipline

Teams that improve cash application don’t do it by endlessly tuning rules. They do it by fixing identity and remittance quality first, treating exceptions as a managed queue and keeping reconciliation lightweight by shrinking exception debt throughout the month.

NetSuite already provides the core mechanics. The real leverage comes from the operating model you build around them: ownership, cadence, and visibility that finance can actually run.

Across hundreds of finance teams, the pattern is consistent. On G2, 200+ verified reviews (4.7/5) point to the same outcomes after moving beyond ERP-only AR workflows: fewer exceptions, cleaner handoffs, and materially less time spent reconciling gaps between systems.

If you want to see how this looks with real workflows and data:

- Interactive Product Demo

Walk through collections, cash application, and cash visibility inside a NetSuite-connected environment end to end, not as isolated features.

- Book a Call

Talk through your AR and cash application setup with specialists who understand NetSuite realities: lockbox inputs, payer identity, exception volume, and close pressure.

If you’re still pressure-testing the decision:

- Download: 2025 AR Benchmark Report

Compare DSO, overdue exposure, and deep-aging risk across 10 industries to see where performance actually diverges.

- Calculate ROI: AR Automation ROI Calculator

Input invoice volume, DSO, and team size to estimate working capital unlocked, productivity lift, and payback timeline based on your current state.

Once you can see how you compare and what unresolved exceptions are really costing, the next steps usually become self-evident.

Frequently Asked Questions

How does NetSuite cash application automation work?

It starts with importing payment data, generating/recording customer payments, applying payments to invoices where identifiers are reliable, routing unclear items into review, and reconciling bank activity to the ledger.

What’s the difference between NetSuite payment matching automation and NetSuite cash reconciliation?

Payment matching can mean applying payments to invoices (cash application) or matching bank activity during reconciliation. Reconciliation ensures bank-to-ledger alignment; cash application ensures AR accuracy.

Why does NetSuite automated cash application still create exceptions?

Because incoming payment and remittance data are often incomplete or ambiguous, especially with lockbox and email-based remittance. Exceptions are normal and must be managed.

When should I consider NetSuite cash application software or a NetSuite lockbox solution?

When remittance is unstructured and exceptions are frequent enough to slow close or require constant manual interpretation, a purpose-built automation layer can reduce manual touches while maintaining control.