7 Best AR Automation Solutions for NetSuite in 2026 (SaaS Finance Leader’s Guide)

TL;DR: Quick Summary

If you run AR for a SaaS or subscription business on NetSuite, this guide helps you choose AR automation that understands renewals, expansion revenue, and subscription complexity.

- Best overall for SaaS on NetSuite: Tesorio – renewal-aware cash flow forecasting, churn-aware collections, and deep NetSuite + billing + CRM integrations; used by companies like Couchbase and Veeva Systems to cut DSO by 10-33 days and double collections productivity.

- Enterprise / high-volume alternative: HighRadius – strongest for very large enterprises with massive transaction volume and treasury needs, but less subscription-native.

- Entry-level / budget options: Bill.com (unified AP/AR for small SaaS) and Lockstep (basic AR automation) work for simpler models and earlier stages.

- Specialized needs: Versapay (customer payment collaboration), BlackLine (revenue recognition and close), Gaviti (AI dunning focus).

- How to choose: Start from your primary constraint. It could be unpredictable renewal cash timing, an overwhelmed collections team, scaling without headcount, complex RevRec, or budget. Then map that to the platform purpose-built for that problem. Most SaaS teams see measurable DSO and cash predictability improvements within ~90 days of focused implementation.

Why This Guide Exists: The SaaS AR Challenge on NetSuite

If you manage AR for a SaaS or subscription business on NetSuite, you already know the core issues: DSO reviews take longer than they should, spreadsheets break as billing complexity grows, and renewal-driven cash timing is hard to predict with any accuracy.

NetSuite tells you what’s invoiced and what’s overdue.

It does not tell you:

- When enterprise customers actually pay renewal invoices

- How payment timing differs by segment (enterprise, mid-market, SMB)

- Which past-due accounts signal churn risk vs. normal AP delay

- How subscription changes (upgrades, downgrades, multi-year terms) impact future cash

That’s the operational gap most SaaS finance teams face in 2026:

- Tech companies average ~48-day DSO; about 30% of invoices are overdue.

- Analysis across tens of billions in receivables shows potential performance improvements of 1.4x–2.5x with the right tooling.

- The issue isn’t team effort. It’s that traditional ERPs and generic AR tools aren’t designed for renewal-heavy, subscription-based cash cycles.

This guide is written for SaaS CFOs, Controllers, and Revenue/Finance leaders who:

- Run financials on NetSuite

- Manage recurring and multi-year contracts

- Need accurate, renewal-aware forecasting and collections automation that reflects customer value, churn signals, and segment-level payment behavior

Here’s what this guide will help you do:

- Identify what SaaS businesses on NetSuite actually require from AR automation (and why generic tools fall short).

- Compare seven leading platforms based on those criteria, with a focus on NetSuite integration depth and subscription-specific capabilities.

- Match tools to practical SaaS finance scenarios (renewal unpredictability, overwhelmed collections team, scaling constraints, RevRec complexity, or budget limitations).

- Understand implementation and expected ROI, so you can present a grounded plan, not just a vendor list.

By the end, you’ll have a clear view of which AR automation solution fits your SaaS business, why it fits, and what to expect within the first 90 days of deployment.

Part 1: Understanding What SaaS Companies Actually Need

Why SaaS AR Is Different (And Why Generic Tools Fail)

Before comparing platforms, let's establish why SaaS businesses on NetSuite face unique challenges that standard AR tools weren't built to solve.

The Multi-Year Contract Forecasting Problem

Most cash flow forecasting tools predict when customers will pay based on invoice due dates. But SaaS renewal payments follow completely different patterns:

- Enterprise customers ($100K+ annual contracts) typically pay 15-30 days after renewal

- Mid-market customers ($10K-$50K annual contracts) pay 7-15 days after renewal

- SMB customers (<$10K annual contracts) pay via automatic payment method within 3-5 days

When your CFO asks, "We have $15M in Q2 renewals. When does that actually convert to cash?", invoice due dates give you the wrong answer. You need renewal-aware forecasting that learns from historical payment patterns by customer segment.

The Churn-Aware Collections Challenge

Not all late payments signal the same thing. Consider two customers, both 15 days past due:

- Customer A: Strategic enterprise account, $200K annual contract, high product usage, healthy NPS scores, payment delayed due to AP approval process

- Customer B: Declining mid-market account, $25K annual contract, usage down 40%, support escalations increasing, renewal at risk

Generic AR automation treats both identically: send payment reminder email, escalate at 30 days. But Customer A needs relationship-sensitive handling (personal outreach from an account manager), while Customer B needs early intervention from the customer success team to address underlying churn risk before the payment issue becomes a lost customer.

SaaS-optimized collections automation integrates customer health scores to differentiate these scenarios.

The Subscription Billing Complexity Reality

Your AR processes need to handle:

- Monthly recurring revenue with annual upfront payment options

- Usage-based overages billed in arrears

- Expansion revenue from mid-contract upsells

- Prorated adjustments from downgrades or cancellations

- Multi-currency subscriptions for global customers

NetSuite records these transactions, but without specialized AR automation, your team manually tracks payment timing, chases down exceptions, and builds forecast models in spreadsheets that break every time your pricing model changes.

With 59% of CFOs now deploying artificial intelligence in their finance functions—up from just 37% two years ago—the question isn't whether to automate, it's which platform understands subscription business complexity well enough to deliver results, not just features.

What to Look For: Essential Capabilities for SaaS

Now that you understand the unique challenges, here's what separates platforms built for subscription businesses from generic AR tools retrofitted for SaaS.

1. NetSuite Integration Architecture That Actually Works

Not all integrations are created equal. You need to understand three critical dimensions:

Data Flow Speed

- Real-time API integration: Payment data syncs immediately, forecasts update continuously, collections workflows trigger instantly

- Batch integration: Payment data syncs overnight, forecasts lag by 24 hours, and collections workflows are delayed until the next sync

- For SaaS businesses managing thousands of subscriptions: Real-time matters: a customer paying at 4pm should update your cash position by 4:01pm

Subscription Data Handling

- Does the platform sync subscription modifications (upgrades, downgrades, cancellations) automatically?

- Can it handle multi-year contract complexity (Year 1, Year 2, Year 3 payments tracked separately)?

- Does it integrate with your billing system (Stripe, Zuora, Chargebee) in addition to NetSuite?

CRM and Customer Success Integration

- Can it pull customer health scores from Gainsight, Totango, or ChurnZero?

- Does it sync renewal pipeline data from Salesforce or HubSpot?

- Can collections priority be influenced by product usage data?

The platform that can't answer "yes" to these questions forces your team into manual workarounds that defeat the purpose of automation.

2. Collections Intelligence vs. Basic Reminders

Entry-level tools send scheduled payment reminders to everyone identically. AI-powered platforms do something fundamentally different: they predict who will pay late, automatically prioritize by both payment risk and customer value, and adapt strategies based on what actually works with your customers.

For SaaS businesses, this sophistication matters enormously because:

- Customer lifetime value varies dramatically: $5K SMB customer vs. $500K enterprise account requires different treatment

- Churn risk influences collections approach: At-risk customers need customer success intervention, not aggressive dunning

- Renewal timing affects strategy: Customers approaching renewal get different messaging than mid-contract customers

Companies using AI-powered collections automation tailored to subscription models report 20-30% better collection performance than generic reminder sequences, while maintaining the customer relationships that drive retention and expansion revenue.

3. Strategic Cash Flow Forecasting vs. Reactive Reporting

Basic AR dashboards show what happened yesterday. Strategic platforms predict what will happen tomorrow based on actual payment behavior, not invoice due dates. For SaaS CFOs, this shift from reactive to predictive transforms AR from operational burden to strategic asset.

What renewal-aware forecasting actually means:

- Models cash timing for upcoming renewals based on historical patterns by customer segment

- Handles multi-year contract complexity (predicts Year 2 and Year 3 payment timing separately)

- Integrates expansion revenue forecasts from the CRM pipeline

- Adjusts predictions based on customer health scores and churn probability

- Enables scenario planning: "If we close 85% of Q2 renewals with a 10% discount, when does cash arrive, and what's the working capital impact?"

This is the capability that enables Couchbase's CFO to say: "We haven't raised capital in three years because we have better cash flow performance and can live off what we bring in."

4. Scalability That Enables Non-Linear Growth

Here's the test of whether AR automation actually works for SaaS: Can you double ARR without doubling your collections team?

One AdTech SaaS company processed a 448% increase in invoice volume without adding collections headcount. A database technology company doubled ARR while maintaining the same team size.

This happens through:

- Automated dunning campaigns handling 70-80% of routine follow-ups

- AI prioritization focusing human effort on the top 20% of accounts (by revenue and risk)

- Self-service payment portals reducing incoming "how do I pay?" inquiries by 60-70%

- Predictive alerts catching at-risk accounts before they're 90+ days past due

For fast-growing SaaS businesses, non-linear scaling is the difference between profitable growth and margin compression from linear cost increases.

Now that you understand what you actually need, let's evaluate which platforms deliver these capabilities.

Part 2: The 7 Best Solutions Compared (Ranked for SaaS)

We'll evaluate each platform against the four essential capabilities just outlined, starting with the solution purpose-built for subscription businesses.

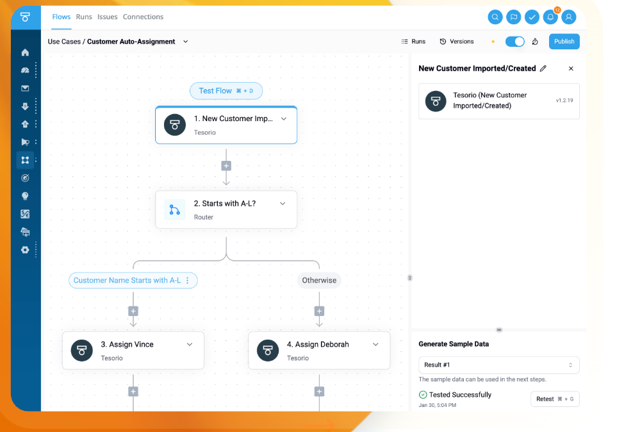

1. Tesorio: Purpose-Built for SaaS Cash Intelligence

Why SaaS Companies Choose Tesorio

Tesorio is the only platform on this list designed specifically for subscription businesses managing complex cash flows. Unlike collections-only tools or treasury-focused platforms, Tesorio connects three critical functions that SaaS finance teams need unified: collections automation, cash flow forecasting, and renewal pipeline visibility.

How It Handles SaaS:

Renewal-Aware Forecasting

Tesorio doesn't just predict when invoices are due. It predicts when customers will actually pay based on their historical behavior. For renewals specifically, it learns:

- How long enterprise customers take to pay renewal invoices (typically 15-30 days after the renewal date)

- Whether mid-market customers pay faster after Year 1 (they do: AP relationships established)

- Which customer segments consistently pay early vs. late

This enables CFOs to answer: "We have $15M in Q2 renewals. When does that cash actually arrive?" with 90%+ accuracy within a 30-day window.

Churn-Aware Collections

Tesorio integrates customer health scores from your customer success platform (Gainsight, Totango, ChurnZero) to adjust both payment predictions and collections strategies:

- High-value, high-health customers 15 days past due → Relationship-led outreach from account manager

- High-value, declining-health customers → Immediate escalation to customer success + collections

- Low-value, low-health customers → Automated dunning campaign, minimal human touch

This approach reduces bad debt while preserving the customer relationships that drive retention.

Multi-Year Contract Intelligence

For SaaS companies with 2-year and 3-year contracts, Tesorio tracks each payment cycle separately. A $300K 3-year deal paid annually creates three distinct payment events with different timing patterns: Year 1 (new logo, often delayed), Year 2 (established AP relationship, faster), Year 3 (late renewal, influenced by churn dynamics). Tesorio models all three accurately.

Best For:

SaaS companies $20M-$500M+ ARR prioritizing predictive cash flow forecasting, renewal pipeline visibility, and strategic cash management. Particularly valuable for businesses with multi-year contracts, expansion revenue complexity, or CFOs viewing AR as a growth enabler rather than a back-office function.

Implementation: 8-12 weeks typical, with most SaaS customers fully operational within 30 days using pre-built NetSuite + billing system + CRM connectors.

2. HighRadius: Enterprise-Scale for High Transaction Volumes

Where It Excels

HighRadius built its reputation on cash application automation: matching high volumes of payments to invoices with minimal manual intervention. For large enterprises processing thousands of daily transactions, this capability matters enormously.

How It Handles SaaS:

HighRadius offers advanced cash flow forecasting and AI-driven collections, but its strengths lean toward treasury operations and cash application rather than subscription-specific workflows. The platform can handle SaaS businesses, but it's not purpose-built for renewal forecasting or churn-aware collections.

Key Strengths:

- Cash application automation (80%+ automatic matching rates)

- Multi-entity consolidation across geographies

- Sophisticated treasury and risk management

- Strong track record with Fortune 1000 companies

SaaS Considerations:

- Better fit for transactional businesses than subscription models

- Implementation typically 12-20 weeks (longer than SaaS-focused alternatives)

- Requires significant IT involvement

- Less emphasis on renewal pipeline integration

- Higher complexity than most mid-market SaaS companies need

Best For:

Large SaaS enterprises ($500M+ revenue) with extremely high transaction volumes (10K+ daily payments), dedicated treasury teams, and complex global operations. Consider whether you need sophisticated treasury management beyond AR automation.

3. Bill.com: Unified AP/AR for Small Businesses

Where It Excels

Bill.com solves a different problem: small businesses that want a single platform for both accounts payable and accounts receivable. If you're writing checks to vendors and collecting from customers, unified management simplifies operations.

How It Handles SaaS:

Bill.com works for simple subscription businesses but lacks the forecasting sophistication and churn integration that growing SaaS companies need.

Key Strengths:

- Unified AP + AR in a single platform

- Transparent, affordable pricing

- Quick implementation (4-6 weeks)

- Simple interface requiring minimal training

SaaS Limitations:

- Basic forecasting: uses invoice due dates, not renewal payment patterns

- No churn risk integration or customer health scoring

- Limited multi-year contract handling

- Treats subscriptions like one-time transactions

- Transaction fees on payments

Best For:

Small SaaS businesses ($5M-$20M revenue) with simple subscription models (mostly monthly or annual billing), limited multi-year contracts, and budget constraints ruling out $50K-$100K+ annual investments. Plan to graduate to a more sophisticated platform at $20M-$50M ARR when basic tools break.

4. Versapay: Customer Self-Service Focused

Where It Excels

Versapay emphasizes customer-facing payment portals and collaborative AR management. If customer payment friction is your primary pain point, Versapay's self-service approach helps.

How It Handles SaaS:

Versapay handles subscription billing but focuses more on payment experience than strategic forecasting or churn-aware collections.

Key Strengths:

- Excellent customer self-service payment portal

- Strong collaboration features

- Real-time data sync with NetSuite

- Automated payment reminders

SaaS Limitations:

- Basic predictive analytics compared to AI-focused platforms

- Limited renewal pipeline forecasting

- Some users report slow data loading

- Doesn't integrate customer health scores for churn-aware collections

Best For:

Mid-market SaaS ($50M-$200M revenue) where customer payment experience is the primary concern rather than forecasting sophistication or strategic cash management.

5. BlackLine: Revenue Recognition Specialists

Where It Excels

BlackLine dominates revenue recognition automation and financial close management. For SaaS companies with complex ASC 606 requirements, BlackLine handles multi-element arrangements and subscription + services revenue separation expertly.

How It Handles SaaS:

BlackLine solves the accounting problem (revenue recognition) but doesn't solve the cash problem (collections efficiency, cash forecasting). Many SaaS companies use BlackLine for accounting and pair it with dedicated AR automation.

Key Strengths:

- Sophisticated ASC 606 revenue recognition

- Multi-element arrangement allocation

- Strong audit trails for compliance

- Comprehensive financial close automation

SaaS Limitations:

- Not designed for collections automation or cash forecasting

- Limited dunning and workflow capabilities

- Higher price point

- More accounting-focused than cash operations-focused

Best For:

Enterprise SaaS with complex revenue recognition (multi-element arrangements, professional services + subscriptions) needing ASC 606 compliance automation. Complement with a dedicated AR platform for collections and forecasting.

6. Lockstep: Budget-Friendly Entry Level

Where It Excels

Lockstep provides basic AR automation at accessible price points for very small businesses.

How It Handles SaaS:

Lockstep offers entry-level functionality suitable for simple operations but lacks AI-powered forecasting, churn integration, or sophisticated subscription handling.

Key Strengths:

- Affordable pricing (<$10K/year typical)

- Quick setup (2-4 weeks)

- Simple interface

- Basic invoicing and collections

SaaS Limitations:

- No AI-powered forecasting or collections

- Treats subscriptions like one-time transactions

- Limited scalability

- No renewal pipeline integration

Best For:

Very small SaaS businesses ($1M-$10M revenue) with simple models needing basic automation on tight budgets. Expect to outgrow this platform at $10M-$20M ARR.

7. Gaviti: AI Dunning Specialists

Where It Excels

Gaviti focuses specifically on AI-powered dunning campaigns and collections workflow automation. For companies where collection efficiency is the primary pain point, Gaviti delivers sophisticated multi-channel campaigns.

How It Handles SaaS:

Gaviti handles subscription billing and offers customer segmentation, but emphasizes collections over strategic forecasting.

Key Strengths:

- AI-powered dunning strategies adaptive to customer behavior

- Multi-channel communication (email, SMS, phone)

- Strong customer segmentation

- Deep NetSuite integration for collections workflows

SaaS Limitations:

- Limited renewal pipeline forecasting

- Less emphasis on strategic cash intelligence

- Better at collections than cash management

Best For:

Mid-market SaaS ($25M-$150M revenue) where collections efficiency is the primary need. Consider pairing with a separate forecasting tool if strategic cash management matters.

Part 3: Making Your Decision

Now that you understand each platform's strengths and limitations, let's match them to common SaaS scenarios you might face.

If Your Primary Challenge Is: Unpredictable Renewal Cash Timing

You need: Renewal-aware forecasting that predicts when payments actually arrive

Recommended: Tesorio

Alternative: HighRadius offers advanced forecasting but isn't renewal-aware and takes longer to implement (12-20 weeks vs. 8-12 weeks).

If Your Primary Challenge Is: Collections Team Drowning in Volume

You need: AI prioritization that focuses effort where it matters

Recommended: Tesorio or Gaviti

Alternative: Gaviti specializes in AI dunning campaigns but lacks renewal forecasting and strategic cash intelligence. Good if collections is your only pain point.

If Your Primary Challenge Is: Complex Revenue Recognition

You need: ASC 606 automation for accounting, AR automation for cash

Recommended: BlackLine (RevRec) + Tesorio (Collections & Forecasting)

If your SaaS business has complex revenue recognition: multi-element arrangements, professional services + subscriptions, multi-year contracts with annual billing, you likely need specialized revenue recognition automation.

BlackLine excels at: ASC 606 compliance, multi-element allocation, and audit trails

But BlackLine doesn't solve: Collections efficiency, cash forecasting, renewal pipeline visibility

Best approach: Use BlackLine for revenue recognition and financial close, pair with Tesorio for collections, cash forecasting, and renewal management. Both integrate with NetSuite: complementary rather than overlapping.

If Your Primary Challenge Is: Limited Budget ($5M-$20M ARR)

You need: Cost-effective basics with clear upgrade path

Recommended: Bill.com or Lockstep (with future planning)

Early-stage SaaS companies with simple subscription models may not need sophisticated forecasting yet. If you're primarily monthly or annual billing with limited multi-year contracts, basic automation might suffice.

Bill.com works if: You want unified AP + AR, have straightforward collections, and accept transaction fees

Lockstep works if: Budget is an absolute constraint (<$10K/year), you need minimal viable automation, and plan to upgrade at $10M-$20M ARR

Bottom line: If your subscription model is simple, save money with basic tools. If you have complexity, pay for sophistication now to avoid paying twice (once for basic tools, again for migration).

Part 4: Implementation Roadmap

You've chosen your platform. Now let's ensure successful deployment.

What Actually Happens (8-12 Week Timeline for Tesorio)

Weeks 1-2: Discovery & Data Foundation

Your implementation team will:

- Map NetSuite customer records to subscription data (ARR, contract length, renewal dates)

- Integrate billing system (Stripe, Zuora, Chargebee) for a complete subscription view

- Connect CRM (Salesforce, HubSpot) for customer health scores and renewal pipeline

- Identify data quality issues: duplicate customers, missing payment methods, incorrect renewal dates

- Define segmentation rules: enterprise vs. mid-market vs. SMB, annual vs. monthly billing

Critical success factor: Clean subscription data before kickoff accelerates everything. Spend 2-3 weeks beforehand ensuring accurate renewal dates, correct ARR values, and validated payment methods.

Weeks 3-4: Configuration & Workflow Setup

Your team will:

- Configure API connections: NetSuite + billing system + CRM + payment processors

- Set up renewal-aware cash flow forecasting models

- Build subscription-specific collection campaigns (different treatment for renewals vs. mid-contract)

- Configure churn prediction integrations with customer success platforms

- Test data flow accuracy: renewal dates, expansion revenue, subscription modifications

Most common challenge: Billing system integration complexity. Stripe typically takes 1 week; custom billing platforms may take 3-4 weeks.

Weeks 5-8: Pilot & Team Training

Your team will:

- Deploy to pilot segment (recommend starting with mid-market customers)

- Train the collections team on new workflows and AI prioritization

- Run parallel processes (old spreadsheet forecasts + new platform) to validate accuracy

- Gather feedback from the collections team, customer success, and finance leadership

- Refine configurations based on actual SaaS payment patterns observed

Why pilot matters: Starting with one segment proves value quickly, builds organizational confidence, and surfaces configuration adjustments before full-scale deployment.

Weeks 9-12: Full Deployment & Optimization

Your team will:

- Expand to all customer segments (enterprise, mid-market, SMB)

- Establish ongoing governance: monthly performance reviews, quarterly optimization sessions

- Begin measuring SaaS-specific ROI: DSO by subscription type, renewal forecast accuracy, and collections productivity

- Hand off from implementation to the customer success team for ongoing support

Result: Most Tesorio customers see measurable ROI within 3-6 months, primarily through DSO reduction (averaging 33 days), staff productivity gains (3x increase), and reduced borrowing costs.

Choosing Your Path Forward

You now have the complete picture: what SaaS companies need, how seven platforms deliver (or don't), how to match solutions to your specific challenges, what implementation actually looks like, and what results to expect.

The SaaS finance leaders transforming AR operations in 2025 and beyond share a common approach: they start with clarity about their primary challenge, choose the platform purpose-built for that challenge, implement systematically with proper change management, and measure results rigorously.

They're not waiting for perfect conditions. They're executing structured evaluations, learning from focused pilots, and building capabilities that compound year over year, turning cash flow predictability from an aspirational goal into a repeatable operating rhythm.

And the market signals show the shift is well underway:

On G2, 200+ verified reviews (4.7/5) consistently cite cleaner revenue workflows, fewer exceptions, and materially less time spent chasing down data gaps. These patterns reinforce what the data makes clear: teams adopting modern AR automation aren’t just improving processes; they’re changing the finance operating model.

Your Next Steps

If you're ready to explore Tesorio:

Interactive Product Demo - See SaaS-specific features (renewal forecasting, churn-aware collections), self-guided

Book Discovery Call - Discuss your subscription business with AR specialists who understand multi-year contracts, expansion revenue, and renewal complexity

If you're still evaluating:

Download: Tesorio 2025 AR Benchmark Report

Compare your DSO, collection rates, and bad debt against 200+ companies across 10 industries. Technology companies average a 48-day DSO with 30% overdue. See how top performers achieve 1.4x-2.5x better results.

Calculate ROI: AR Automation ROI Calculator for SaaS

Input your ARR, current DSO, and invoice volume to see projected working capital improvement, collections productivity gains, and payback timeline specific to subscription businesses.