AR Automation Software: The Complete Guide to AI Agent AR Software That Actually Works

Healthy revenue growth means little when cash isn’t moving. Across industries, finance teams are seeing record bookings but delayed collections: a silent drag on liquidity, planning, and investor confidence that compounds quarter after quarter.

The statistics paint a sobering picture. Over 60% of invoices contain at least one error. A quarter of overdue receivables age past 120 days, where recovery rates crash below 30%. And while top performers collect 1.4 to 2.5 times faster, the rest are left fighting uphill to fund growth with stale cash.

But here's what's changed: accounts receivable automation has evolved from glorified reminder systems into intelligent financial infrastructure. Modern AI Agent AR Software doesn’t just automate: it learns, predicts, and acts, transforming collections from a reactive back-office chore into a real-time performance engine.

This guide will show you a tactical, benchmark-backed breakdown of how today’s leading finance teams are doing it: what works, what doesn’t, and what kind of results you can expect when AI agents take over your collections workflows.

By the end, you’ll know exactly how to separate software that looks good in demos from systems that actually improve cash flow. and how to lead your finance team through that transformation with confidence.

Understanding Modern AR Automation Software: Beyond Basic Automation

Traditional AR management still runs on patchwork systems: one tool for invoicing, another for reminders, spreadsheets for tracking, and reports that are outdated the moment they’re pulled. It works, but barely. Every update requires another manual step, another check, another follow-up. The result is fragmented visibility and slow, inconsistent cash conversion.

Modern AR automation software changes that foundation entirely. Instead of treating collections as a sequence of isolated tasks, it connects every part of the process from invoice generation to cash application inside one workflow. Payments, forecasts, and customer risk data update automatically across your ERP, CRM, and banking systems.

The key difference lies in connectivity. Where traditional systems create data silos, leading AR automation software platforms provide a single source of truth that automatically updates payment predictions, customer risk scores, and collection priorities as new data flows through your systems. This connected approach eliminates the manual handoffs and information gaps that plague traditional AR management.

How AI Agent AR Software Changes Everything

The emergence of AI Agent AR Software represents the next evolution in accounts receivable automation. Unlike traditional rule-based systems that follow predetermined workflows, AI agents analyze complex scenarios, make autonomous decisions, and adapt their strategies based on real-time feedback.

These intelligent agents excel at tasks that previously required human judgment: determining optimal timing for collection communications, selecting the most effective message tone for different customer segments, and identifying accounts requiring immediate escalation. The result is a more nuanced approach to collections that maintains customer relationships while dramatically improving cash flow performance.

Practical AI Applications That Drive Results

Predictive Payment Analytics continuously analyzes customer payment patterns, industry trends, and external economic factors to predict which invoices will be paid on time and which require proactive intervention. This allows finance teams to focus efforts on high-risk accounts while avoiding unnecessary contact with reliable customers.

Dynamic Communication Optimization crafts personalized messages based on customer communication history, payment behavior, and relationship status. These systems automatically adjust message tone, timing, and channel selection to maximize response rates while preserving customer satisfaction.

Automated Dispute Resolution instantly accesses relevant documentation, analyzes dispute patterns, and recommends resolution strategies when payment disputes arise. This significantly reduces resolution time and prevents escalation into larger customer relationship issues.

Risk Assessment and Credit Management continuously monitors customer financial health using both internal payment data and external credit information, enabling proactive credit limit adjustments and early warning systems for potential collection issues.

When Complex Relationships Require Entity Graph AR Automation

For organizations managing intricate business relationships like subsidiaries, divisions, and parent-child customer hierarchies, traditional AR systems fall short. They treat related entities as separate customers, missing opportunities for consolidated billing, payment netting, and relationship-based collection strategies.

Entity Graph AR Automation addresses this challenge by mapping and maintaining dynamic relationships between all business entities in your customer ecosystem. This graph-based approach enables sophisticated AR management strategies that consider the full scope of business relationships rather than treating each entity in isolation.

When Entity Graph AR Automation Becomes Critical

Multi-Entity Corporations with subsidiaries, divisions, or legal entities requiring consolidated AR management benefit from automated relationship mapping that enables consolidated billing and payment processing.

Complex Customer Hierarchies involving parent-subsidiary relationships, multiple billing entities, or consolidated payment arrangements require systems that understand these connections and optimize collection strategies accordingly.

Integrated Financial Operations demanding seamless data flow between AR, AP, treasury, and financial planning systems need the comprehensive connectivity that graph-based systems provide.

The technical implementation requires careful consideration of existing system architecture, but the most successful deployments integrate with existing ERP systems while providing flexibility to handle complex entity relationships through real-time data synchronization and scalable architecture.

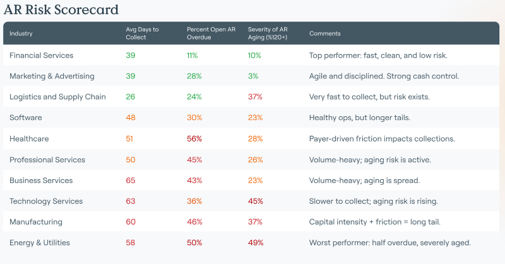

Industry Benchmarks: Where You Stand

Understanding your industry's AR performance landscape is crucial for setting realistic improvement targets and building compelling business cases for AR automation software implementation.

Analysis of receivables data representing over $80 billion in transactions reveals dramatic performance differences across industries. Financial services companies demonstrate the strongest performance, with only 11% of receivables overdue and 39-day average collection times. In stark contrast, energy and utilities companies struggle with 50% overdue rates and 58-day collection cycles.

These numbers represent massive working capital differences. Top-performing industries convert cash 1.4 to 2.5 times faster than their peers, a gap that compounds over time. For a mid-market company generating $100 million annually, closing that gap could unlock $2-5 million in additional working capital without raising a single new dollar of revenue.

Organizations implementing comprehensive AR automation software report substantial performance improvements within the first 90 days, with the most significant gains occurring in organizations transitioning from previously manual processes. They typically achieve a 33-day average DSO reduction, with companies like Veeva Systems reducing 90-day aged accounts by 50% and Couchbase achieving 10-day DSO improvements. The key is selecting solutions that address your specific industry challenges while providing scalability for future growth.

The Strategic Implementation Framework: Your 90-Day Roadmap

Successfully implementing AR automation software requires more than selecting the right platform. It demands strategic planning, stakeholder alignment, and phased execution.

Phase 1: Assessment and Foundation (Days 1-30)

Begin with a comprehensive AR health assessment using industry benchmarks to understand your current position. Identify the top 20% of customers representing 80% of receivables value. These will be your initial focus for maximum impact.

Document existing workflows meticulously, identifying manual touchpoints, approval requirements, and integration needs. Most companies discover more process complexity than initially realized, making this mapping crucial for successful implementation.

Establish baseline metrics for DSO, aging buckets, and collection effectiveness. Without clear starting points, measuring improvement becomes impossible. Audit data quality and completeness of customer records, payment history, and transaction data. Poor data quality is the leading cause of implementation delays.

Phase 2: Implementation and Optimization (Days 31-60)

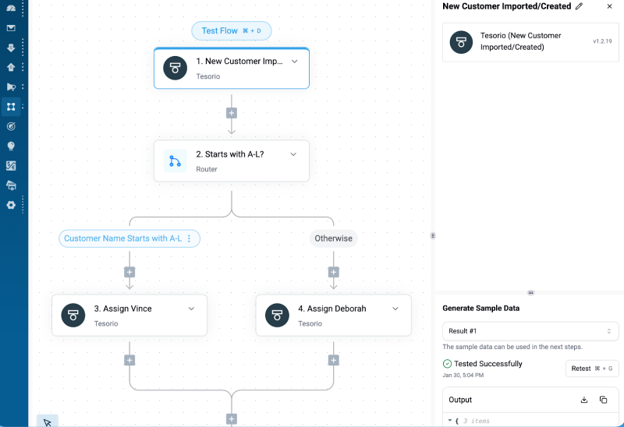

Deploy AI Agent AR Software for customer segmentation and risk scoring, starting with your highest-value accounts. Implement automated payment reminders and personalized communication sequences, but maintain human oversight during the initial rollout.

Establish real-time cash flow forecasting and reporting capabilities, giving your team immediate visibility into the impact of automation. Train team members on new workflows and performance metrics, emphasizing how automation enhances rather than replaces their capabilities.

Focus on integration quality during this phase. Seamless ERP connectivity with real-time data synchronization is essential for automation effectiveness. Address any integration issues immediately to prevent downstream problems.

Phase 3: Scaling and Refinement (Days 61-90)

Expand automation to additional customer segments and transaction types based on initial results. Optimize AI algorithms using performance data from the first 60 days. This is where machine learning begins showing its value.

Implement advanced features like predictive analytics and exception handling as your team becomes comfortable with basic automation. Establish ongoing performance monitoring and continuous improvement processes to maintain momentum.

By day 90, you should see measurable improvements in DSO, collection effectiveness, and team productivity. Use these early wins to build support for expanded automation initiatives.

Maximizing B2B Success: Advanced Strategies That Work

B2B companies face unique AR challenges: complex approval processes, relationship-sensitive collections, and varying payment terms require sophisticated automation strategies.

Customer Segmentation and Personalization

The most effective B2B AR automation software implementations begin with sophisticated customer segmentation. Rather than one-size-fits-all approaches, create distinct treatment paths based on customer value, payment history, relationship sensitivity, and industry characteristics.

High-value customers receive white-glove treatment with dedicated account management, while reliable payers get streamlined processes. Risky accounts receive enhanced monitoring, and strategic partnerships require careful communication, timing, and escalation procedures.

Self-Service and Payment Optimization

Modern B2B customers expect consumer-grade payment experiences. Implement comprehensive self-service capabilities, including secure customer payment portals, multiple payment options (credit cards, ACH, wire transfers, digital wallets), and mobile optimization.

AI Agent AR Software can automatically offer payment plans to customers showing signs of payment difficulty, preventing disputes before they escalate. This proactive approach maintains relationships while protecting cash flow.

Relationship-Aware Communication

The best AR automation software strategies enhance rather than replace human relationships. Use automation to free up team members for high-value activities while ensuring consistent, professional communication through intelligent escalation, personalized messaging, and multi-channel coordination.

Overcoming Common Implementation Challenges

Even well-planned AR automation software implementations face predictable obstacles. Here's how to address the most common challenges.

Data Quality and Integration Issues can derail projects before they start. Invest in data cleansing before implementation and choose platforms with proven integration capabilities. Consider phased rollouts that allow incremental data issue resolution.

Team Resistance and Change Management often stems from fear of job displacement. Focus on how AR automation software enhances human capabilities rather than replacing them. Provide comprehensive training and involve team members in platform configuration decisions.

Customer Communication Concerns require careful handling. Implement gradual automation with human oversight, using personalization and intelligent escalation to maintain relationship quality while improving efficiency.

ROI Timeline Expectations need realistic management. Set clear expectations with milestone metrics. Most implementations show initial improvements within 30-60 days, with full ROI realized within 6-12 months.

The Future of Collections: What's Coming Next

The AR automation software landscape continues evolving rapidly, driven by AI advances, changing customer expectations, and growing cash flow management importance.

Hyperautomation represents the next frontier: integrating multiple automation technologies to create end-to-end intelligent processes. Rather than automating individual tasks, future platforms will orchestrate entire financial workflows from order-to-cash to financial planning.

Advanced AI Agent AR Software capabilities will move beyond pattern recognition to true predictive intelligence, anticipating customer payment behavior, market conditions, and business impacts with unprecedented accuracy.

Real-Time Financial Intelligence will accelerate, with AR automation software platforms providing instant insights into cash flow, customer risk, and collection opportunities, enabling more agile decision-making and strategic planning.

Your Next Steps: From Insight to Action

Most finance teams don’t fail from lack of tools but from lack of visibility. You can’t fix what you can’t see. Before any system overhaul or automation rollout, the real work starts with clarity: where cash gets stuck, which processes create drag, and how performance actually stacks up against peers.

The question isn't whether AR automation software will transform your industry. It's whether you'll lead that transformation or watch competitors pull ahead. On platforms like G2, where over 200 verified users rate Tesorio 4.7 out of 5, finance leaders consistently highlight more predictable collections, cleaner forecasting, and less time lost to manual work: proof that the shift is already underway.

Start your transformation:

Size the upside: Use the ROI calculator to quantify how DSO, working capital, and team output could shift. Mid-market companies often uncover $2-5M in trapped cash in the first year.

See it in action: Book a personalized demo to map your AR workflows, customer segments, and risk tiers to proven automation frameworks.

Experience it yourself: Explore the interactive sandbox to test-drive forecasting, dispute handling, and collection prioritization: real data, zero pressure.

Frequently Asked Questions

What ROI timeline should I expect from AR automation software?

Most companies see initial improvements within 30-60 days, with full ROI typically realized within 6-12 months. Timeline depends on implementation complexity, data quality, and team adoption rates.

How does AR automation software integrate with existing ERP systems?

Modern platforms offer native integrations with major ERP systems, including NetSuite, SAP, Oracle, and QuickBooks, typically requiring minimal custom development while maintaining real-time data synchronization.

Can AR automation software handle complex B2B payment terms and relationships?

Enterprise-grade platforms are designed for complex B2B scenarios, including multiple payment terms, parent-child customer relationships, and multi-entity billing arrangements.

How do AI Agent AR Software solutions actually improve collections?

AI Agent AR Software analyzes payment patterns, customer behavior, and external factors to optimize collection strategies, predict payment likelihood, personalize communications, and automatically prioritize high-impact activities, typically resulting in 20-30% collection effectiveness improvements.