Bridging the Gap: How to Optimize the Accounts Receivable to Accounts Payable Cycle for Strategic Cash Flow Management

You’re closing out the day with yet another cash forecast on your desk. Revenue looks fine. Bookings are steady. But liquidity still feels unpredictable.

Your AR team is chasing invoices, while AP is holding supplier payments as long as possible. Each is doing their job. Yet you can’t shake the sense that money is getting trapped between them, and you don’t have a clear, real-time view of where cash truly stands.

The consequences aren’t abstract. Forecasting takes days, sometimes weeks. Strategic bets feel riskier than they should. And when capital markets are expensive, every inefficiency pushes you closer to external funding you’d rather avoid.

Keeping AR and AP separate exposes the business to risks that chip away at financial flexibility. But firms that close this gap often shorten DSO by more than a month, slash overdue accounts, and release significant cash reserves. More importantly, they gain visibility: the ability to fund growth confidently from cash on hand.

In this article, we’ll unpack why this gap exists, what it’s costing you, and how leading companies are closing it. You’ll see:

- The hidden costs of siloed AR/AP teams

- The connected operations model transforming finance

- Benchmarks that separate leaders from laggards

- Real-world case studies proving the impact, and

- A practical roadmap to unify your own operations.

Because the real edge isn’t just in saving a few dollars per invoice. It’s about repositioning finance from an administrative role into a driver of growth.

Understanding the Current Landscape: The Cost of Disconnection

To close the gap, we first need to map the current landscape. Most organizations manage accounts receivable and accounts payable as separate functions with different objectives, technologies, and performance metrics.

This separation isn't arbitrary, but evolved naturally as businesses grew and specialized. AR teams focus on accelerating collections and reducing DSO, while AP departments often prioritize extending payment terms to preserve cash.

This natural tension creates several challenges that ripple throughout the organization:

The Visibility Problem

Disconnected receivables and payables create gaps in visibility that make cash planning unreliable. This fragmented visibility makes accurate forecasting nearly impossible, forcing decisions based on incomplete information. Without a clear picture of both incoming and outgoing cash flows, organizations struggle to answer basic questions like:

- When will we have sufficient cash to fund our next growth initiative?

- What happens to supplier obligations if we lengthen payment terms for a major customer?

Where are the opportunities to optimize our working capital?

This lack of visibility doesn't just create operational headaches, but fundamentally limits strategic decision-making.

The Efficiency Challenge

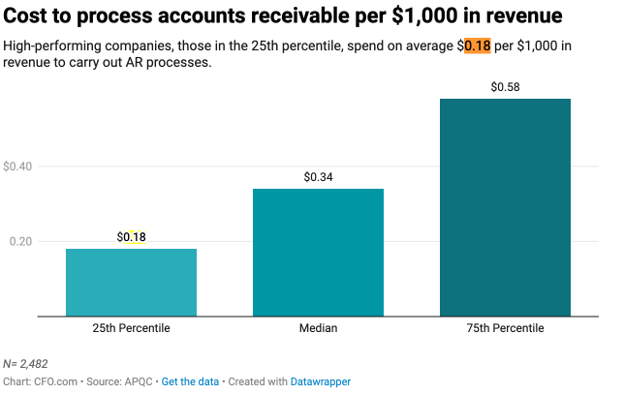

The cost of disconnected processes shows up clearly in the numbers. According to APQC benchmarking data cited by CFO.com, high-performing companies spend just $0.18 per $1,000 in revenue on accounts receivable processes, while low performers spend $0.58, which is more than three times as much. For smaller companies with revenues under $100 million, this gap widens dramatically, with low performers spending up to $2.77 per $1,000 in revenue.

On the accounts payable side, organizations with manual, disconnected processes spend an average of $10-15 per invoice processed, compared to just $2-3 with automation.

These inefficiencies create a significant drag on financial performance, diverting resources that could otherwise be invested in growth initiatives.

The Strategic Impact

What’s most concerning is how disconnected financial operations limit an organization's strategic agility. Without unified visibility into cash flow, businesses often find themselves unable to:

- Make confident decisions about investments and growth initiatives

- Free up cash reserves to limit dependence on outside capital

- Respond quickly to market opportunities or challenges

- Build strong relationships with both customers and suppliers

This isn't just an operational issue, but a strategic vulnerability that limits an organization's ability to compete effectively in today's fast-moving business environment.

The question then becomes: how do we move from this fragmented approach to a more integrated, strategic model?

The Connected Financial Operations Approach: A New Paradigm

Progress requires a new perspective on how finance functions connect and operate. Rather than treating AR and AP as separate functions, forward-thinking organizations are adopting a Connected Financial Operations approach that integrates the entire cash conversion cycle.

What Exactly Is Connected Financial Operations?

At its core, Connected Financial Operations represents a strategic approach that integrates accounts receivable, accounts payable, and treasury functions through:

- Unified Data and Visibility: Creating a single source of truth for cash position and forecasting

- Aligned Processes: Coordinating policies and workflows to optimize the entire cash conversion cycle

- Integrated Technology: Implementing solutions that enable seamless data flow and process automation

- Strategic Metrics: Measuring the efficiency of the entire cash cycle rather than isolated departmental metrics

- Collaborative Culture: Fostering cooperation between AR and AP teams with shared objectives

This approach transforms financial operations from a collection of administrative tasks into a strategic asset that drives business performance.

The Business Case: Quantifiable Benefits

The value of Connected Financial Operations is undeniable, with measurable benefits that strengthen core financial results:

- Accelerated Cash Conversion: Companies using AI-powered automation for both AR and AP see 20-30% improvements in working capital metrics, according to McKinsey Digital Finance Transformation research. The result is significant cash released back into the business, fueling growth priorities.

- Dramatic Efficiency Gains: Veeva Systems achieved a 75% reduction in bad debt write-offs and doubled its collections team efficiency after implementing connected financial operations. These efficiency improvements allow finance teams to do more with less, focusing on strategic activities rather than administrative tasks.

- Enhanced Forecast Accuracy: Couchbase reduced its forecast preparation time from 10 days to just a few hours while improving accuracy, enabling more confident decision-making. Stronger forecasting reduces blind spots and gives finance teams room to move decisively.

Reduced Aging Risk: With connected operations, companies typically see a 50% reduction in 90-day aged accounts, which is critical when you consider that only 20-30% of receivables aged more than 120 days are ever collected. This directly impacts cash flow and reduces write-off risk.

These aren't just incremental improvements, but transformative changes that can reshape an organization's financial trajectory. But how do you know where your organization stands today, and what improvement opportunities exist?

How Do You Compare? Industry Benchmarks as a Starting Point

Before embarking on your journey to connected financial operations, it's valuable to understand where you stand compared to industry peers. Comparative benchmarks reveal gaps and steer practical improvement objectives.

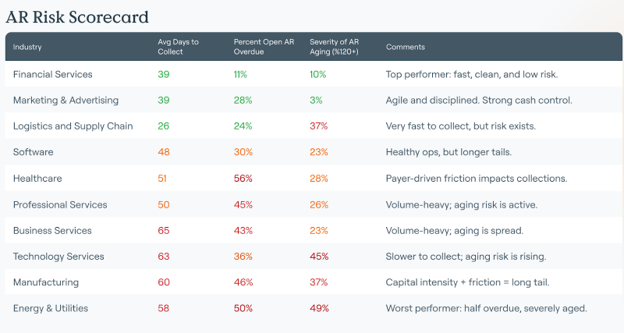

Tesorio's 2025 AR Benchmark Report provides comprehensive data across ten industries, highlighting significant performance gaps that represent improvement opportunities:

The Leaders and Laggards

The data reveals clear patterns of leadership and lagging performance across industries:

- Top Performers: Financial Services and Marketing & Advertising lead with Average Days to Collect (ADC) of 39 days and overdue AR percentages of just 11% and 28% respectively. These industries have embraced automation, implemented clean operational structures, and developed disciplined collections processes.

- Struggling Industries: Energy & Utilities and Healthcare face challenges with overdue AR exceeding 50% and high percentages of severely aged receivables. These sectors often struggle with manual invoicing processes, complex contract cycles, and legacy ERP systems.

- The Performance Gap: Top-performing industries collect 1.4x to 2.5x faster than lower-performing industries, demonstrating the significant opportunity for improvement. This gap isn't just about industry differences. It reflects varying levels of process maturity and technology adoption.

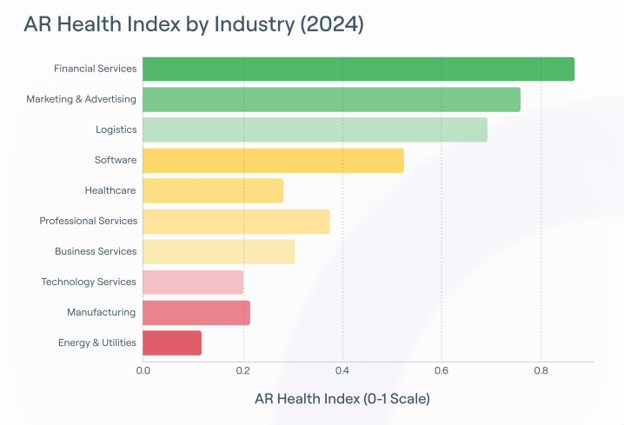

The AR Health Index: A Holistic Measure

To provide a more comprehensive view, the AR Health Index combines three critical metrics such as Average Days to Collect, Percent of Open AR Overdue, and Severity of AR Aging:

- Financial Services leads with a score of 0.84

- Marketing & Advertising follows at 0.76

- Logistics & Supply Chain scores 0.67

- Energy & Utilities lags at just 0.12

This index provides a useful benchmark to assess your current performance and set realistic improvement targets. But benchmarks alone don't tell the whole story. Real-world examples bring the potential of connected financial operations to life.

Real-World Transformation: Success Stories That Illuminate the Path

Understanding the theory and benchmarks is important, but seeing how actual organizations have transformed their AR-to-AP cycle makes the potential benefits tangible. These success stories demonstrate how companies across industries have implemented connected financial operations with remarkable results:

Veeva Systems: From Manual Collections to Strategic Customer Engagement

Veeva Systems, a cloud software leader serving 750+ global life sciences companies, faced a challenge familiar to many growing businesses: their spreadsheet-driven collections process couldn't scale with their rapid growth.

By implementing an AR automation platform, Veeva transformed its approach to collections:

- They automated routine follow-ups while customizing messaging for different delinquency stages

- They leveraged AI-driven payment prediction to prioritize collection efforts

- They created team workspaces that helped staff focus on high-value activities

The results were dramatic: a 75% reduction in bad debt write-offs, 50% fewer 90-day aged accounts, and twice the collections efficiency. Most importantly, they reduced time spent on lower-priority accounts from 25% of the week to less than 2 hours, freeing their team to focus on strategic customer relationships.

This perspective shift, from collections as an administrative function to a strategic customer touchpoint, exemplifies the mindset change that drives successful transformation.

Couchbase: Achieving Financial Independence Through Connected Operations

Couchbase, creator of a NoSQL database used by Fortune 500 companies, faced a different challenge: they needed to improve cash flow and forecasting to support sustainable growth without constantly raising capital.

Their implementation of a cash flow performance platform delivered transformative results:

- DSO was reduced by 10 days permanently

- Collections per analyst doubled in two years

- What once took around 10 days now takes only hours

Collections resources were maintained even as ARR grew by 100%

The most striking outcome was that they haven’t raised capital in three years because they have better cash flow performance and can live off what they bring in. This financial self-sufficiency demonstrates how connected financial operations can fundamentally change a company's strategic position.

Currencycloud: Scaling Collections with Automation and Precision

Currencycloud, a London-based fintech powering global cross-border payments, was scaling fast. With billions processed across 180+ countries and customers like Klarna and Starling Bank, growth wasn’t the problem; collections were.

With just one analyst juggling collections alongside other responsibilities, the company faced mounting pressure with inefficient collections, slow cash inflows, and a process that couldn’t keep up with business growth.

By adopting better team collaboration, Currencycloud transformed its AR operations with:

- Collections climbed 60% in six months with the same headcount

- 15% reduction in average time-to-payment, accelerating cash inflows

- Time spent on dunning fell by 75%, freeing capacity for higher-value work

- Improved customer relationships, with smoother outreach and better timing on follow-ups.

AI-powered payment predictions and automated email sequences gave Currencycloud new precision. Instead of chasing every overdue invoice, the collections team could focus only on where it mattered most.

Currencycloud’s journey underscores the same shift seen at Veeva and Couchbase: AR isn’t just about collecting cash faster but transforming collections into a strategic, customer-aligned function that scales with growth.

Your Path Forward: A Practical Implementation Roadmap

With a clear understanding of the potential benefits and real-world examples to guide you, it's time to map out your own journey to connected financial operations. This plan helps organizations capture short-term efficiencies while steadily building long-term strategic advantage.

Phase 1: Assessment and Foundation (Months 1-3)

The journey begins with understanding your current state and building the foundation for transformation:

- Process Mapping: Document current AR and AP workflows, identifying bottlenecks and disconnection points. This mapping helps you understand where the greatest improvement opportunities exist.

- Technology Audit: Evaluate existing systems and their integration capabilities. Understanding your current technology landscape is essential for planning a successful implementation.

- Performance Benchmarking: Compare your metrics against industry standards using resources like Tesorio's 2025 AR Benchmark Report. These results show where you stand and help inform achievable targets.

- Gap Analysis: Identify specific opportunities for improvement in both AR and AP. Rank initiatives by value vs. effort, tackling high-impact, low-friction wins first.

- Business Case Development: Quantify the potential benefits and secure executive sponsorship. A compelling business case is essential for gaining the resources and support needed for successful transformation.

- Solution Selection: Evaluate and select technology solutions that enable connected operations. Look for platforms that provide the core capabilities needed for your specific improvement priorities.

This foundational work is critical. Rushing to implementation without a clear understanding of your starting point and objectives often leads to suboptimal results.

Phase 2: Initial Implementation (Months 4-6)

With your foundation in place, begin implementing the core elements of connected financial operations:

- Deploy Core Technology: Implement solutions that provide visibility and automation across AR and AP. Focus on establishing the basic infrastructure needed for connected operations.

- Standardize Processes: Create consistent approaches to invoicing, collections, and payments. Standardization is essential for effective automation and integration.

- Train Team Members: Ensure staff understand both the new systems and the strategic vision. Hands-on enablement drives adoption and cements the change.

- Start with Quick Wins: Focus initially on high-volume, low-complexity transactions to build momentum. Early successes help build confidence and support for the broader transformation.

- Establish Baseline Metrics: Begin measuring performance to track improvement over time. These metrics provide the foundation for continuous improvement.

During this phase, focus on building confidence and demonstrating value rather than attempting to transform everything at once. Quick wins create momentum that supports the broader transformation journey.

Phase 3: Expansion and Integration (Months 7-12)

With initial implementation complete, expand your approach to create truly connected operations:

- Extend Automation: Push automation deeper into advanced workflows and edge scenarios. This integration closes the last visibility gap, turning fragmented processes into a connected system for cash flow management established in Phase 2.

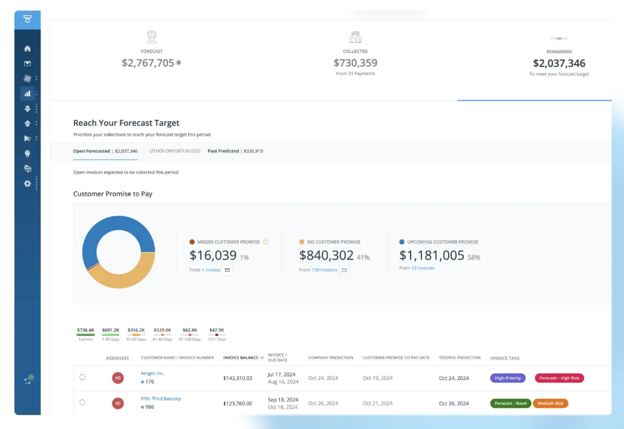

- Implement Advanced Analytics: Deploy predictive capabilities for payment timing and risk assessment. These analytics generate the clarity leaders need for informed strategic decisions.

- Develop Cross-Functional Collaboration: Create mechanisms for AR and AP teams to work together effectively. This collaboration is essential for optimizing the entire cash conversion cycle.

- Refine Metrics and Reporting: Implement integrated dashboards that provide a holistic view of performance. These dashboards support data-driven decision-making across the organization.

- Optimize Working Capital: Begin strategically aligning customer and supplier payment terms. This alignment is where significant working capital improvements are often realized.

This phase moves beyond basic implementation to create the connections that drive strategic value. It's where the true potential of connected financial operations begins to emerge.

Phase 4: Optimization and Innovation (Year 2)

In the final phase, focus on continuous improvement and leveraging advanced capabilities:

- Leverage AI for Predictive Insights: Implement machine learning for payment prediction and risk identification. These advanced capabilities take financial operations to the next level.

- Refine Based on Performance Data: Use analytics to identify and address remaining inefficiencies. Sustained iteration is the engine that maintains and grows your market edge.

- Expand to Treasury Integration: Connect AR and AP with broader treasury functions. Extending integration turns fragmented steps into a connected cash-flow system.

- Develop Advanced Forecasting: Build more sophisticated cash flow models to serve as a foundation for long-term financial strategy. The forecast outputs become the base layer for strategic planning.

- Explore Ecosystem Integration: Consider connections with suppliers, customers, and financial institutions. These external connections create new opportunities for efficiency and strategic advantage.

This ongoing optimization ensures your connected financial operations continue to deliver increasing value over time. It's not the end of the journey, but rather the beginning of a new approach to financial operations that continuously evolves and improves.

The Technology Enablers: Tools That Power Connection

While strategy and process are essential, successful implementation of connected financial operations requires the right technology foundation. The good news is that recent advances in cloud computing, artificial intelligence, and integration capabilities have made connected financial operations more accessible than ever before.

Core Technology Requirements

When evaluating technology solutions, focus on these essential capabilities:

- Cloud-Based Platforms: Look for solutions that provide real-time visibility and accessibility across your organization. Cloud platforms offer the flexibility and scalability needed for connected operations.

- AI and Machine Learning: Prioritize platforms with predictive capabilities for payment timing and risk assessment. These capabilities transform data into actionable insights.

- Automation Capabilities: Ensure solutions can automate routine tasks in both AR and AP to free staff for strategic activities. Automation is where significant efficiency gains are realized.

- Integration Flexibility: Select platforms that connect seamlessly with your ERP and other financial systems. Bringing them together gives your team a single, consolidated picture to act on.

- Analytics and Reporting: Look for analytics and reporting tools that generate insights you can act on, not just raw data. These drive continuous improvement and strategic decision-making.

When evaluating specific solutions, consider platforms that provide:

- AI-powered workflows for AR automation

- Predictive analytics for payment timing

- Real-time cash flow visibility

- Integration with major ERP systems

The right technology foundation makes connected financial operations not just possible but practical and sustainable. It provides the infrastructure needed to transform financial operations from a collection of administrative tasks into a strategic asset.

Beyond Technology: The Human Element of Transformation

While technology enables connected financial operations, successful transformation requires attention to the human elements as well. Technology alone isn't enough: people and processes are equally important for sustainable change.

Process Alignment

Standardizing and aligning processes across AR and AP creates the foundation for connection:

- Consistent Documentation: Create standardized formats for invoices, purchase orders, and payment terms. This consistency reduces errors and improves efficiency.

- Harmonized Payment Terms: Align customer and supplier payment terms to optimize working capital. This alignment is where significant working capital improvements are often realized.

- Clear Exception Handling: Develop protocols for managing disputes and discrepancies. Effective exception handling prevents issues from disrupting the cash conversion cycle.

These process improvements create the operational foundation for connected financial operations. They ensure that technology is applied to well-designed processes rather than automating inefficient workflows.

Cultural Transformation

The most challenging and important aspect in any implementation is fostering a collaborative culture that breaks down traditional silos:

- Shared Objectives: Develop goals that span both AR and AP, focused on overall cash flow optimization. These shared objectives align incentives across departments.

- Regular Communication: Implement joint meetings between AR and AP teams to align priorities. Communication is essential for effective collaboration.

- Cross-Training: Build understanding of how AR and AP impact each other. This understanding creates empathy and supports collaborative problem-solving.

- Aligned Incentives: Ensure compensation structures reward collaboration rather than departmental optimization. Incentives drive behavior, so alignment is critical for sustainable change.

This cultural shift transforms finance from a collection of specialized functions into a unified team focused on optimizing the entire cash conversion cycle. It's often the most challenging aspect of transformation, but also the most rewarding.

Looking Ahead: The Future of Connected Financial Operations

As connected financial operations mature, several emerging trends will shape their evolution. Tracking these trends keeps you future-ready and protects your edge.

AI and Machine Learning: From Automation to Intelligence

The next wave of innovation centers on artificial intelligence that moves beyond automation to provide true intelligence:

- Predictive Payment Behavior: AI models that forecast exactly when customers will pay based on historical patterns. These predictions enable proactive cash flow management.

- Intelligent Cash Positioning: Automated recommendations for optimal payment timing to balance cash flow needs. These recommendations optimize working capital utilization.

- Anomaly Detection: Machine learning surfaces irregular transactions before they become losses. This detection improves control and reduces risk.

- Natural Language Interfaces: Conversational capabilities that allow finance teams to query cash flow data in plain language. These tools open up insights to stakeholders across the business.

According to McKinsey, adoption of generative AI rose from 33% in 2023 to 71% in 2024 across business functions, with finance departments increasingly leveraging this technology for AR/AP (36%), process automation (35%), and predictive analytics (33%).

Ecosystem Integration: Beyond Company Boundaries

The future of AR-AP connection extends beyond individual organizations to create interconnected financial ecosystems:

- Supplier Networks: Digital platforms link buyers and vendors, streamlining purchase orders, invoicing, and settlement. These networks reduce friction in the procure-to-pay process.

- Industry Standards: Common data formats and protocols facilitating interoperability. These standards enable more efficient ecosystem integration.

- Financial Marketplaces: These platforms read authenticated receivables and payables data to match companies with financing. The result is more options to free and deploy cash.

- Collaborative Forecasting: Stakeholders see the same payment expectations in real time. This visibility improves planning and reduces surprises.

These ecosystem connections will further enhance the value of connected financial operations, creating new opportunities for efficiency and strategic advantage. They represent the next frontier in financial operations transformation.

From Administrative Function to Strategic Asset

Bringing AR and AP together elevates finance from execution to strategy that can fundamentally change your organization's financial trajectory. As we've seen through industry benchmarks and real-world examples, the gap between leaders and laggards in financial operations performance is widening.

Organizations that embrace connected financial operations gain significant advantages:

- Shortened cash conversion cycle, relying far less on external capital.

- Enhanced visibility that enables more confident strategic decisions

- Improved efficiency that frees resources for high-value activities

- Stronger relationships with both customers and suppliers

By following the roadmap outlined in this guide, your organization can transform accounts receivable and accounts payable from administrative functions into strategic assets that drive competitive advantage and sustainable growth. The journey may be challenging, but as Couchbase, Veeva Systems, and others have demonstrated, the rewards are well worth the effort.

The time to act is now. In a world of rising capital costs and increasing competitive pressure, connected financial operations aren't just a nice-to-have. Don’t aim to survive: use this to pull ahead.

Ready to take the next step?

- Start by sizing the upside: use our interactive calculator to forecast DSO, working capital, and team-efficiency gains.

- See it in action to map your AR/AP use cases to Tesorio’s AI-powered platform and explore how we’d tackle your specific challenges.

- Get inspired by peers. Browse our customer success stories for detailed playbooks from companies like yours.

Free finance from repetitive tasks and redirect that time to impact. Join the growing community of forward-thinking finance leaders turning AR/AP from cost centers into strategic assets.

FAQs:

How do accounts receivable and accounts payable work together in the cash conversion cycle?

AR is money customers still owe you; AP is money you still owe your suppliers. They’re two sides of cash timing: AR brings cash in, AP sends cash out, so managing DSO vs. DPO together gives a true view of liquidity and tighter working-capital control.

In what ways does connecting AR and AP improve liquidity?

Connecting AR and AP improves cash flow by providing complete visibility into both incoming and outgoing payments, enabling more accurate forecasting, reducing processing costs through shared automation, and allowing for strategic timing of payments to optimize working capital.

What happens when AR and AP stay siloed?

Risks include suboptimal cash flow management, higher processing costs, reduced forecast accuracy, missed early payment discounts, strained supplier relationships, and limited ability to make strategic financial decisions. Most critically, disconnected operations often result in higher percentages of severely aged receivables, where collection probability drops to just 20-30%.