Best Cash Flow Forecasting Software for SaaS Companies: The Complete Guide

By the time your team hits $20M-$50M ARR, the gap between the revenue forecast and the actual cash position stops being a rounding error. It becomes a weekly fire drill.

You know the routine: the bookings dashboard looks great, the ARR chart is up and to the right, yet the cash-on-hand number refuses to behave.

Collections slipped two weeks because a cluster of enterprise renewals paid late. A batch of usage invoices hit the wrong approval workflow. Stripe retries are spiking because a handful of large customers updated their cards after mid-month close.

None of this shows up in the revenue forecast. All of it hits cash immediately.

And that’s the real reason most SaaS CFOs plateau at ~70% cash-forecast accuracy: subscription cash flow isn’t linear. It moves in lumpy renewals, unpredictable expansions, failed payments, multi-entity billing delays, and customer behaviors that no spreadsheet cadence can keep up with.

At $10M ARR, you can brute-force the gaps.

At $50M ARR, the gaps start making decisions for you.

This guide is for the finance leaders living in that gap, the ones who already know that generic forecasting tools don’t understand subscription physics.

TL;DR: What You'll Learn

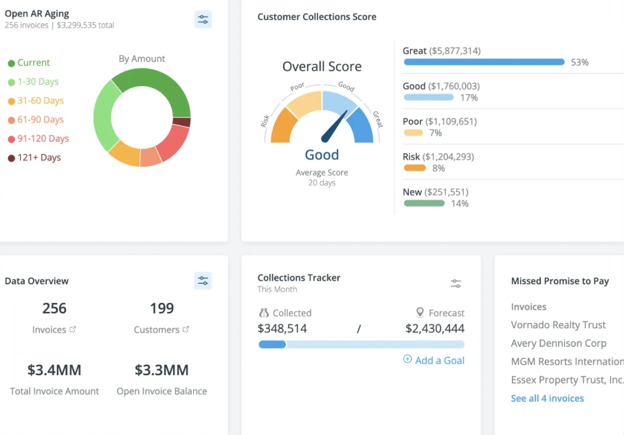

You’ll see why traditional forecasting tools fail for SaaS, which features materially improve accuracy, and how AI-driven cash prediction helps companies reach 95% forecast accuracy, reduce DSO by 33 days, and recover up to 85% of failed payments.

We’ll cover integration requirements, realistic implementation timelines, and how to quantify ROI for your own company. By the end, you’ll know whether you’re ready for a forecasting platform and how to move from reactive cash guessing to a predictable, subscription-aware forecasting model.

The SaaS Finance Paradox: Why Predictable Revenue Doesn't Mean Predictable Cash

SaaS companies built their entire business model on predictability: recurring revenue. contracted ARR. multi-year commitments. Yet when you ask most SaaS CFOs how accurate their 90-day cash forecasts are: "Maybe 70% if we're lucky."

The problem is that revenue and cash follow completely different timelines in subscription businesses. A $120,000 annual contract looks beautiful on your revenue forecast, recognized smoothly at $10,000 per month. But cash might arrive as $120,000 upfront, $30,000 quarterly, or $10,000 monthly: depending on payment terms you negotiated six months ago.

Layer in subscription churn (customers canceling), expansion revenue (upsells that spike unpredictably), and failed payments, and suddenly that "predictable" revenue becomes a highly unpredictable cash flow.

This is why generic cash flow forecasting software built for transactional businesses falls short for SaaS. You need something that understands:

- subscriptions aren't one-time sales

- MRR differently from expansion ARR

- knows a failed payment isn't a lost customer yet.

Must-Have Features: What Actually Matters for SaaS Companies

Let's cut through vendor marketing and focus on capabilities that genuinely impact SaaS cash flow management. Some features are essential; others are nice-to-have. Here's how to prioritize.

Tier 1: Non-Negotiable for SaaS (Must Have)

Native Subscription Billing Integration

Your cash flow forecasting software must connect directly to your subscription billing platform, not just your accounting system.

Why accounting integration isn't enough: By the time a subscription event (upgrade, downgrade, cancellation, failed payment) hits your ERP, it's already historical. You've lost the real-time visibility needed for accurate forecasting.

What "native integration" means:

- Bi-directional sync: Changes in the forecasting system update the billing platform and vice versa

- Webhook-based updates: Real-time (sub-15-minute) sync, not daily batch jobs

- Subscription lifecycle capture: Upgrades, downgrades, cancellations, reactivations

- Payment event tracking: Successful charges, failures, retry results, refunds

Deal-breaker test: If the vendor says, "We pull data from your ERP," that's insufficient for SaaS. You need direct billing system integration, or forecast accuracy can suffer significantly.

Churn-Adjusted Forecasting

Generic forecasting assumes all current MRR will persist indefinitely. SaaS-specific platforms automatically reduce future periods based on historical churn.

How this should work:

- Separate churn rates by cohort (not blended average)

- Higher churn weighting for newer customers (typically 2-3x first-year churn)

- Seasonal churn patterns incorporated (many SaaS companies see Q4/Q1 spikes)

- Product usage signals integrated if available (declining usage = higher churn probability)

- Ask: "Show me a 12-month forecast. Now increase churn from 5% to 8%. How does the forecast change?"

- Quality platforms will show declining cash forecasts with a specific dollar impact per period

- Poor platforms will just show a churn % field with no visible forecast impact

Cohort-Based Payment Predictions

Your software should predict when different customer segments actually pay, not apply a single DSO to everyone.

Minimum segmentation:

- By customer size (SMB vs. Mid-Market vs. Enterprise)

- By billing frequency (monthly vs. quarterly vs. annual)

- By payment method (credit card vs. ACH vs. wire vs. check)

By geography (if operating internationally)

- By industry vertical (if your SaaS serves multiple sectors)

- By sales channel (direct vs. partner-sold)

- By customer tenure (new vs. established)

Demo test: "Our enterprise customers pay in 55 days, but SMB pays in 18 days. Show me how your forecast accounts for this." If they can't demonstrate segment-specific predictions, the platform isn't truly SaaS-aware.

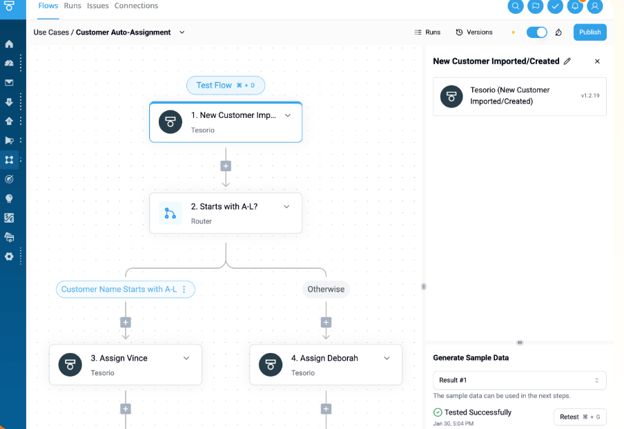

Intelligent Dunning Automation

SaaS collections require finesse: you're trying to recover failed payments without driving customers to churn. Look for platforms that offer:

Risk-based dunning sequences:

- High-value customers ($50K+ ARR): Gentle, relationship-preserving approach

- Medium-value customers ($5K-$50K ARR): Standard multi-channel sequence

- Low-value customers (<$5K ARR): More aggressive automated recovery

Multi-channel outreach:

- Email campaigns (triggered by payment events)

- In-app notifications (for logged-in users)

- SMS alerts (for high-urgency situations)

- Payment portal self-service links

Graceful degradation vs. immediate shutoff:

- Feature limitation (restrict to basic plan) rather than service termination

- Grace periods that balance recovery with retention

- Automatic service restoration when payment succeeds

Smart pause triggers:

- Active support ticket? Pause dunning until resolved

- Recent upgrade? Give a 48-72 hour grace period for payment method update

- High-engagement user? Prioritize the relationship over the immediate payment

What separates good from great: The ability to A/B test dunning sequences and automatically optimize based on recovery rate vs. churn impact.

Tier 2: High-Value Capabilities (Should Have)

Product Usage & Health Score Integration

While not strictly required for basic forecasting, connecting customer behavior signals dramatically improves accuracy.

- Product analytics: Amplitude, Mixpanel, Heap

- Customer success platforms: Gainsight, ChurnZero, Totango

- Support systems: Zendesk, Intercom, Freshdesk

What this enables:

- Declining product usage → Increased non-payment risk

- Multiple support tickets → Cancellation likelihood increases

- Low feature adoption → Reduced expansion revenue probability

- NPS drops → Adjusts payment timing expectations

ROI impact: SaaS companies integrating product signals reduce bad debt by 35-50% through early churn detection and proactive intervention.

Scenario Planning & Stress Testing

Your platform should make "what-if" analysis trivial, not painful.

Must-test scenarios:

- Churn rate changes (+/- 2-3 percentage points)

- Expansion rate shifts (what if upsells slow by 20%?)

- Payment term extensions (enterprise customers negotiate longer terms)

- Billing frequency changes (monthly to quarterly transition impact)

- Failed payment recovery rate drops (dunning effectiveness declines)

Quality indicators:

- Run 100+ scenarios in under 1 minute

- Side-by-side comparison view

- Ability to save and share scenarios with executives

- Export to presentation-ready format

Multi-Currency & Multi-Entity Support

If you operate globally or have multiple legal entities, ensure your software handles:

Currency management:

- Automatic FX rate updates (daily or real-time)

- Forecast in functional currency with FX impact separated

- Hedging activity incorporation (if applicable)

Entity consolidation:

- Roll-up forecasts across subsidiaries

- Eliminate intercompany transactions

- Separate entity-level cash positions

When this matters: Any SaaS company with $50M+ ARR likely has international operations or multiple entities. Verify this capability before signing.

The Question Nobody Asks Until Week 3: "Are We Actually Ready for This?"

Some SaaS companies aren't ready for advanced cash flow forecasting software yet. And that's okay. Better to know now than discover it mid-implementation.

Let's honestly assess whether you should move forward now or address foundational issues first.

Red Flag #1: Your Billing Data Is a Mess

Warning signs:

- Customer master data has 10%+ duplicates

- Same customer appears under multiple names ("Acme Corp" vs. "Acme Corporation" vs. "Acme Inc")

- Subscription status doesn't match actual service access (shows "active" but customer hasn't paid in 60 days)

- Payment terms vary randomly with no clear segmentation logic

- Historical payment data is incomplete (can't access reliable data beyond 3-6 months)

- Manual billing adjustments are happening weekly

Why this blocks success: AI cash flow prediction trains on historical patterns. If your data says Customer A paid in 30 days historically, but it was actually three different customers incorrectly merged, the AI learns nothing useful. Garbage in, garbage out.

What to do instead:

- Audit your billing system: Export customer list, identify duplicates, and inconsistencies

- Deduplicate and consolidate: Merge duplicate records, standardize naming

- Standardize payment terms: By customer size, industry, or billing frequency

- Document cleanup: Track what you changed and why

- Build a clean history: Let 6-12 months pass with clean data flowing

- Then implement: AI will train on accurate patterns

Timeline: 3-6 months to clean data, then proceed with platform implementation.

Red Flag #2: Your Subscription Billing Process Is Too Manual

Warning signs:

- Still generating invoices manually or via templated documents

- No automated payment retry logic (one attempt, then manual follow-up)

- Customers must call or email to update payment methods

- Dunning consists of occasional manual emails when you remember

- No self-service payment portal

- Subscription changes (upgrades, downgrades) require manual intervention

Why this blocks success: Advanced forecasting assumes automated billing workflows. Manual processes create unpredictable delays that AI can't model. If invoice generation takes 2 days sometimes and 9 days other times, depending on who's available, no algorithm can predict payment timing accurately.

What to do instead:

- Migrate to proper subscription billing: Stripe Billing, Chargebee, Recurly, Zuora

- Implement automated payment retries: Standard schedule (Day 3, 7, 14)

- Set up a self-service payment portal: Let customers update cards themselves

- Create automated dunning sequences: Basic email workflow

- Enable card updater services: Automatically update expired cards

- Build 6-12 months of automated history: Let the system run consistently

Timeline: 2-4 months to implement billing automation, then proceed with the forecasting platform.

Red Flag #3: Your ARR/MRR Is Below Critical Mass

Consider waiting if:

- <$1M ARR: Focus on product-market fit and growth, not forecasting optimization

- <100 active subscriptions: Spreadsheets still manageable at this scale

- Simple pricing: Single plan, monthly billing, immediate credit card charges

- High forecast accuracy already: If spreadsheets already deliver 85%+ accuracy, platform ROI is marginal

Why timing matters: Cash flow forecasting software delivers ROI through efficiency gains (time saved) and improved accuracy (better decisions, reduced DSO). Below a certain scale, these benefits don't justify $18K-$60K annual investment.

ROI tipping points:

Positive ROI likely:

- $5M+ ARR with complex pricing (multiple tiers, annual contracts, usage components)

- $10M+ ARR with simple pricing (straightforward monthly/annual)

- 300+ active customers regardless of ARR (volume drives complexity)

- Current forecasting takes 3+ days monthly and accuracy <75%

Negative ROI likely:

- <$3M ARR with simple pricing

- <100 customers with predictable payment patterns

- Current forecasting takes <1 day monthly and accuracy >80%

What to do instead:

- Use basic forecasting in your billing system: Stripe Revenue Recognition, Chargebee Analytics, etc.

- Build spreadsheet templates: With cohort-based formulas and churn adjustments

- Implement basic dunning: Automated email sequences in billing platform

- Track key metrics manually: DSO, failed payment rate, churn

- Revisit when you hit scale: $5M+ ARR or 300+ customers

Timeline: 12-24 months to reach scale, then implement.

Red Flag #4: Your Finance Team Lacks Implementation Bandwidth

Warning signs:

- Finance team already working 60+ hour weeks (especially during close)

- No dedicated project owner available for a 6-8 week implementation

- IT resources unavailable for integration work (or "we'll try to fit it in")

- Can't commit to 3-5 days of training and configuration

- Implementation would coincide with the year-end close, audit, or major financing event

Why this blocks success: Even "quick start" cloud platforms require dedicated focus. Trying to squeeze implementation into spare moments leads to:

- 3-6 month timeline delays (vs. planned 8 weeks)

- Poor configuration and missed features (rushed setup)

- Low user adoption <40% (team never properly trained)

- Failure to achieve ROI (platform becomes "shelfware")

What to do instead:

- Hire or reassign a finance operations specialist: Someone who owns systems and process improvement

- Document current-state forecasting: Map existing processes and pain points

- Build business case: Quantify hours wasted, forecast inaccuracy costs, DSO opportunity

- Get executive approval: Secure resources and priority commitment

- Plan implementation timing: Q1 or Q3 (avoiding year-end and mid-year close crunches)

Resource requirements for successful implementation:

- Finance project lead: 50% capacity for 8 weeks (400 hours)

- IT/integration support: 20% capacity for 4 weeks (64 hours)

- End-user training time: 8-16 hours per person

- Executive sponsor: 2 hours weekly for status and roadblock removal

Timeline: 1-3 months to free up resources and plan timing, then implement.

Green Light

You should proceed with implementation if you can honestly answer "yes" to these:

Data readiness:

- Subscription billing data is clean and consistent

- Can export 12+ months of reliable payment history

- Customer segmentation is clear and documented

- Payment terms are standardized by segment

Process maturity:

- Using a proper subscription billing platform (not manual invoicing)

- Automated payment retries are running

- Self-service payment portal exists

- Basic dunning workflow is in place

Business scale:

- $5M+ ARR with complex billing OR $10M+ ARR with simple billing

- 300+ active subscriptions OR high transaction volume

- Current forecasting takes 2+ days monthly

- Forecast accuracy <80% at 30 days

Team readiness:

- Finance team member can dedicate 50% for 8 weeks

- IT support committed to integration work

- Executive sponsor engaged and supportive

- Implementation window doesn't conflict with close/audit/major events

If you checked 12+ boxes above, you're ready. If you checked fewer than 8, address foundational gaps first.

When to Expect Results: Realistic Timeline

What happens when you rush:

Companies that try to compress below 6 weeks:

- 50-70% lower forecast accuracy improvements

- 40-60% lower user adoption rates

- 6-9 month delays in achieving ROI

- Higher frustration and "shelfware" risk

What happens when you drag it out:

Companies that let implementation exceed 16 weeks:

- Loss of momentum and executive attention

- Team reverts to old spreadsheet habits

- Benefits delayed, harder to prove ROI

- Higher risk of project being "paused indefinitely"

Sweet spot: 8-10 weeks for most mid-market SaaS companies.

Red flags that suggest problems:

If by Month 6 you haven't seen:

- At least 10% forecast accuracy improvement

- At least 5-day DSO reduction

- At least 15% failed payment recovery improvement

- Daily platform usage by the finance team

Then troubleshoot:

- Is integration working properly? (check data flow)

- Is the team actually using it? (check adoption metrics)

- Were the cohorts defined correctly? (review segmentation)

- Is dunning optimized? (review messaging and timing)

Most issues can be traced back to integration problems or low adoption, not platform capability.

Your Next Steps: Three Paths Forward

You've learned why SaaS cash flow forecasting is different, how AI solves subscription-specific challenges, what features matter, what integration requires, how implementation works, whether you're ready, and what results to expect.

Now, what do you actually do?

The answer depends on where you are in your journey. Here are three clear paths forward.

Path 1: "I'm Not Sure We're Ready Yet" → Start With Assessment

Who this is for:

- <$10M ARR or <300 customers

- Uncertain about data quality

- Finance team bandwidth is constrained

- Want to build a business case first

Your next 30 days:

Week 1: Baseline Metrics. Calculate your current cash flow performance:

- DSO (cash-based): (Ending AR / Last 30 Days Cash Collected) × 30

- Forecast accuracy: Compare last month's 30-day forecast to the actual bank balance

- Failed payment rate: (Failed Payments / Total Payment Attempts) × 100

- Forecasting time: Track hours spent this month gathering data and building a forecast

Week 2: Data Quality Audit. Export your billing system data and assess:

- Customer duplicates: How many customers appear multiple times under different names?

- Payment term consistency: Do similar customers have wildly different terms?

- Historical completeness: Can you export 12-24 months of reliable payment data?

- Subscription accuracy: Does the billing system status match the actual service access?

Week 3: Benchmark Against Peers Compare your metrics to SaaS industry standards:

- DSO comparison: Are you 10+ days above your segment average?

- Failed payment recovery: Below 60%? Significant opportunity.

- Forecast accuracy: Below 75% at 30 days? Room for improvement.

Week 4: Build Business Case. Quantify opportunity:

- DSO improvement opportunity: Calculate cash freed by reducing DSO to 15-20 days

- Time savings opportunity: Value hours currently spent on manual forecasting

- Failed payment recovery: Calculate revenue currently lost to unrecovered failures

- Total first-year benefit: Sum all opportunities

- Platform cost: Research vendor pricing for your ARR range

- ROI calculation: First-year benefit ÷ Total cost

Decision point: If ROI >300% and you have clean data, proceed to Path 2. If ROI <200% or data quality is poor, spend the next 3-6 months addressing foundations before revisiting.

Resources to check out:

- 2025 AR Benchmark Report

- ROI Calculator (SaaS-specific)

Path 2: "We're Ready to Evaluate" → Explore Solutions

Who this is for:

- $10M-$100M ARR with complex billing

- Clean billing data or committed to the cleanup

- Finance team bandwidth available for implementation

- Executive support secured

Your next 60 days:

Weeks 1-2: Define Requirements

Create your vendor evaluation framework:

- Must-have features:

- Native integration with [your billing system]

- Churn-adjusted forecasting

- Cohort-based predictions

- Intelligent dunning automation

- [Other non-negotiables from your business case]

- High-value capabilities:

CRM pipeline integration- Product usage signals

- Multi-currency support

- Scenario planning

- [Features that would deliver significant value but aren't dealbreakers]

- Nice-to-have features:

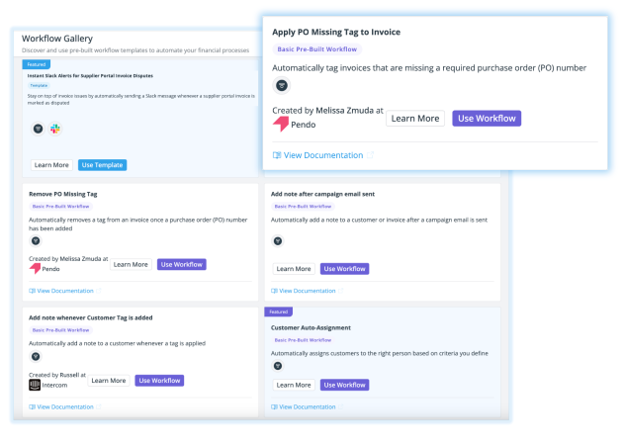

- Custom workflow builders

- Advanced reporting

- [Bonus capabilities]

- Evaluation criteria:

- Integration depth and quality (40% weight)

- AI/forecasting capabilities (30% weight)

- User experience and adoption (15% weight)

- Implementation support (10% weight)

- Pricing and TCO (5% weight)

Weeks 3-4: Shortlist Vendors

Research and narrow to 2-3 platforms:

- Screen for SaaS focus: Does the vendor have 20+ customers in your ARR range?

- Verify billing integration: Confirm the native connector exists for your exact system

- Check customer references: Talk to 2-3 SaaS companies using the platform

- Review case studies: Look for quantified results (DSO reduction, accuracy improvement)

Weeks 5-7: Conduct Deep-Dive Demos

Schedule 90-minute demos with each vendor:

First 30 minutes: Discovery

- Let the vendor ask about your business model, challenges, and goals

- Assess whether they understand SaaS-specific complexities

- Note whether questions are thoughtful or generic

Next 45 minutes: Demo

- Bring your actual data if possible (sample customer list, historical payment data)

- Request specific scenarios:

- "Show me churn-adjusted forecasting with our 5% monthly churn rate."

- "How do you handle a mid-cycle upgrade from $10K to $15K MRR?"

- "Demonstrate failed payment retry and dunning workflow"

- "Run a scenario: What if DSO increases by 10 days due to economic slowdown?"

Final 15 minutes: Logistics

- Implementation timeline for companies of your size

- Integration approach and resource requirements

- Pricing (transparent breakdown, not "we'll send a quote")

- Customer references in your segment

Week 8: Compare and Decide

Create a comparison spreadsheet:

Decision factors:

Choose Vendor A if:

- Highest weighted score

- At least 2 strong customer references in your segment

- Transparent pricing fits the budget

- Implementation timeline works with your calendar

- Gut feeling: "This team understands our business."

Red flags to avoid:

- Vague about integration specifics

- No customers in your ARR range

- Pushy on pricing, unwilling to be transparent

- Implementation approach seems generic, not SaaS-tailored

- Can't demonstrate the core features you need

Week 8 outcome: Select vendor, negotiate contract, kick off implementation.

Resources to check out:

Path 3: "We're Ready to Implement" → Execute

Who this is for:

- Decision made, vendor selected

- Budget approved, contract signed

- Resources allocated (finance lead, IT support, executive sponsor)

- Ready to begin Week 1

Your next 90 days:

Pre-Kickoff Prep (Week 0):

Before vendor engagement begins:

- Assemble project team:

- Finance project lead (50% capacity, 8 weeks)

- AR/Collections stakeholder

- FP&A stakeholder

- IT integration resource (20% capacity, 4 weeks)

- Executive sponsor (2 hours weekly)

- Prepare data:

- Export 24 months pof ayment history from the billing system

- Export customer master data

- Document current cohort segmentation logic

- Clean and deduplicate customer records

- Map billing system fields to what the vendor needs

- Document current state:

- Current DSO (baseline)

- Current forecast accuracy (baseline)

- Current forecasting time spent (baseline)

- Current failed payment recovery rate (baseline)

- Set expectations:

- Share the implementation timeline with the broader team

- Block finance lead calendar for dedicated project time

- Communicate "why" to affected stakeholders

- Schedule weekly project status meetings

Weeks 1-8: Implementation Timeline

Critical checkpoints:

End of Week 2:

- Integration scoped and mapped

- Success metrics defined

- Historical data exported and ready

End of Week 5:

- Core integrations live and syncing

- Historical data migrated

- Cohorts configured

End of Week 6:

- AI model trained and validated

- Forecast accuracy baseline beaten

- Dunning workflows configured

End of Week 8:

- Team trained

- Using the platform for daily operations

- Running parallel to spreadsheets for validation

Weeks 9-12: Optimization

- Monitor accuracy weekly

- Optimize dunning sequences

- Refine cohort definitions

- Track ROI metrics

- Celebrate early wins with the team

Day 90 outcome:

- Platform fully adopted

- Measurable accuracy improvement (10-15% gains)

- Early DSO reduction visible (5-10 days)

- Finance team is enthusiastic about capabilities

- Business case validation underway

Final Thought: From Reactive to Predictive

Here's what this entire guide has been building toward:

The best cash flow forecasting software for SaaS companies isn't about replacing spreadsheets with prettier dashboards, but fundamentally transforming how your finance organization operates from reactive firefighting to proactive strategy.

Reactive finance (where most SaaS companies live today):

- Discover cash shortfalls 2 weeks before payroll

- React to failed payments after customers have been without service

- Build forecasts that are outdated before you finish them

- Spend most time gathering data, little time analyzing it

Predictive finance (where AI cash flow prediction takes you):

- Know 90 days in advance if cash will tighten

- Prevent failed payments before they affect customer experience

- Maintain always-current forecasts that update as business changes

- Spend most time on strategic decisions, minimal time on data gathering

You're not just doing the same work faster. You're doing fundamentally different work that moves finance from a cost center to a growth enabler.

For a $50M ARR SaaS company, predictive financial intelligence typically frees:

- $2-3M in working capital (15-20 day DSO reduction)

- 25-30 hours monthly (forecasting automation)

- $200K-400K annually (failed payment recovery improvement)

However, the strategic value exceeds these numbers. When your CFO can confidently tell the board, "Here's our cash position for the next 90 days with 90% accuracy, and here's how different scenarios would impact it," you make different decisions.

You invest in growth earlier. You negotiate better terms with vendors. You plan hiring with confidence. You avoid expensive emergency financing.

The data proves it works. The question is whether you'll lead or lag your competition in capturing that value.

Ready to transform your SaaS cash flow from reactive to predictive?

Schedule Your SaaS-Focused Demo

See how Tesorio's connected financial operations platform delivers 95% forecast accuracy, 15-25 day DSO reduction, and 85% failed payment recovery for SaaS companies like yours.

Download 2025 SaaS AR Benchmark Report

Compare your DSO, failed payment rate, and forecast accuracy to 200+ SaaS companies analyzed.

Calculate Your ROI Potential

Use our SaaS-specific calculator to quantify the cash flow improvement opportunity for your business.