How to Automate AR in NetSuite: A Practical Playbook with AR Best Practices & Benchmarks

TL;DR (quick summary)

If you want to automate AR in NetSuite without creating “automated chaos,” focus on these five moves in order:

- Make invoice creation “boringly correct” (readiness checks + required fields + approval gates).

- Run collections on a cadence (segmented reminders + escalation rules + clear ownership).

- Treat disputes like a workflow (intake, routing, SLAs, and reporting).

- Automate cash application and build an exception queue (maximize auto-match, minimize mystery items).

- Operate AR weekly using a tight KPI pack (overdue exposure, long-tail risk, and cycle time).

Then benchmark your performance against peers and use those numbers to align stakeholders on where to automate first.

How to Automate AR in NetSuite Without Making It Harder to Run

Most NetSuite AR teams don’t struggle with whether to automate. They struggle with what they automated first: Collections run. Cash applies. Invoices post.

Yet month-end still includes manual checks, side spreadsheets, and a growing list of “we’ll fix this later” exceptions.

That usually traces back to sequence, not tooling.

NetSuite lets you automate downstream activity long before upstream consistency exists. When that happens, speed improves in isolated pockets, but control doesn’t. The system stays busy. The team stays involved. This looks like:

- Collections volume increases, but DSO doesn’t move much.

- Auto-match rates improve, but the exception list grows.

- Disputes are “tracked,” but resolution still happens ad hoc.

At that point, AR looks automated on paper, but still feels manual to operate.

This guide is for finance teams who already know NetSuite well and want automation that actually simplifies the day-to-day.

It lays out:

- What AR automation in NetSuite really consists of, beyond features

- The specific process controls that need to exist before automation works

- The order high-performing teams follow when automating invoices, collections, disputes, and cash application

- How to decide what to automate first, based on where friction actually lives

- How to benchmark your AR operation against peers and use that data to set priorities

NetSuite AR best practices before you automate

Automation amplifies whatever process you already have. If the underlying process is inconsistent, you’ll simply scale inconsistency faster. These are the NetSuite AR best practices that prevent that.

1. Standardize the invoice readiness gate

Most late payments don’t start in collections. They start with invoices that should never have gone out.

In our 2025 benchmark data, invoice issues consistently show up as a leading cause of delayed payment behavior. That makes invoice readiness a control point, not admin hygiene.

What that looks like in practice:

- Required fields enforced at creation, not fixed later (PO reference, bill-to entity, payment terms, delivery contact, dispute path)

- One approval gate before invoices post

- No exceptions handled “this one time” without changing the rule

If an invoice can leave the system incomplete, it eventually will, and everything downstream slows down. A working readiness gate makes “wrong invoice sent” an edge case. That’s what gives the rest of AR automation a chance to work.

2. Clean up the customer + collections data model

If contacts are inconsistent, terms vary by exception, or dispute reasons are free-text, NetSuite has nothing stable to automate against. Every rule turns into a workaround.

What needs to be standardized:

- Contact roles: Who receives invoices, reminders, and escalations. No guessing or CC chaos.

- Customer segmentation: Clear rules for strategic vs long-tail, low-risk vs high-risk. Collections logic depends on this.

- Dispute reason taxonomy: Finite, enforced reasons so disputes can be routed, timed, and reported instead of sitting unowned.

This is what allows collection rules to run without human interpretation. Once the data model is consistent, automation becomes predictable.

3. Decide your “manage by exception” rules

AR doesn’t get risky in the first 30 days. It gets risky in the long tail. That’s where balances age quietly, ownership blurs, and recovery rates drop fast.

Once invoices move into severe aging, exposure compounds while recoverability declines. Automation should be designed around that reality, not average payment timing.

This means “manage by exception” is being explicit about two things:

- What qualifies as normal behavior: Expected delays by segment, contract type, or customer risk profile.

- What triggers intervention: Aging thresholds, dispute duration, balance size, or customer importance.

In NetSuite, this usually translates to:

- Clear escalation points for long-tail balances

- Early intervention rules for high-risk or high-value accounts

- Automation that ignores noise and surfaces only what actually needs attention

Good exception rules narrow focus so human effort goes where it still matters.

How to automate AR in NetSuite (step-by-step playbook)

If you’re past “should we automate” and you’re at “what do we touch first,” this is the sequence. It covers what to automate, in what order, and which steps typically move DSO.

Step 1: Map your order-to-cash flow and pick 3 measurable targets

Write down your current path from “invoice created” to “cash applied.” Then pick three quarter-level targets such as:

- Reduce time from invoice send → first follow-up

- Reduce 1 to 30-day overdue exposure

- Cut cash application manual time per payment and shrink the exception backlog

These should be things you can measure weekly and explain without caveats. The objective here isn’t a perfect process, but forward motion you can see in the numbers.

Step 2: Automate invoice accuracy and delivery standards (the fastest DSO lever)

If you want fewer disputes and fewer “we’re missing details” delays, start here. Preventing these issues is one of the few AR moves that reduces work and improves timing at the same time. It’s not a nice-to-have.

In NetSuite, this means automating invoice correctness and delivery before you automate follow-ups.

What teams that move DSO fastest usually lock down:

- Invoices don’t post unless the required fields are complete

- Delivery rules are explicit and consistent

- Exceptions are documented once, not rediscovered every cycle

The goal is simple: stop creating problems that collections have to solve later.

Invoice readiness checklist

Use this as your internal policy baseline:

- Customer bill-to and ship-to verified

- PO number requirements met (if applicable)

- Payment terms correct + exceptions documented

- Tax/VAT fields consistent (if relevant)

- Customer contact list current (AP inbox + backup contact)

- Invoice includes payment instructions + dispute process

- Approval completed (if required)

Once this gate is enforced, disputes drop, follow-ups land faster, and the rest of AR automation starts to behave predictably.

Step 3: Build a segmented collections cadence (automation without annoying customers)

Collections automation only works if customers experience it as intentional. When automation is paired with guardrails on tone, timing, and eligibility, it can improve the customer experience. McKinsey cites up to ~30% CSAT lift in some deployments.

The difference is in the segmentation and escalation rules. A simple cadence most teams can run consistently:

- Pre-due (key segments only): Short confirmation note. Anything blocking payment.

- Day 1 overdue: Clear request. Invoice attached. Payment link included.

- Day 7: Follow-up. Confirm invoice receipt. Point to dispute the path.

- Day 14–30: Escalation based on balance size, risk profile, and past behavior.

- 60/90+ days: Executive escalation. Credit policy actions. Payment plan options, if appropriate.

Once this cadence is defined and enforced, automation does the boring part. Collectors step in only when the signal says it matters.

That’s how follow-up scales without becoming noise.

Step 4: Route disputes like a workflow, not a Slack thread

Disputes are one of the biggest reasons AR becomes unpredictable. When disputes live in email threads or Slack messages, ownership shifts, timelines slip, and cash sits idle without a clear next action. Adding more notes doesn’t fix that. Structure does.

What works is treating disputes as time-bound work with a single owner at each step.

A simple intake most teams can run without friction:

Dispute intake template

- Dispute reason

Selected from a standard list. No free text.

- Invoice(s) impacted and amount at risk

- Owner

Finance, Sales, CS, or Ops. One at a time.

- SLA for first response and target resolution date

- Next action and next check-in date

Once this is enforced, disputes stop being “open conversations” and start behaving like a queue.

Step 5: Automate cash application and create an exception queue

Cash application is where a lot of AR time disappears, especially at month end.

The objective isn’t to auto-match everything, but push as much volume as possible through clean rules, then isolate what truly needs review.

Teams that do this well focus on two outcomes:

- High straight-through match rates for routine payments

- A small, explainable exception queue that can be cleared quickly

In practice, this means:

- Tight matching rules for common payment patterns

- Clear categorization of exceptions so they’re routed, not investigated from scratch

- Visibility into why a payment didn’t match, not just that it didn’t

Most payments flow through untouched. The rest land in one place, with context, ownership, and a next action. That’s what keeps month-end from turning into cleanup.

Step 6: Run AR weekly with one KPI pack (best practice that sustains automation)

Automation holds only if AR is reviewed the same way, every week. For NetSuite teams, this set usually covers what actually matters:

- Collection speed (DSO/ADC equivalent)

- Overdue exposure (current vs overdue buckets)

- Severe aging (your 90+ / 120+ tail)

- Dispute cycle time (open disputes + aging)

- Cash application cycle time (plus exception rate)

Reviewed weekly, these metrics do two things:

- They surface where automation is breaking before month end.

- They keep ownership clear when volumes change.

If the same numbers come up every week, AR stays operable. If they don’t, automation slowly erodes back into manual work.

What to automate first: a simple decision table

Benchmark your NetSuite AR against peers

If you’re trying to justify automation work internally, benchmarks make the conversation easier.

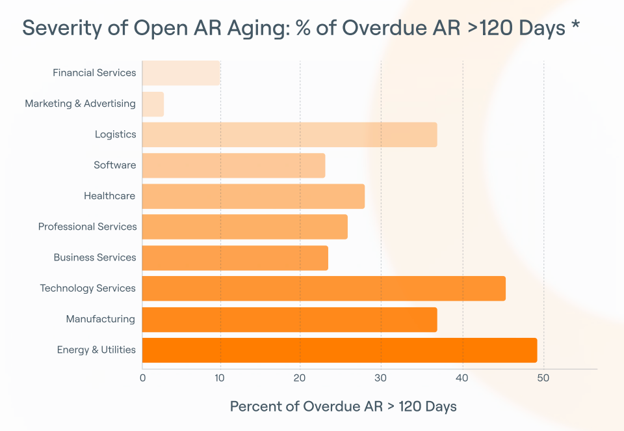

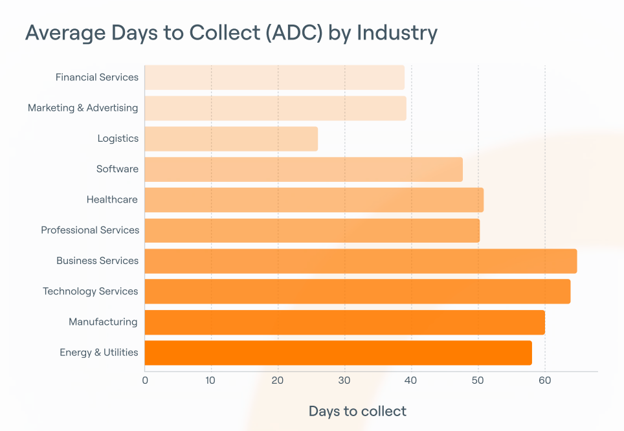

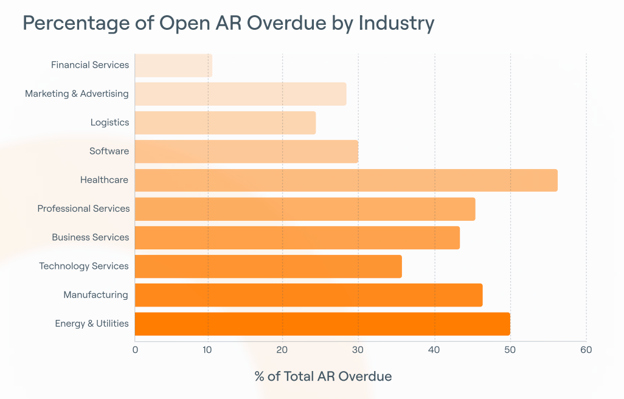

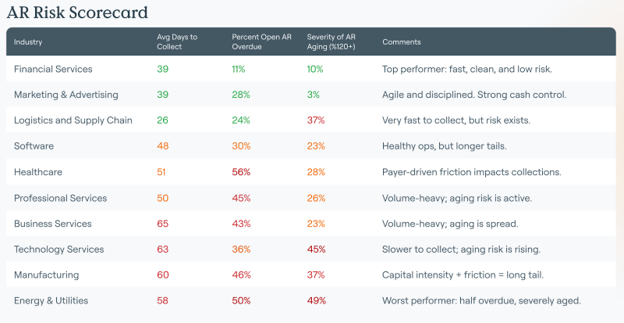

Tesorio’s 2025 AR Benchmark Report uses observed AR performance across 10 industries and includes peer-level comparisons on collection speed, overdue exposure, and long-tail severity. This is useful for understanding what “good” looks like and where risk sits.

1. Average Days to Collect by Industry: This view helps set realistic targets by industry and business model. It shows whether your collection speed is lagging behind peers or simply reflects how customers in your segment pay. That context matters before you start changing cadence or escalation rules.

2. Percent Open AR Overdue by Industry: Overdue exposure is where inconsistent execution shows up first. Seeing how quickly overdue balances accumulate by industry makes segmentation feel necessary. It reinforces why cadence, ownership, and escalation rules need to exist before automation scales.

3. AR Risk Scorecard (speed + overdue + severe aging): This scorecard makes tradeoffs visible. A team can be fast but risky, slow but controlled, or exposed in the long tail without realizing it.

Used internally, this gives finance a simple way to tell where AR risk actually sits, which part of the workflow deserves automation first, and what “improvement” should look like over the next quarter.

Gartner’s data lines up with how AR teams actually succeed: AI shows up first in process automation (44%) and anomaly detection (39%) before forecasting or copilots. That’s exactly where AR automation delivers ROI: invoices, disputes, exceptions, then prioritization.

When NetSuite ends and “connected finance ops” begins

Day to day, collections and cash application spill across inboxes, customer portals, bank files, and handoffs between finance, sales, and customer teams. NetSuite holds the data. The execution happens elsewhere.

In practice, it’s about connecting systems and turning AR data into a workflow. Tools like Tesorio sit alongside NetSuite and use native integration paths to keep NetSuite authoritative while coordinating what happens around it.

A simple rule usually holds:

If your AR “process” depends on spreadsheets, inbox checks, and constant context switching, you’re already operating beyond what an ERP alone is designed to orchestrate.

At that point, the question isn’t whether NetSuite is enough. It’s how you connect execution back to the system of record without losing control.

Conclusion: Next steps (30-day plan)

Industry guidance and implementation data from NetSuite both point to the same pattern: partial AR automation delivers limited gains, while end-to-end approaches materially improve speed, accuracy, and cash conversion. That’s why invoice readiness, collections execution, dispute routing, and cash application have to be treated as one operating system, not disconnected optimizations.

If there’s one clean takeaway, it’s this: don’t start with “AI.” Start with operating discipline.

Over the next 30 days, focus on three moves that actually change how AR runs week to week:

- Lock down invoice readiness: Enforce required fields and a readiness gate so preventable issues stop reaching customers.

- Launch a segmented collections cadence: Clear ownership, defined escalation rules, and consistency across accounts.

- Stand up a cash application exception queue and weekly KPI rhythm: Auto-match what you can. Isolate the rest. Review the same numbers every week.

Once those are in place, benchmark where you stand.

Peer comparisons help turn “we should improve AR” into a concrete discussion about where risk sits and what to automate next.

If the operating basics aren’t stable, automation just moves work around. If they are, automation compounds quickly.

If you want to see how this gets implemented in real AR workflows:

Request a SaaS Finance Demo

See how collections, renewals, and cash forecasting operate when NetSuite, billing systems, and bank data are actually connected in one workflow.

Run the Cash Impact Model

Estimate potential DSO reduction, working capital unlocked, and collections productivity gains using your current metrics.

Review peer outcomes on G2

Across 200+ verified reviews (4.7/5), finance teams consistently point to clearer cash visibility, fewer exceptions, and materially less manual follow-up after moving beyond ERP-only AR workflows.

Frequently Asked Questions

Should I automate collections or cash application first?

Look at where time is leaking. If follow-up is inconsistent and overdue balances are creeping up, start with a defined collections cadence.

If cash is coming in but sits unapplied at month end, start with cash application and an exception queue.

Most teams eventually do both. The first move should address the constraint you feel every week.

How does AI help reduce DSO?

AI only helps when it changes execution, not reporting.

In AR, that usually means:

- prioritizing which accounts need attention now

- detecting anomalies that signal risk earlier

- automating routine follow-ups so collectors focus on exceptions

Used this way, AI reduces manual work and tightens timing. Used only for dashboards, it doesn’t move outcomes.

Do I need to clean all my data before automating?

No. You need to clean the data that automation depends on. Invoice fields, customer segmentation, dispute reasons, and contact roles matter. Historical edge cases usually don’t.

Trying to make everything perfect delays progress. Enforce standards going forward and let the system normalize over time.

How do I know if my AR team is understaffed or just under-tooled?

Look at the exception volume. If most time is spent on repeatable work like reminders, basic disputes, and payment matching, tooling is the issue. If time is spent on complex negotiations and escalations, staffing may be the constraint.

What’s the biggest mistake teams make with AR automation?

Automating activity before enforcing standards. Reminders without invoice readiness. Cash application without exception ownership. Disputes without SLAs.

That speeds up work without reducing it.