NetSuite Collections Automation: How to Automate Dunning and Run Modern Collections Campaigns

It’s the middle of the month. You’ve already run the AR aging. Nothing in it is surprising and that’s the problem:

- The same accounts are past due.

- The same customers are “waiting on approval.”

- The same notes show up again: emailed last week, follow up tomorrow, needs escalation.

You’re not missing visibility. NetSuite gives you plenty of that. What you don’t have is consistency.

Two collectors work the same type of account differently. Escalation depends on who noticed what, and when. Dunning technically exists, but it’s either too aggressive, too passive, or quietly ignored because fixing it feels risky.

Meanwhile, the long tail keeps aging because no one owns what happens next.

That’s the gap NetSuite collections automation is supposed to close - turning collections into a system:

- clear rules for who gets worked

- predictable escalation when invoices cross risk thresholds

- automated outreach that supports (not replaces) human judgment

This guide breaks down how teams actually do that in NetSuite using its native building blocks, understanding where automation breaks at scale, and designing collections campaigns that reduce overdue without creating downstream issues.

If your collections process still relies on inboxes, spreadsheets, or tribal knowledge, this is how it gets out of hero mode and into something you can run quarter after quarter.

What NetSuite collections automation actually means

NetSuite collections automation is the operating system you build on top of NetSuite AR data to make follow-up consistent.

In practice, most high-performing teams treat it as three layers:

1) NetSuite as the system of record

NetSuite stores invoices, customer records, terms, and aging. Teams often rely on saved searches, dashboards, and workflows to drive internal tasks and visibility.

This layer answers: “What is owed? To whom? How old is it?”

2) NetSuite dunning automation (baseline rules)

NetSuite supports dunning processes through dunning procedures, levels, templates, and scheduled evaluation workflows (via the Dunning Letters capability), with activity tracked in system notes.

This layer answers: “Who should be contacted at each stage?”

3) Automated collections campaigns (the program layer)

This is the missing layer in most implementations.

Automated collections campaigns means you’re managing outreach like a program:

- segmented cadences by customer type

- consistent escalation paths

- pause/resume rules for disputes and promises-to-pay

- governance (who can change messaging, what needs approval)

- measurement loops so you can improve the process every quarter

This layer answers: “How do we run collections predictably at scale?”

Why controls matter: overdue and deep aging are where predictability breaks

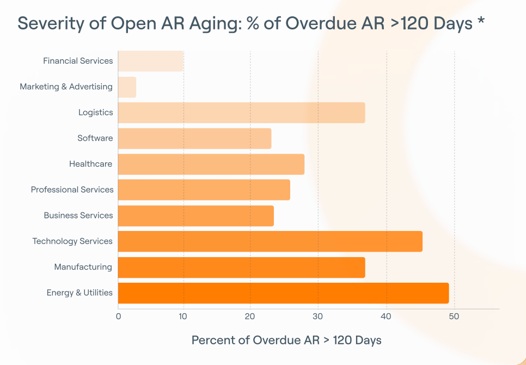

A lot of collections content talks about DSO as if it’s the whole story. It isn’t. This chart shows why.

Across industries, a meaningful share of overdue AR doesn’t just slip a little late. It concentrates in the 120+ day bucket, where recovery probability drops sharply. In some operating models, more than a third of overdue balances sit in this long tail. Once receivables reach this zone, outcomes are driven less by reminder frequency and more by whether escalation happened early enough and consistently enough to prevent them from getting there.

That’s the risk NetSuite teams have to design for: not average lateness, but structural aging.

The 2025 AR Benchmark Report reinforces this pattern. Time-to-collect and overdue exposure vary widely by industry and operating model, which means “average best practice” targets can be misleading if you don’t control how invoices move through risk stages.

Two operational takeaways from the benchmark framing are especially useful when designing automation:

Invoice readiness and billing friction drive late payment behavior

Late payment is not always “collections didn’t follow up.” Billing errors, missing POs, and misrouted invoices create friction and disputes that delay payment even when intent exists. Automation needs exception paths and readiness controls, not just reminders.

Deep aging is a structural risk zone

As receivables age into long-tail buckets, recovery becomes significantly less likely. This is why escalation timing, policy, and governance matter more than “how many emails you sent.”

NetSuite dunning automation: set the policy before you set the workflow

NetSuite can automate dunning. The hard part is making it dependable in the real world.

Before you touch configuration, document these policies in plain language:

- When does an invoice enter dunning?

- When does dunning pause? (dispute open, payment plan, executive escalation, strategic account handling)

- What is the escalation ladder? (friendly reminder → collector task → manager review → policy action such as credit hold)

- Customer-level vs invoice-level behavior: do you want to treat an entire customer based on their portfolio, or individual invoices based on age and amount?

If you skip policy, automation amplifies inconsistency. The system will still send messages, but your team won’t trust what it’s doing, and customers will feel the confusion.

NetSuite dunning automation: what it does well and what breaks at scale

NetSuite’s Dunning Letters capabilities are designed to support structured dunning via procedures/levels/templates and scheduled evaluation workflows. It uses operational mechanics like email sending queues and printing queues, and it records dunning activity in system notes.

That’s a strong baseline. But the reason teams keep searching for “NetSuite dunning automation” is that real-world collections introduce scale problems that aren’t obvious at first.

The scale pitfalls you should plan around

Oracle documentation highlights limitations and best practices that matter in production. A few themes are especially relevant when you’re building an automation program:

1) Queue mechanics and throughput constraints

Dunning isn’t “send unlimited emails instantly.” It runs through system queues and operational processes. When volume increases, you have to plan how runs are scheduled, monitored, and retried.

2) Deliverability reality and blind spots

In the real world, email bounces and inbox deliverability affect outcomes. Automation that can’t detect or react to deliverability issues can create “we sent it” confidence that doesn’t match reality. NetSuite documentation discusses functional constraints that teams need to understand as they operationalize sending at scale.

3) Manual steps can remain, even in an “automated” flow

Some elements of the dunning process may not be fully hands-off (for example, how output like PDFs is generated and managed). That’s not a deal-breaker, but it changes how you design the process and who owns exceptions.

4) Saved search and configuration fragility

This is one of the most common and least visible failure points in NetSuite dunning automation. Most dunning logic ultimately depends on saved searches, filters, and field conditions: invoice status, aging buckets, customer flags, dispute indicators, contact fields, subsidiaries, currencies, and so on.

It works well until something changes. This matters because teams often build logic that works until a field or filter changes and the whole process quietly degrades.

What to do about it: treat dunning automation as a production system. Assign ownership, create a monitoring routine, and instrument KPIs that detect drift (more on that below).

Automated collections campaigns: the operating manual most teams are missing

If you want collections automation that actually moves cash outcomes, you need campaigns. In AR, a campaign is a structured set of touches and escalation steps that change based on customer segment, invoice stage, and exception status.

Step 1: Segment customers like you intend to treat them differently

Segmentation is how you avoid both extremes:

- spamming customers who pay reliably

- under-escalating customers who consistently delay payment

A simple segmentation model that works for many NetSuite teams:

- Value tier: strategic accounts vs long-tail

- Risk tier: habitually late, dispute-heavy, unpredictable payers

- Balance size: high-dollar vs low-dollar

- Payment behavior: on-time, pays after reminder, pays after escalation

If your automation can’t support segmentation, it will either be too timid (no impact) or too aggressive (bad customer experience).

Step 2: Use a staged cadence, not a generic reminder schedule

A practical staged cadence often includes:

- Pre-due confirmation: reduce “invoice friction” early

- Due-date reminder: simple, low-friction

- Early delinquency follow-up: firm, still customer-friendly

- Mid delinquency escalation: collector-led, adds context

- Late-stage policy escalation: consistent and auditable

Smartsheet is a concrete example of why pre-due touches matter. By shifting outreach earlier in the invoice lifecycle before invoices were overdue, Smartsheet eliminated spreadsheet tracking across 150,000+ customers, scaled proactive outreach across 11,000 open invoices per month, and let collectors spend ~85% of their day in a single system instead of chasing context. The result wasn’t just cleaner operations: the team exceeded a quarterly cash goal by ~$14M, while maintaining a customer-care-first experience.

That’s the practical payoff of a staged cadence that starts before delinquency: fewer downstream exceptions, less reactive chasing, and materially better cash outcomes without adding headcount.

Step 3: Governance controls (so automation stays safe)

Automation becomes risky when messaging changes are uncontrolled, disputes aren’t respected, or multiple teams contact the same account out of sync.

Your governance layer should answer:

- Who can edit templates and rules?

- What requires approval?

- How do you prevent duplicate/conflicting outreach across teams?

- How do pause/resume rules work for disputes and promises-to-pay? :cite[a31]

Discovery Education shows why governance is not optional at scale. With complex one-to-many customer structures (districts, schools, individual bill-to contacts, and funding sources), ungoverned automation would have created noise fast. Instead, by centralizing rules, contact routing, and pause/resume logic in one system, Discovery Education was able to safely scale outreach to 900+ collections emails in a single day without misfires or customer backlash.

The payoff was measurable. In their largest business segment, they cut DSO by 66% in one year, reducing the average collection period from ~97 days to 59 days, while shrinking AR review time from hours to minutes.

That’s what governance buys you: the confidence to automate aggressively, knowing the right contacts are reached, exceptions are respected, and leadership can trust the numbers.

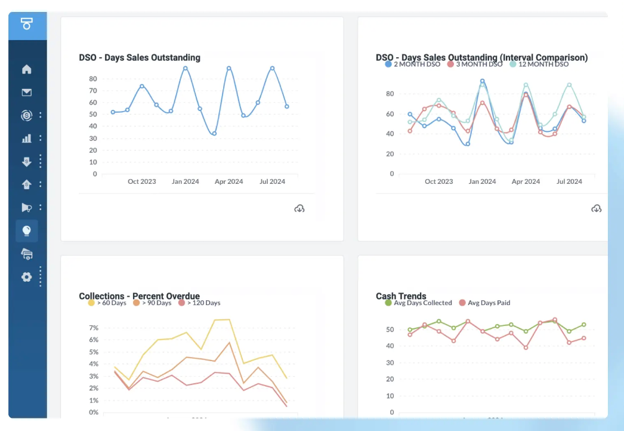

Measurement and controls: how to prove ROI (and improve every quarter)

Automation only matters if it changes outcomes you can defend. The discipline here is simple: baseline first, run the program, then quantify what actually moved and why.

This is the minimum KPI set finance leaders tend to align on because it links execution to cash, not activity.

Minimum viable collections KPI scorecard

Two practical rules that keep this useful:

- Baseline before you change cadence or automation rules. Otherwise you can’t separate signal from activity.

- Track overdue exposure and deep aging separately. DSO alone hides where risk is actually accumulating.

Best NetSuite collections automation for SaaS

If you run AR for a SaaS business, you’ve already felt this tension: you need discipline and scale, but you can’t afford blunt automation. The margin for error is smaller when invoices sit next to renewals and expansions.

Why SaaS collections is different

SaaS collections is uniquely sensitive because:

- the relationship affects renewals and expansion

- invoice volume can be high

- billing complexity creates disputes (usage, proration, mid-cycle changes)

- a “collections email” is also a customer experience touchpoint

This is why segmentation and governance matter more in SaaS than in many other industries.

SaaS segmentation model (simple and effective)

For SaaS teams running NetSuite, segmentation that changes behavior usually looks like:

- Enterprise accounts near renewal windows (highest CX sensitivity)

- Annual prepay vs monthly cohorts

- Long-tail standardized accounts

- Dispute-prone segments (billing/usage questions)

Then apply a cadence where pre-due confirmation is standard, but escalation intensity varies by tier and risk.

SaaS cadence blueprint (example you can adapt)

- Pre-due: confirm invoice receipt + correct bill-to

- Due date: lightweight reminder + payment path

- 7–14 days past due: standard escalation for low/med risk; collector intervention for high-value

- 30+ days: manager escalation for strategic accounts

- Late-stage: documented policy action

The point is to remove friction early so you don’t create avoidable late payments that turn into renewal risk.

SaaS KPI interpretation

In SaaS, deep-aging exposure is not only a cash metric. It can be a signal that exception handling and customer communication are breaking down. The benchmark emphasis on overdue exposure and long-tail risk supports why you measure the long tail, not just the average.

How to choose the best collections software for NetSuite

Use this rubric in buying committees to evaluate a NetSuite collections software.

Decision rubric

If a tool can’t support segmentation, governance, and KPI measurement, it may automate activity without improving outcomes.

Automate the mechanics, run AR like a system

NetSuite collections automation is about designing an AR system that holds up under volume: consistent follow-up without blunt messaging, escalation that happens early enough to matter, and controls that let leadership trust the numbers quarter after quarter. When collections is run as a program with segmentation, governance, and measurement, you stop chasing symptoms and start managing outcomes.

If you want a clean path forward, keep it simple:

- baseline the KPIs that actually move cash,

- segment customers the way you already treat them,

- run a staged cadence with clear ownership,

- review performance on a regular rhythm.

Then iterate deliberately. That’s how AR improvements compound instead of resetting every quarter.

Where to go next

If you want to see how this looks end-to-end in a live environment, you can:

- Explore a SaaS finance walkthrough

See how collections, renewals, and cash forecasting work when NetSuite, billing platforms, and bank data operate as one connected workflow.

- Model the cash impact for your own numbers

Use your current DSO, invoice volume, and team size to estimate working capital unlocked and productivity gains before committing to change.

- Pressure-test outcomes with peers

Review verified feedback from finance teams who’ve moved beyond ERP-only AR workflows and report clearer visibility, fewer exceptions, and materially less manual follow-up (200+ reviews, 4.7/5 on G2).

If you’re evaluating options, these steps tend to surface quickly whether your current setup can support program-level collections or whether it’s time to rethink the operating model.

Frequently Asked Questions

Does NetSuite support dunning automation?

Yes. NetSuite supports dunning processes using procedures, levels, templates, and scheduled evaluation workflows. Teams often add governance and measurement so it remains reliable at scale.

What’s the difference between NetSuite dunning automation and automated collections campaigns?

Dunning is a baseline rule-driven reminder. Campaigns add segmentation, staged cadences, governance, exception handling, and KPI loops so results improve over time.

How do SaaS teams avoid spamming customers?

Segment accounts by relationship value and risk, use staged cadences, and implement pause/resume rules for disputes and promises-to-pay to prevent conflicting outreach.

Which KPIs prove ROI for collections automation?

Track time-to-collect, percent overdue, deep-aging exposure, collector productivity, and dispute cycle time where relevant. Baseline first, then measure before/after changes.