The Complete Guide to Financial Internal Control Systems

You close the books. The quarter looks fine until you dig into what’s still sitting in receivables. Revenue is booked. But cash? Still waiting for signatures, reconciliations, or someone to check an approval box that should have been automated years ago.

Every other function has evolved. Sales runs on real-time dashboards. Operations forecast demand with AI. But finance still spends 60% of internal audit hours proving compliance instead of improving performance.

Across $80 billion in receivables in the 2025 AR Benchmark Report, the divide is widening. Financial Services teams collect in 39 days, with only 11% of invoices overdue, while Energy and Utilities teams stretch past 58 days, with half of their invoices aging out.

The difference isn’t regulation, headcount, or talent. It’s control design: how systems handle exceptions, risk, and accountability at scale.

This guide looks under the hood of that gap. You’ll see:

- How modern internal control systems shift from static reviews to continuous assurance.

- What AI-auditor frameworks actually automate, and where human judgment still matters.

- Case studies from finance teams that cut DSO by 33 days without adding staff.

- A one-year roadmap for transforming controls from compliance overhead to operational infrastructure.

By the end, you won’t get another reminder that “automation saves time.” You’ll get a clearer picture of what control maturity actually looks like when finance stops working for the system and starts letting the system work for it.

Understanding Modern Financial Internal Control Systems

Before diving into transformation strategies, it's crucial to understand what separates modern financial internal control systems from their traditional counterparts. A financial internal control system encompasses the policies, procedures, and technologies that ensure accurate financial reporting, protect assets, and maintain compliance with regulatory requirements.

The key difference lies in their approach: traditional systems react to problems after they occur, while modern systems prevent problems before they happen. This shift from reactive to proactive management creates the foundation for everything that follows.

The Three Pillars of Effective Control Systems

Data Integration and Real-Time Visibility

Modern financial internal control systems connect every financial data source: ERP systems, CRM platforms, banking systems, and third-party applications into a unified view. This integration eliminates the data silos that create blind spots and delays in traditional systems.

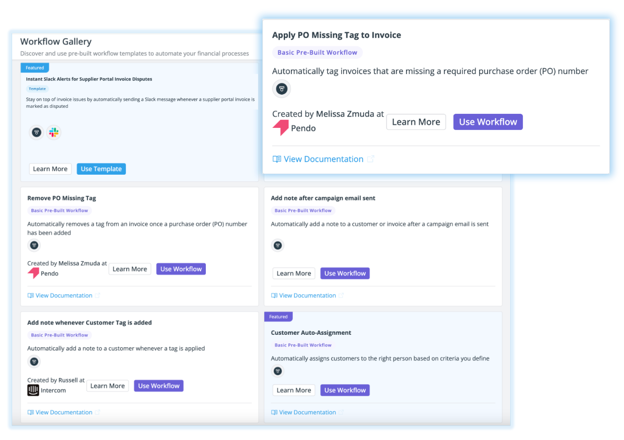

Automated Financial Controls and Workflow Management

Instead of relying on manual processes prone to human error, advanced systems automate routine control activities. This includes invoice processing, payment approvals, compliance reporting, and audit trail generation: all happening without human intervention while maintaining full oversight.

Predictive Risk Assessment and Monitoring

AI-powered analytics continuously assess financial risks, identifying potential issues before they impact cash flow. This represents the most significant evolution: moving from detecting problems to preventing them entirely.

The Performance Reality: Where Industries Stand Today

To understand the transformation opportunity, we need to examine current performance across industries that reveals dramatic variations that directly correlate with control system sophistication.

The Leaders: Financial Services and Marketing Excellence

Financial Services companies demonstrate what's possible with sophisticated automated financial controls. Their 39-day collection cycles and 11% overdue rates result from three key factors: recurring billing structures that reduce payment friction, disciplined collections processes powered by automation, and comprehensive risk assessment that prevents problems before they occur.

Marketing and advertising companies achieve similar performance through high transaction volumes that benefit from automation, recurring contract structures that create predictable cash flows, and customer expectations for prompt service delivery that align with efficient collections.

The Laggards: Energy, Healthcare, and Manufacturing Challenges

At the other end of the spectrum, Energy and Utilities companies struggle with 58-day collection cycles and 50% overdue rates. These challenges stem from manual invoicing processes that create delays and errors, complex contract cycles that resist standardization, and legacy ERP systems that lack modern automation capabilities.

Healthcare organizations face similar difficulties with 51-day collection cycles and 56% overdue rates, primarily due to payer-driven friction and complex billing requirements that traditional financial internal control systems can't handle efficiently.

This performance gap, where leaders collect payments 1.4 to 2.5 times faster than laggards, represents millions of dollars in working capital optimization opportunities. More importantly, it demonstrates that transformation is possible regardless of industry complexity.

How AI Auditor Frameworks Are Changing the Game

The biggest shift in financial internal control design isn’t new regulation but the quiet normalization of AI inside finance itself.

According to Gartner’s 2025 AI in Finance research, 56% of finance functions plan to increase their AI investments by at least 10% within the next two years, and enterprises already running one AI use case are exploring an average of ten more. AI in finance is no longer experimental. It’s the infrastructure that’s used to extend visibility.

Continuous monitoring replaces quarterly reviews. Transaction-level learning replaces static rulebooks. And CFOs who once viewed AI as a compliance risk now treat it as a co-worker: one that audits, predicts, and explains at machine speed without losing human accountability.

From Periodic Audits to Continuous Intelligence

Traditional audits occur monthly, quarterly, or annually, creating gaps where issues can develop undetected. AI auditor frameworks provide continuous monitoring, analyzing every transaction, payment pattern, and risk indicator in real-time.

This shift enables three critical capabilities that weren't possible before:

Predictive Payment Analytics AI algorithms analyze historical payment patterns, customer behavior, and external factors to predict when customers are likely to pay. This enables finance teams to optimize outreach timing and prioritize high-risk accounts before they become problematic.

Dynamic Risk Scoring Machine learning models continuously evaluate customer creditworthiness and payment probability, automatically adjusting collection strategies based on risk profiles. This replaces static credit policies with responsive, data-driven decision-making.

Intelligent Workflow Automation AI systems automatically escalate overdue accounts, customize communication strategies based on customer preferences, and predict which collection approaches are most likely to succeed for specific customer segments.

Real-World Results: What Companies Are Achieving

The shift from traditional controls to AI-driven audit frameworks is already paying off in hard numbers.

McKinsey’s latest findings show that financial institutions deploying generative AI across core finance workflows are seeing 20-30% productivity gains in development and reporting teams.

For companies that have gone all-in, the outcome is unmistakable: faster reconciliations, cleaner audit trails, and real-time risk visibility that used to take weeks to verify manually.

Veeva Systems: 50% Reduction in Aged Accounts

Veeva Systems, a global leader in cloud-based software for life sciences, implemented AI-powered financial internal control systems that delivered measurable results. The company achieved a 50% reduction in 90-day aged accounts while reducing time spent on lower-priority accounts from 25% of the week to under 2 hours weekly.

The implementation focused on an integrated approach that combined automated financial controls and workflows with AI-powered payment predictions, demonstrating how technology can amplify human efficiency rather than replace it.

Currencycloud: 200% Efficiency Improvement Without Adding Staff

Currencycloud, processing over $50 billion annually across 180+ countries, faced the challenge of scaling collections operations without proportional staff increases. Their AI-powered financial internal control system resulted in a 200% increase in accounts receivable efficiency and 60% improvement in cash collections within six months, all without adding headcount.

The implementation demonstrated how automated financial controls can enable organizations to scale operations while maintaining personalized customer relationships, addressing a common concern about automation reducing service quality.

Couchbase: 10-Day DSO Reduction and Doubled Collections Productivity

Couchbase, creator of a powerful NoSQL database serving Fortune 500 companies including AT&T, Verizon, and Wells Fargo, needed to improve cash flow performance without scaling their collections team linearly with business growth. Their implementation of a financial internal control system delivered significant results within two years.

The company achieved a permanent 10-day reduction in DSO while doubling collections productivity per analyst. Most notably, Couchbase maintained consistent DSO/DPO parity and avoided raising capital for three years due to improved cash flow performance. The system cut the cash flow forecast build time from 10 days to just hours, enabling real-time decision-making on payments and receivables.

This case demonstrates how comprehensive automated financial controls can transform not just operational efficiency but strategic financial management, enabling companies to fund growth through improved working capital rather than external financing.

The Implementation Journey: From Foundation to Optimization

Building effective automated financial controls requires a structured approach. Based on Tesorio's experience with customers who have unlocked $200M+ from their balance sheets, the most effective methodology follows three distinct phases:

Phase 1: Foundation Building (Months 1-3)

Success begins with a comprehensive assessment of existing financial processes, identifying inefficiencies, control gaps, and automation opportunities. This includes process mapping, data flow documentation, and performance benchmarking against industry standards.

Many organizations discover that their existing ERP systems can support advanced automated financial controls with proper configuration and integration tools, reducing implementation complexity and cost.

Phase 2: Core System Implementation (Months 4-8)

This phase focuses on implementing core automation features, beginning with data integration and basic workflow automation. The goal is to connect financial systems, automate routine processes, and establish real-time reporting capabilities.

Critical activities include developing comprehensive control frameworks that leverage automation while maintaining appropriate oversight, establishing automated approval workflows, and creating exception handling procedures with complete audit trails.

Phase 3: Advanced Optimization (Months 9-12)

The final phase deploys advanced AI features, including predictive payment analytics, automated risk assessment, and intelligent workflow optimization. These features transform reactive financial management into proactive optimization.

Organizations also establish continuous improvement processes, including regular performance reviews, system optimization, and feature enhancement. The most successful implementations treat financial internal control systems as evolving platforms rather than static solutions.

Overcoming Implementation Challenges

While the benefits of modern financial internal control systems are substantial, organizations often encounter predictable challenges during implementation. Understanding these challenges and their solutions significantly improves implementation success rates.

Technology Integration Realities

Legacy System Compatibility

Many organizations struggle with integrating modern automation tools with legacy ERP systems. The solution involves implementing middleware platforms that bridge the gap between old and new systems while providing modern automated financial controls capabilities.

Data Quality and Consistency Requirements

Poor data quality can undermine even the most sophisticated control systems. Successful implementations begin with data cleansing and standardization efforts, establishing data governance policies that maintain quality over time.

Organizational Change Management

Team Resistance to Automation

Finance team members may resist automation due to concerns about job security or changes to familiar processes. Address these concerns through comprehensive training programs that demonstrate how automated financial controls enhance rather than replace human capabilities.

Process Standardization Needs

Automation requires standardized processes, which can be challenging for organizations with highly customized workflows. The solution involves carefully analyzing existing processes to identify which customizations add value and which can be standardized for efficiency.

Executive Buy-in and Support

Successful implementations require strong executive support, particularly during challenging phases. Build this support by demonstrating quick wins and maintaining clear communication about implementation progress and benefits.

The Future of Financial Internal Control Systems

Understanding emerging trends helps organizations prepare for the future while making informed decisions about current implementations. The evolution continues to accelerate, driven by advances in artificial intelligence, machine learning, and cloud computing technologies.

Emerging AI Capabilities

Natural Language Processing Integration

Advanced AI systems increasingly incorporate natural language processing capabilities, enabling them to analyze unstructured data such as customer communications, contract terms, and regulatory guidance. This capability enhances risk assessment and compliance monitoring within AI auditor frameworks.

Autonomous Financial Operations

The next generation of financial internal control systems will feature autonomous capabilities that can make routine financial decisions without human intervention. These systems will handle credit approvals, payment scheduling, and collection strategies based on predefined parameters and real-time data analysis.

Predictive Compliance Management

Future systems will predict compliance issues before they occur, automatically adjusting processes and controls to maintain regulatory compliance. This proactive approach will significantly reduce compliance costs and risks.

Integration and Connectivity Advances

Ecosystem-Wide Integration

Financial internal control systems will increasingly integrate with broader business ecosystems, including customer systems, supplier platforms, and regulatory databases. This integration will enable more comprehensive risk assessment and automated financial controls verification.

Real-Time Regulatory Updates

Advanced systems will automatically incorporate regulatory changes, updating control procedures and compliance requirements without manual intervention. This capability will be particularly valuable for organizations operating in multiple jurisdictions.

Taking Action: Your Next Steps

With top-performing industries collecting payments 1.4 to 2.5 times faster than their peers, the competitive advantage has never been more pronounced. Verified implementations show average gains of 33 days in faster cash collection, 50% fewer aged receivables, and 200% higher operational efficiency.

The shift from reactive compliance to proactive financial optimization isn’t just about technology, but redefining how finance creates value from protecting revenue to accelerating it.

Start your transformation:

- Size the upside: Use the ROI calculator to forecast improvements in DSO, working capital, and team productivity. Mid-market companies typically unlock $2–5M in working capital within the first year.

- See it in action: Book a personalized demo to map your collection scenarios, integration needs, and reporting requirements to proven automation workflows.

- Experience it yourself: Explore the interactive sandbox to test-drive AI-powered controls, forecasting tools, and real-time visibility features: no commitment required.

The question is no longer if modernization is necessary, but how quickly you can execute it. Every day of delay keeps cash trapped, productivity lost, and competitors moving faster.

By implementing connected financial operations platforms that integrate AI auditor frameworks with comprehensive automated financial controls, you can transform your finance function from a cost center into a growth engine.

Frequently Asked Questions

What is the difference between traditional and modern financial internal control systems?

Traditional financial internal control systems rely heavily on manual processes, periodic reviews, and reactive management approaches. Modern systems integrate AI-powered automation, real-time monitoring, and predictive analytics to create proactive, continuously optimizing control environments. The key difference is that modern systems prevent problems rather than just detecting them after they occur.

How do AI auditor frameworks ensure compliance and auditability?

AI auditor frameworks enhance compliance through continuous monitoring, automated documentation, and comprehensive audit trails. These systems maintain detailed records of all decisions and actions, provide real-time compliance verification, and can automatically adjust processes to meet changing regulatory requirements. Many auditors prefer AI-powered controls because they provide more consistent and comprehensive documentation than manual processes.

What are the key success factors for financial internal control system implementation?

Based on analysis of 500+ implementations, success factors include strong executive sponsorship, comprehensive change management, proper data preparation, phased implementation approach, and continuous performance monitoring. Organizations that invest in team training and maintain clear communication throughout the implementation process achieve significantly better results than those that focus solely on technology deployment.

How do modern financial internal control systems handle data security and privacy?

Modern financial internal control systems incorporate bank-grade security measures, including encryption, multi-factor authentication, and role-based access controls. Cloud-based platforms often provide superior security compared to on-premises systems, with dedicated security teams, regular security updates, and compliance with industry standards such as SOC 2 and ISO 27001.