The Complete Guide to Financial Workflow Automation for SaaS: How to Reduce DSO and Scale Without Adding Finance Headcount

In most SaaS finance teams, the day doesn’t start with strategy. It starts with a queue: overdue invoices, renewal reminders, reconciliations from yesterday that never ended. Financial workflow automation is how leading B2B SaaS organizations are breaking that cycle.

Teams that deploy automated billing, collections, and cash-application workflows see 33-day DSO reductions, 75% cuts in bad debt, and 3x increases in collections productivity, often within 90 days.

This guide shows you what that transformation actually looks like

- what to automate

- how to implement it, and

- how to build a 90-day plan that scales ARR without scaling headcount.

Whether you’re running finance at $10M or $500M ARR, you’ll learn how to turn subscription revenue into steady, predictable cash.

Understanding the Challenge: Why SaaS Finance Is Different

Every day your finance team manually processes subscription invoices, chases renewal payments, and reconciles recurring charges, you're not just spending time, you're bleeding capital. For a SaaS company generating $50 million in annual revenue, even a modest 5% improvement in Days Sales Outstanding (DSO) unlocks over $685,000 in working capital currently trapped in accounts receivable.

But here's what makes SaaS fundamentally different from traditional businesses: a sale doesn't equal immediate cash. You incur customer acquisition costs upfront (sales commissions, marketing spend, and implementation costs), but collect revenue monthly over 12-36 months. A $100K annual contract paid monthly means you've invested $15K-$30K to acquire that customer, but only collect $8,333 in month one.

This structural gap creates a working capital deficit that worsens as you grow. Counterintuitively, faster growth means more cash consumption, not more cash generation. Without efficient collections and accurate forecasting, scaling becomes a cash management nightmare that automation can solve.

What is Financial Workflow Automation?

Financial workflow automation applies artificial intelligence and machine learning to streamline repetitive finance processes that traditionally required manual intervention. For SaaS companies specifically, this means automating the unique workflows around subscription billing, recurring revenue recognition, multi-year contract collections, and usage-based invoicing.

Rather than finance professionals manually sending renewal reminders, reconciling subscription payments, or building cash flow forecasts in spreadsheets, intelligent systems handle these tasks automatically while maintaining accuracy and compliance.

The scope extends across the entire quote-to-cash cycle:

- Subscription Billing Management: Automated invoice generation for monthly/annual subscriptions, mid-cycle upgrades/downgrades, proration calculations, and multi-year contract billing schedules

- Collections Optimization: AI-powered prioritization based on subscription tier and payment probability, with automated dunning campaigns tailored to customer segments

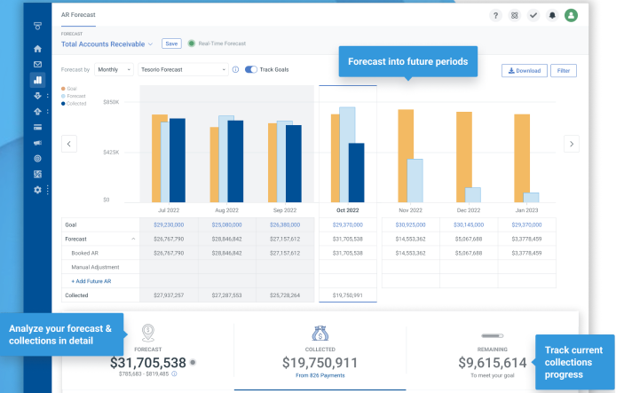

- Cash Flow Forecasting: Real-time visibility into expected cash inflows from renewals, expansion revenue, and new bookings based on historical subscription payment patterns

- Churn Impact Analysis: Continuous monitoring of payment behavior to identify at-risk customers before renewal dates

Why This Matters Now

Converging pressures are making 2025 the inflection point for SaaS finance automation:

The Cash Efficiency Imperative

The era of zero-interest-rate policy ended abruptly, and with it, the luxury of inefficient capital allocation. Working capital tied up in receivables now carries an explicit opportunity cost.

A company with $100M in annual revenue operating at energy sector benchmarks (58-day DSO) has an additional $5M+ tied up in receivables compared to financial services benchmarks (39-day DSO): capital that could fund growth initiatives or improve margins.

Research analyzing $80+ billion in receivables across ten major industries reveals performance gaps of 1.4x to 2.5x between top and bottom quartile organizations. This isn't an incremental difference but a structural competitive advantage.

AI Maturity and Proven ROI

Finance AI adoption reached a tipping point in 2025, with 59% of CFOs now using artificial intelligence in their finance functions, according to Gartner. This came from just 37% two years prior.

More significantly, 67% of these finance leaders report feeling more optimistic about AI than they did twelve months ago, with optimism strengthening as organizations gain hands-on experience.

The shift from experimentation to production deployment explains this confidence growth.

Reducing DSO Through AI-Powered Collections

Now, let's examine specific tactics for reducing Days Sales Outstanding, the metric representing working capital efficiency.

Tactic 1: Implement Predictive Payment Date Forecasting

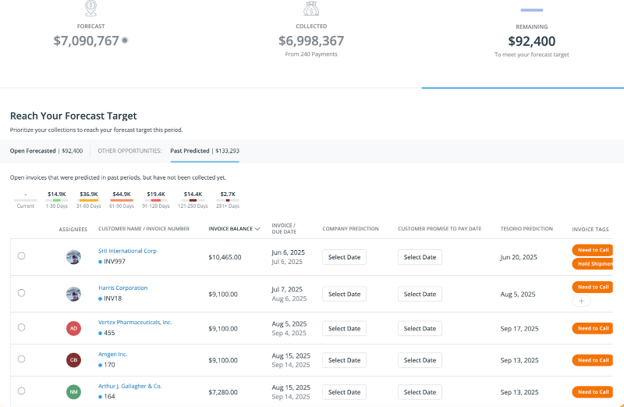

Traditional DSO management reactively chases overdue invoices. Predictive AI transforms this into proactive cash flow management by analyzing hundreds of variables: historical payment timing by customer and cohort, subscription tier and contract value, payment method, industry and company size, seasonal patterns, invoice amount relative to typical payments, auto-pay status, and geographic payment norms.

The AI doesn't just predict if customers will pay. It forecasts when with 90%+ accuracy for most customer cohorts.

A marketing analytics SaaS company implementing predictive payment intelligence across 700+ customers saw average days to collect decrease by 31%, achieved 67% current invoice status (significant aging prevention), and handled a 448% increase in invoice volume, demonstrating a platform's scalability without adding collections headcount.

Tactic 2: Optimize Dunning Campaigns by Customer Cohort

Generic "Your payment is overdue" emails damage relationships and deliver poor results. SaaS companies need nuanced communication strategies that respect the different needs of self-serve SMB customers ($500-$5K ACV), mid-market customers ($5K-$50K ACV), and enterprise customers ($50K+ ACV).

For SMB customers, automated sequences focus on efficiency: payment reminder with a one-click link at day 0, "payment failed" notification at day 3, service interruption warning at day 7, and final notice before suspension at day 15.

For enterprise customers, the approach emphasizes relationship preservation: renewal/payment process confirmation 30 days before due date, invoice delivery with account executive awareness at day 0, relationship-sensitive personal outreach at day 15, and coordinated account executive + finance engagement at day 30.

Effective dunning orchestrates multiple channels: email, in-app notifications, SMS for high-priority communications, phone calls for enterprise accounts, and account manager task assignments for relationship-sensitive situations, with personalization at scale impossible to achieve manually.

A cloud-based software implementing AI-powered customer segmentation and prioritization reduced time spent on lower-priority accounts from 25% of the week to under 2 hours weekly: a 90%+ time savings that freed the team to focus on high-value relationships. The approach delivered a 75% reduction in bad debt write-offs and a 50% reduction in 90-day aged accounts, demonstrating that appropriate collection intensity by customer tier improves both efficiency and outcomes.

Tactic 3: Create Real-Time Subscription Cash Flow Visibility

SaaS finance teams need fundamentally different forecasting than traditional businesses. Your cash flow comes from recurring revenue (monthly/annual subscriptions), expansion revenue (upsells, cross-sells), new bookings (sales pipeline converting), renewals (existing contracts expiring), and churn (customers canceling—negative cash impact).

Modern financial workflow automation integrates data from Salesforce (sales pipeline), ERP (invoicing and payments), subscription billing platforms (upcoming renewals), customer success platforms (health scores), and product analytics (usage patterns) to provide instant visibility into contracts renewing next 30/60/90 days, expansion opportunities, new bookings, and churn risk.

A NoSQL database company serving Fortune 500 customers transformed its cash flow forecasting from a 10-day manual spreadsheet process to instant, real-time dashboard access.

This real-time visibility fundamentally changed their decision-making speed: capital allocation decisions moved from days to hours, and the cash flow improvement enabled them to operate without raising capital for three years, despite doubling ARR.

The Reality Check: What Results to Expect

Understanding realistic expectations helps set appropriate goals and measure success. Results vary by company size, business model, and starting point, but consistent patterns emerge across hundreds of implementations.

Results by ARR Size

Actual outcomes vary by starting baseline, customer mix, industry, and implementation scope. Early-stage companies often see faster implementation timelines; larger enterprises require longer but achieve greater absolute dollar impact.

Results by Business Model

Different SaaS business models benefit from distinct automation priorities:

Self-Serve/SMB-Focused Models: High transaction volumes and small contract values make manual collections economically unviable. Automation enables 100% coverage: every invoice receives appropriate attention regardless of size. Failed payment recovery becomes critical, with intelligent retry logic preventing involuntary churn that manual processes miss.

Mid-Market Models: Renewal management complexity drives value. With annual contracts ranging $10K-$50K, missing a renewal creates a significant cash impact. Automated renewal workflows starting 60-90 days before expiration catch administrative oversights and budget approval delays that cause accidental churn.

Enterprise Models: Relationship preservation requires a segmented approach. Automation handles administrative tasks (payment reminders, method updates, tracking) while freeing relationship owners for strategic engagement. Multi-year contract billing automation prevents revenue recognition errors and accelerates month-end close.

Usage-Based Models: Billing complexity creates dispute risk and customer friction. Automated metering integration eliminates manual usage calculation, provides customer self-service visibility, and reduces billing cycle time from days to hours.

The Roadmap: Your 90-Day Path to Implementation

With a clear understanding of strategy, tactics, and expected results, the critical question becomes: how do you actually implement this? Successful transformations follow a structured, phased approach.

Phase 1: Assessment & Pilot Setup (Weeks 1-4)

The first two weeks focus on process discovery and baseline metrics. Map current order-to-cash workflow specifically for SaaS model, document pain points by frequency and impact, interview collections team and customer success about challenges, and establish baseline metrics: current DSO overall and by segment, collections productivity (ARR per FTE), bad debt and involuntary churn rates, time spent on various activities, close timeline breakdown, and failed payment volume and recovery rate.

Weeks 2-3 involve vendor selection based on SaaS-specific requirements: billing system integration (Stripe, Zuora, Chargebee), ERP and CRM integration, critical SaaS features, and evaluation criteria weighted toward SaaS expertise (30%), integration depth (25%), implementation support (20%), time to value (15%), and scalability (10%).

Weeks 3-4 focus on data preparation and pilot scope definition. Clean subscription data by standardizing customer records between systems, validating subscription data (active vs. canceled, correct MRR/ARR), cleaning payment methods, and reconciling mismatches. Choose pilot scope: typically collections automation for one segment (most common and highest impact), renewal management (high strategic value), or failed payment recovery (quickest win), with a 4-8 week pilot timeline and clear success metrics.

Phase 2: Pilot Implementation & Testing (Weeks 5-12)

Weeks 5-7 involve system configuration:

- connecting the automation platform to billing, ERP, and CRM

- configuring data synchronization

- setting up segmentation rules

- building the first automated workflow

- creating a pilot metrics dashboard, and

- establishing user permissions.

Testing validates three critical areas: system integration (data syncing correctly between billing, ERP, and CRM), workflow execution (segmentation identifying correct customers, campaigns triggering appropriately, emails displaying properly across devices), and user experience (payment links functioning seamlessly, dashboards showing accurate real-time data).

Weeks 7-8 focus on team training covering platform navigation, interpreting AI prioritization scores, when to follow automated workflows vs. manual intervention, handling exceptions and escalations, and reporting. Soft launch starts with 50-100 customers with close monitoring for two weeks and rapid adjustments based on real-world usage.

Weeks 9-12 involve full pilot deployment with 4-6 weeks of data collection as AI models learn from actual payment behavior. Track metrics weekly: DSO for pilot segment vs. baseline, collections team time allocation, customer feedback, payment timing improvements, and platform usage rates. Common adjustments include fine-tuning segmentation thresholds, adjusting dunning timing and messaging based on response rates, refining escalation rules, and optimizing dashboards.

End of week 12 requires pilot evaluation against the success criteria:

- Did DSO improve 10-20% for the pilot segment?

- Did the collections team save 30-50% time?

- Did customer satisfaction maintain or improve?

- Was platform adoption 80%+ daily usage?

Strong results warrant immediate Phase 3 scaled deployment. Conditional results suggest addressing specific issues before proceeding after 2-4 weeks. Significant issues require pause and reassessment.

If the pilot proves what it should, the remaining path is execution at scale: expanding automation across segments, tightening forecasting, modernizing collections, and connecting finance signals across the company.

What begins as a tactical efficiency project becomes a strategic advantage: stronger cash flow, faster closes, tighter renewal cycles, and a finance team capable of supporting 2–3x ARR without growing headcount.

In a market defined by capital constraints and efficiency benchmarks, this is no longer optional. It’s the operating model high-performing SaaS companies are already shifting toward.

Next Steps

If you’re ready to move from uncertainty to control, from chasing payments to anticipating them, this is where that shift begins.

Request a SaaS Finance Demo

Watch how automated collections, renewals, and forecasting work when everything is connected end-to-end.

Access the 2025 SaaS AR Benchmark Report

Benchmark your finance performance against hundreds of subscription businesses.

Run Your Cash Impact Model

Estimate the DSO reduction, working capital unlocked, and productivity lift your team can achieve.

See how this plays out in real teams: 200+ verified G2 reviews (4.7/5) consistently highlight cleaner revenue recognition, fewer surprises, and dramatically fewer exceptions to chase.