The Complete Guide to AI-Powered Revenue Control Systems in 2025

The Cash Flow Crisis Hiding in Plain Sight

You finish the quarter and the numbers look fine…until you dig into receivables. Cash that should be in the bank is still stuck in limbo. Meanwhile, every other function has leveled up: sales is closing faster with AI, marketing is automating customer journeys, but finance is still chasing invoices with processes that haven’t changed since 2015.

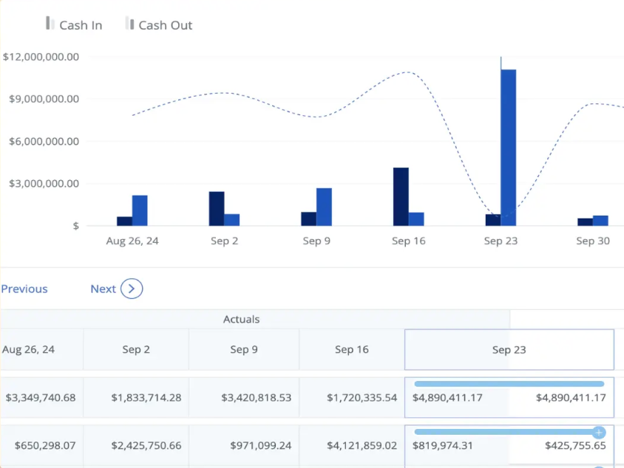

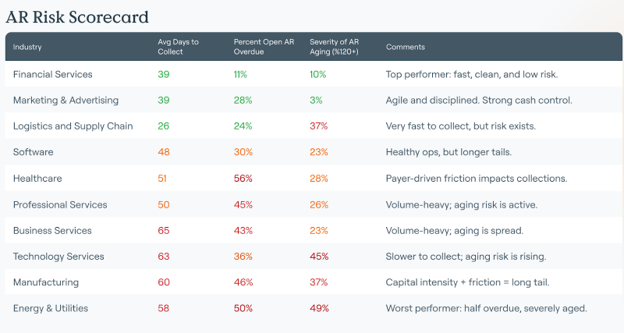

The cost is staggering. Across $80+ billion in receivables analyzed in our 2025 AR Benchmark Report, we've seen industries where half of AR is overdue. Even the strongest performers still see 11% unpaid. The real dividing line isn’t sector, but whether companies have modernized cash flow management with revenue control systems.

Leaders have already made the shift from reactive tracking (“who owes what”) to proactive revenue control (“when and how to get paid”). And the gap between them and laggards is widening every quarter.

In this guide, you’ll learn:

- What separates Revenue Control Systems from traditional AR management

- How AI-powered forecasting, risk scoring, and entity graph intelligence actually work in practice

- Benchmarks from $80B+ in receivables showing where your industry stands today

- Proven frameworks and case studies that cut DSO and scaled collections without extra headcount

- A step-by-step roadmap to implement and measure a Revenue Control System in your organization

By the end, you’ll see why finance leaders treating revenue control as a strategy (not a back-office hygiene) are pulling ahead, and how you can follow the same path in 2025.

Understanding Revenue Control Systems: Beyond Traditional AR Management

Traditional AR management is like checking the weather after the storm has already hit. A revenue control system is the radar that shows what’s coming and helps you prepare.

The difference shows up in five areas:

Connected Operations: ERP, CRM, and payment platforms integrate into a single source of truth, giving finance teams a consolidated view of every customer account.

Predictive Intelligence: Machine learning models surface likely payment dates and highlight potential delays before they show up in aging reports.

Automated Decisions: Instead of flagging issues for manual follow-up, the system executes workflows like tailored reminders or escalations based on customer behavior.

Real-Time Forecasting: Cash flow projections update continuously, not just at month-end. This way, strategic decisions can be made based on current payment trends, not stale data.

Relationship Intelligence: Entity Graphs map complex webs of subsidiaries, decision-makers, and payment patterns, showing how cash moves across organizations.

These five areas altogether show organizations moving from traditional AR to comprehensive revenue control systems with measurable results. Customer data from our platform shows an average DSO reduction of 33 days and collections productivity increases of 3x.

The AI Revolution in Revenue Control

Behind every number improvement is a company that had to break old habits and rebuild its approach. AI in revenue control isn't an incremental improvement. It's a complete reimagining of financial operations.

AI-powered revenue control systems learn from payment patterns, customer behavior, and market conditions, then make intelligent decisions at scale that no finance team could realistically cover.

These are the four critical advantages:

- Payment Prediction: Machine learning models analyze customer history, industry trends, and economic indicators to forecast likely payment dates. This allows finance teams to move from reactive collections to proactive cash flow management.

- Dynamic Risk Assessment: Instead of relying on static credit scores, AI continuously updates customer risk profiles as conditions shift. Collection strategies can be adjusted in real time to reflect changes in payment behavior or market signals.

- Optimal Timing Intelligence: AI models identify when outreach is most likely to result in payment, balancing probability of success with relationship considerations. This shifts collection timing from judgment calls to data-backed decisions.

- Intelligent Segmentation: Customers are grouped automatically by payment patterns, enabling differentiated workflows. High-risk accounts can be escalated quickly, while reliable payers are managed with lighter-touch processes at scale.

Real-World AI Success:

Currencycloud's Transformation

Currencycloud processed $50+ billion in cross-border payments. Manual collections couldn't scale with growth.

Finance manager Victoria Vetrova spent two full days a week chasing payments. Their ERP dunning module was "a nightmare" that wasn't flexible and sometimes wouldn't work.

After implementing AI-powered revenue control:

- 60% cash collections increase (six months, no additional headcount)

- 15% reduction in average time-to-payment

- 75% reduction in dunning campaign time

- Customer relationships actually improved through personalized communication

Now, she spends half a day on high-priority clients instead of two days chasing routine payments. The shift illustrates how AI takes over repetitive work, freeing finance teams to focus where their expertise matters most.

Couchbase’s Transformation

Couchbase was hitting a ceiling: collection headcount grew in lockstep with revenue, and manual forecasting took 10 days, which was too slow for strategic decisions.

After adopting a revenue control system, they had:

- 100% ARR growth without expanding the collections team

- Forecasting cycle shortened from 10 days to hours

- DSO/DPO ratio improved from negative to parity

According to their CFO, Greg Henry, the improved cash flow position allowed Couchbase to operate for three years without raising additional capital. This is proof that revenue control has shifted from a back-office function to a source of strategic flexibility.

Veeva Systems’ Transformation

Veeva Systems faced a challenge familiar to many B2B finance teams: too much time was being spent on lower-priority accounts, while high-value relationships weren’t receiving enough attention.

After implementing a revenue control system, they achieved:

- 50% reduction in 90-day aged accounts

- Time on lower-priority accounts cut from 25% of the week to under 2 hours

- Improved focus on high-value customer relationships

- Greater overall team productivity

By redirecting routine follow-ups and freeing capacity, the collections team was able to concentrate its expertise where it had the most impact.

Industry Performance Patterns

Our analysis of $80+ billion in receivables exposes a troubling reality for finance executives: the gap between operational leaders and laggards isn't narrowing but accelerating.

Market Leaders with High AI Adoption Industries (Financial Services, Marketing):

- Days to Collect: 39 days

- Overdue AR: 11-28%

- Severely Aged AR: 3-10%

Operational Laggards with Low AI Adoption Industries (Energy, Healthcare, Manufacturing):

- Days to Collect: 51-65 days

- Overdue AR: 43-56%

- Severely Aged AR: 28-49%

This isn't about operational efficiency tweaks. Companies in the bottom quartile are essentially operating with 2x longer cash conversion cycles while carrying 4x the bad debt risk.

In today's capital environment, it's an existential threat to growth financing and market positioning.

Advanced Intelligence: Entity Graph Intelligence in Action

The case studies above show how AI improves forecasting, risk scoring, and collections efficiency. But the next frontier goes deeper: understanding the complex webs of relationships that influence when and how payments are made.

This is where entity graph intelligence comes in. Rather than just automating collections, it uncovers how decisions ripple across parent companies, subsidiaries, and networks of stakeholders. That insight allows finance teams to prioritize accounts with the greatest strategic impact, which captures four dimensions of payment behavior:

- Organizational Hierarchies: Mapping how parent companies, subsidiaries, and related entities influence payment decisions.

- Payment Pattern Correlations: Identifying how payment habits in one entity affect others across the same ecosystem.

- Decision-Maker Networks: Pinpointing which stakeholders have real authority over payment timing, so outreach reaches the right person.

- Risk Propagation Models: Detecting how financial stress in one part of the network spreads to others, enabling proactive intervention.

Instead of asking only “who owes what?”, this approach reveals “who influences payment, and how the decision flows across organizations.” It turns collections from a transactional process into a strategic capability.

Proven Strategies: How to Reduce DSO with AI

Understanding benchmarks is valuable. The question now is, how do you move from laggard to leader?

Based on customer implementations across our platform, successful DSO reduction needs a systematic approach addressing root causes, not symptoms.

A Three-Phase Framework

The most effective organizations reduce DSO by following a phased journey that starts with clarity, moves into targeted deployment, and matures into continuous improvement:

Phase 1: Diagnostic Analysis

Transformation begins with understanding the baseline. Finance teams map their current collections process, analyze historical payment patterns, and identify the causes of delay. Customers are segmented by payment behavior and risk profile, and key metrics are established to measure progress.

Phase 2: Predictive Implementation

Once the baseline is clear, AI capabilities are deployed where they have the highest leverage. Algorithms predict payment dates, risk scoring helps prioritize accounts, and personalized workflows adapt to each customer segment. Real-time monitoring ensures potential issues are flagged before invoices age.

Phase 3: Optimization and Scale

Over time, the system improves itself. AI models are refined with new data, automation expands into more processes, and insights are integrated across broader financial operations. What begins as efficiency gains evolves into a strategic advantage that scales with the business.

Three Essential AR Automation Strategies

Across industries, four approaches consistently deliver the highest ROI:

Intelligent Customer Segmentation

Not all customers behave the same. Machine learning creates dynamic segments that evolve as payment behavior changes, enabling more targeted and effective collection strategies. In practice, this kind of segmentation has been shown to dramatically improve accuracy and efficiency.

For example, JP Morgan’s research on AI in treasury management found that AI-driven forecasting models can reduce error rates by up to 50% compared to traditional approaches. This is evidence of how segmentation and prediction together sharpen financial decision-making at scale.

Automated Escalation Workflows

Intelligent escalation paths adjust automatically based on customer response and payment behavior. Workflows move from automated reminders to personal outreach depending on engagement history, reducing manual effort while keeping the customer experience personalized.

Broader research on enterprise automation reinforces the impact: a Forrester study commissioned by Microsoft found that employees handling high-volume, repetitive tasks saved 200-450 hours per year through process automation, alongside a 20% reduction in development time. In collections, this translates into leaner workloads for finance teams and faster resolution of overdue accounts.

Real-Time Risk Monitoring

Continuous monitoring of customer financial health and payment patterns allows risks to be identified before they affect collections. Dynamic risk scores trigger proactive interventions, reducing exposure to bad debt.

Academic research supports this approach: a multi-institutional study published in GSC Advanced Research Reviews found that real-time monitoring systems improved credit risk assessment accuracy by 25% and reduced fraud incidents by 35%. In accounts receivable, the same principles apply: continuous visibility enables earlier interventions and stronger protection against loss.

Implementation Roadmap: Building Your Revenue Control System

Designing a revenue control system isn’t only a technology decision. It requires sequencing the right steps so adoption is smooth and results are measurable. The most effective implementations follow a roadmap that begins with assessment, moves through integration, and anchors progress with clear performance targets.

Getting Started: Assessment and Planning

Every successful revenue control system implementation begins with a clear-eyed assessment of the current state. The goal isn’t to catalogue failures, but to surface opportunities and establish a reliable baseline for measuring progress.

This stage involves a comprehensive review of collection processes, technology infrastructure, and performance metrics. Typical areas of focus include: current DSO and aging distribution, collections team productivity and time allocation, integration between existing systems, segmentation and communication strategies, and the accuracy and timeliness of cash flow forecasting.

With the baseline established, leadership can set measurable objectives grounded in real-world benchmarks. Verified customer outcomes from our platform show: an average DSO reduction of 33 days, 3x improvements in collections productivity, and up to 50% reduction in severely aged receivables. Additional improvements in payment prediction accuracy and forecasting capabilities vary by implementation.

Technology Selection and Integration

Once goals are defined, the next step is selecting a platform that can support them. A modern revenue control system should integrate seamlessly with core systems like ERP, CRM, and payment processors, while providing comprehensive automation capabilities. Critical features typically include AI-powered payment prediction and risk scoring, automated workflows with built-in personalization, real-time cash flow forecasting, relationship intelligence, and open APIs for smooth connectivity with existing infrastructure.

Equally important is the integration strategy. Successful implementations plan for clean data flows between systems, eliminating manual entry and ensuring that information is accurate in real time. In practice, most organizations achieve full integration quickly, giving finance teams faster access to insights without disrupting day-to-day operations

Finally, external validation helps build confidence. For example, independent G2 reviews show Tesorio maintaining a 4.7/5 rating with 98% customer retention, with over 200 users citing ease of implementation and measurable ROI as standout benefits.

Change Management and Performance Monitoring

Even the best technology won’t deliver results without organizational alignment. Successful implementations start by securing leadership support and setting clear expectations around goals, timelines, and outcomes. Communicating that automation is designed to enhance, not replace, finance expertise that helps build trust and buy-in across the team.

Training is another critical step to collaborating effectively. Teams need hands-on guidance with new workflows, reporting tools, and AI-driven insights, with the emphasis placed on how automation frees them to focus on high-value activities rather than routine tasks.

Finally, performance monitoring ensures the system continues to deliver. Regular review cycles track progress against baseline metrics, highlight opportunities for optimization, and reinforce early wins. Customer implementations typically show meaningful improvements quickly, creating momentum for long-term adoption.

Your Path Forward: From Understanding to Action

Across $80+ billion in receivables we’ve implemented in our platform, one pattern stands out: companies that implement comprehensive revenue control systems achieve stronger cash flow, higher efficiency, and a sharper competitive edge. While some industries still face overdue rates of 50%, leaders have reduced that figure to 11%.

Case studies make the difference tangible. Couchbase scaled without raising capital for three years by relying on improved cash flow. Currencycloud increased collections by 60% without adding headcount. Both show how finance teams can move beyond manual processes and treat revenue control as a growth lever, not just a back-office function.

Independent research also reinforces this point. Gartner’s study found that outsourced, AI-enabled approaches accelerate automation from 36 months down to just 12 months, with measurable P&L savings in the first year. Together, these findings highlight a simple truth: companies that commit to structured, tech-enabled change move faster, capture benefits earlier, and position themselves more competitively.

Your Next Steps

The most successful implementations follow a deliberate sequence: assess the current state, quantify the opportunity, select the right platform, and execute with discipline. Companies that rush or skip steps often struggle with adoption and leave value on the table.

Size the upside: Use our interactive ROI calculator to forecast improvements in DSO, working capital, and team productivity. On average, mid-market companies can unlock $2-5 million in working capital within the first year.

See it in action: Book a personalized demo to connect your AR challenges directly to the platform. Our team will map your collection scenarios, integration needs, and reporting requirements against proven workflows.

Experience it yourself: Test drive the platform in our interactive sandbox with no commitment required. Experiment with collections workflows, real-time forecasting, and customer communication tools that are already transforming finance operations.

The question is no longer if but when. Each day of delay leaves cash tied up in receivables, drains productivity, and strengthens more agile competitors.

Revenue control has become a strategic capability. Acting now ensures cash flow fuels growth rather than constrains it.

Frequently Asked Questions

How long does revenue control system implementation take?

Most organizations achieve full deployment within 30-60 days, with initial results often visible in the first month. The exact timeline depends on system complexity and integration requirements, but modern platforms are designed for rapid rollout.

What ROI can I expect from AI-Powered Revenue Control Systems?

Customer data shows typical outcomes of a 20–35% reduction in DSO, a 2–3x increase in collections productivity, and significant improvements in working capital. Many companies unlock millions in cash flow within the first year of implementation.

Will automation harm customer relationships?

Quite the opposite. Properly implemented revenue control systems improve relationships by enabling personalized communication, consistent follow-up, and reduced payment friction. Customers value clarity and flexibility, and automation makes both easier to deliver.

How accurate are AI payment predictions?

Modern AI models regularly achieve 85%+ accuracy in predicting payment dates by analyzing historical patterns, customer behavior, and external signals. Accuracy improves continuously as the system learns from new data.

What industries benefit most from Revenue Control Systems?

While all industries see gains, the largest impact comes in sectors with complex customer relationships, high transaction volumes, or reliance on manual processes. B2B companies with recurring revenue models often achieve the fastest ROI.