The Complete Guide to Accounts Receivable Automation: From Basic Tools to Agentic AR Experience

You close the books, revenue looks healthy, but something’s off. Cash that should already be in the bank is sitting in limbo: buried in overdue receivables, customer disputes, or billing errors that no dashboard alert caught in time.

In many sectors, over 25% of receivables age beyond 120 days, and once that happens, recovery rates sink to 20-30%. The leak isn’t just operational but structural. Every small inefficiency compounds into a major working capital drag that limits growth, funding flexibility, and investor confidence.

Meanwhile, the AR automation market is set to reach $4.27 billion, yet most finance teams are still chasing payments manually, reconciling spreadsheets, and patching disconnected systems. The tools exist, but the transformation hasn’t caught up.

This guide breaks down what separates teams that automate tasks from those that automate outcomes.

You’ll learn:

- How AR workflow engines orchestrate collections end-to-end with intelligent prioritization, dynamic routing, and real-time risk assessment

- What defines the emerging Agentic AR Experience, where AI agents negotiate, predict, and self-optimize without manual intervention

- The architecture of connected AR systems that eliminates silos between ERP, CRM, and cash flow forecasting tools

- Real-world case studies: from Couchbase to Currencycloud showing verified results with 33-day DSO reductions, 3x collections productivity, and $200M in working capital unlocked

- A four-phase implementation roadmap used by enterprises to go live in under 90 days

Drawing from Tesorio’s orchestration of $80B+ in receivables and verified customer implementations, this guide is what top-performing finance teams are doing right now to build intelligent, self-improving cash flow systems.

By the end, you’ll know how to evolve from reactive collections to an autonomous, agentic AR ecosystem that predicts outcomes, preserves relationships, and scales with precision.

Understanding Accounts Receivable Automation: Beyond Basic Task Management

Accounts receivable automation represents the strategic use of technology to streamline, optimize, and intelligently manage the entire cash collection process. Unlike traditional manual approaches that rely on spreadsheets and individual effort, modern accounts receivable automation creates connected workflows that span from invoice generation through cash application.

The evolution has been remarkable. Early AR tools focused on basic task automation: sending reminder emails or generating reports. Meanwhile, today's connected financial operations platforms integrate AI-powered insights, predictive analytics, and autonomous decision-making capabilities that transform how finance teams approach cash flow management.

According to CFO.com's recent analysis, tracking total cost to process accounts receivable per $1,000 in revenue can translate into significant time and money savings for enterprise organizations. This metric-driven approach aligns with modern accounts receivable automation strategies that prioritize measurable outcomes over feature lists.

The Real Cost of Manual Processes

To understand why accounts receivable automation has become essential, consider the hidden costs of manual AR management. Beyond the obvious time drain, manual processes create cascading inefficiencies that impact the entire organization.

Victoria Vetrova, Finance Manager at Currencycloud, experienced this challenge firsthand. Previously spending two full days weekly on collection activities, she struggled with the time-intensive nature of manual follow-ups and customer communications. After implementing an accounts receivable automation platform, she now dedicates just half a day to high-priority client management while achieving superior results: 60% increase in cash collections within six months, 15% reduction in average time-to-payment, 75% reduction in time spent on dunning campaigns, and 200% improvement in AR efficiency.

This transformation illustrates why leading organizations are moving beyond basic automation to embrace more sophisticated solutions.

The Architecture of Modern Collections: AR Workflow Engines

As organizations outgrow basic accounts receivable automation tools, they discover the limitations of simple task automation. This realization leads to the next evolution: AR workflow engines that orchestrate complex, multi-step processes, adapting to customer behavior, payment history, and risk profiles.

AR workflow engines represent a fundamental shift from reactive to proactive collections management. Unlike simple automation tools that handle individual tasks, these sophisticated systems create dynamic workflows that automatically adjust collection strategies based on real-time data. For example, an AR workflow engine might recognize that a customer typically pays within 45 days and adjust communication cadence accordingly, while flagging accounts that deviate from historical patterns for immediate attention.

How AR Workflow Engines Transform Collections Operations

The power of AR workflow engines lies in their ability to combine multiple capabilities into a cohesive system:

Intelligent Routing and Prioritization ensures that high-value accounts with strong payment history receive different treatment than new customers or those showing risk indicators. Modern AR workflow engines use AI to automatically route accounts to the most appropriate collection strategy, maximizing efficiency while maintaining customer relationships.

Dynamic Communication Orchestration moves beyond generic reminder emails to personalized communication based on customer preferences, payment behavior, and relationship history. This approach maintains positive customer relationships while accelerating cash collection through targeted accounts receivable automation.

Risk-Based Decision Making enables AR workflow engines to continuously assess account risk using multiple data points: payment history, credit scores, industry trends, and economic indicators, making intelligent decisions about collection intensity and resource allocation.

The impact can be dramatic. Michael Renner, former Senior AR & Collections Manager at Veeva Systems, experienced this transformation firsthand. His team reduced time spent on lower-priority accounts from 25% of their weekly schedule to less than two hours per week, demonstrating the power of intelligent AR workflow engines to focus human effort where it matters most.

Integration-First Architecture

Enterprise AR workflow engines seamlessly connect with existing ERP systems, CRM platforms, and banking infrastructure to create a unified view of customer relationships and financial data. This integration eliminates data silos and enables more strategic decision-making across the entire financial operations ecosystem.

The technical sophistication of modern AR workflow engines enables them to process thousands of customer interactions simultaneously, using machine learning algorithms to analyze payment patterns and forecast behavior with high accuracy. This predictive capability allows finance teams to proactively address potential issues before they impact cash flow.

The Next Frontier: Agentic AR Experience

While AR workflow engines represent a significant advancement over basic accounts receivable automation, the cutting edge of financial operations technology lies in agentic AR experience systems. These platforms transcend traditional rule-based automation by deploying AI agents that can make autonomous decisions, learn from outcomes, and continuously optimize collection strategies without human intervention.

The agentic AR experience represents a paradigm shift in how organizations approach collections. These AI agents operate with a sophisticated understanding of customer behavior patterns, market conditions, and business objectives. They can negotiate payment terms, adjust collection strategies in real-time, and even predict which accounts are likely to become problematic before issues arise.

The Technology Behind Agentic AR Experience

Agentic AR experience systems are built on large language models trained on extensive financial transaction data and customer interactions. This training enables them to understand context, maintain relationship awareness, and make nuanced decisions that balance collection efficiency with customer satisfaction: capabilities that extend far beyond traditional accounts receivable automation.

Autonomous Decision-Making allows AI agents in an agentic AR experience to evaluate account status, assess risk factors, and determine optimal collection actions without waiting for human approval. This capability dramatically reduces response times and improves collection efficiency beyond what's possible with conventional approaches.

Predictive Intervention enables agentic AR experience systems to predict which customers are likely to pay late and proactively adjust communication strategies to prevent aging, rather than simply reacting to overdue accounts.

Continuous Learning and Optimization means that each interaction provides data to improve future performance. Agentic AR experience systems learn which communication approaches work best for different customer segments and continuously refine their strategies.

Relationship-Aware Collections represent perhaps the most sophisticated capability, where advanced AI agents understand the broader customer relationship, balancing collection efficiency with customer satisfaction to maintain long-term business value through intelligent accounts receivable automation.

Industry Performance: Understanding Where You Stand

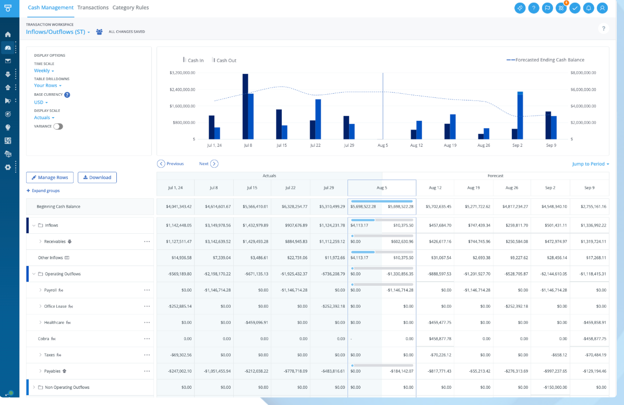

To appreciate the impact of advanced accounts receivable automation, it's essential to understand current industry performance variations. Comprehensive analysis across $80B+ in receivables reveals significant differences in receivables management effectiveness across sectors, with top-performing industries maintaining average days to collect (ADC) that are significantly shorter than lower-performing ones.

Financial services typically lead with strong AR performance, maintaining shorter collection periods and lower overdue percentages. Technology companies often achieve good performance due to subscription models and automated billing systems. However, other industries face varying challenges based on payment patterns and customer relationships, making accounts receivable automation particularly valuable for improvement.

Real-World Transformation: Couchbase's Success Story

Greg Henry, CFO at Couchbase, exemplifies how strategic accounts receivable automation implementation can transform business outcomes. His team achieved remarkable results: reduced DSO by 10 days, doubled collections per analyst over two years, cut cash flow forecast build time from 10 days to hours, and improved DSO/DPO ratio from negative to parity.

The business impact extended beyond operational efficiency. Henry noted that Couchbase hasn't raised capital in three years due to improved cash flow performance through accounts receivable automation, allowing the company to operate sustainably on generated revenue. He emphasized the critical importance of the platform to their financial operations, comparing its necessity to essential business tools.

This transformation illustrates how different industries can leverage accounts receivable automation to address their specific challenges:

Technology and SaaS Companies benefit from automated subscription billing and predictive analytics, though enterprise software companies with complex contracts often struggle with longer collection cycles without proper automation.

Manufacturing and Distribution face unique challenges with seasonal payment patterns and complex supply chain relationships, making AR workflow engines that account for industry-specific payment cycles particularly valuable.

Professional Services often struggle with project-based billing and scope disputes, where agentic AR experience systems excel by maintaining context about project status and client relationships.

Strategic Implementation: Moving Beyond Point Solutions

Understanding the technology is only the beginning. The most successful accounts receivable automation implementations take a connected approach rather than deploying isolated tools. Connected financial operations platforms integrate receivables management with cash flow forecasting, working capital optimization, and broader financial planning processes.

The Connected Advantage

This integration provides several critical advantages that isolated tools cannot deliver:

- Real-time visibility into the cash flow impact of collection decisions

- Coordinated strategies across all financial operations

- Reduced data silos and improved decision-making

- Streamlined reporting and compliance processes

The connected approach also enables the 30-day implementation advantage that sets modern platforms apart. While traditional accounts receivable automation projects often require six months or more, connected platforms can deliver value within 30 days through pre-built integrations with major ERP and CRM systems, configurable AR workflow engines that adapt to existing processes, AI models trained on extensive receivables data, and dedicated implementation support.

Implementation Roadmap: Your Path to Success

Understanding the technology and benefits of accounts receivable automation is just the beginning. Successful implementation requires a strategic approach that addresses both technical and organizational considerations.

Phase 1: Assessment and Planning (Days 1-7)

Begin with a comprehensive assessment of current AR processes and performance metrics. This includes analyzing existing systems, identifying integration requirements, and establishing baseline measurements for DSO, aging accounts, and team productivity. Successful accounts receivable automation implementations start with a clear understanding of the current state and desired outcomes.

Phase 2: Platform Selection and Configuration (Days 8-21)

Choose between basic accounts receivable automation, AR workflow engines, or an agentic AR experience based on organizational needs and maturity. Configure the platform according to business requirements, establish ERP and CRM system integrations, design workflows and approval processes, and implement user access controls and security measures.

Phase 3: Testing and Training (Days 22-28)

Conduct comprehensive user acceptance testing with finance team members, implement training programs for all system users, develop process documentation and standard operating procedures, and prepare go-live plans with contingency measures. This phase ensures smooth adoption of accounts receivable automation capabilities.

Phase 4: Launch and Optimization (Days 29-90)

Deploy the production system with monitoring and support, track performance against baseline metrics, continuously optimize based on user feedback and system learning, and gradually roll out advanced features, including AR workflow engines and agentic AR experience capabilities.

Ongoing Success Factors

Successful accounts receivable automation requires ongoing attention to change management, data quality, system optimization, and performance measurement. Organizations that treat implementation as an ongoing journey rather than a one-time project achieve the best results.

The Future of Financial Operations Starts Today

The transformation from manual accounts receivable processes to intelligent, connected financial operations represents one of the most significant opportunities available to modern finance teams. The evidence is overwhelming: organizations implementing comprehensive accounts receivable automation achieve dramatic improvements in cash flow performance, team productivity, and customer satisfaction.

The journey from basic task automation to AR workflow engines and ultimately agentic AR experience reflects the broader evolution of financial operations toward predictive, autonomous systems that enhance human capabilities rather than simply replacing manual tasks.

The question facing finance leaders isn't whether to embrace accounts receivable automation, but how quickly they can implement connected solutions that deliver measurable results that will establish sustainable competitive advantages that compound over time.

Ready to transform your cash flow performance? Discover how Tesorio's Connected Financial Operations Platform can deliver the understanding, control, and predictability your organization needs to thrive in an increasingly complex business environment.

- Download the Tesorio 2025 AR Benchmark Report - Benchmark your metrics against industry leaders and uncover where the biggest cash flow gains lie.

- Explore Customer Success Stories - See verified results from organizations that modernized their receivables with workflow engines and AI-driven automation.

- Calculate your upside with the ROI Assessment Tool - Forecast potential DSO reduction, productivity improvements, and working capital impact.

- Schedule a Personalized Demo - Map your current AR challenges against proven automation frameworks, from AR workflow engines to agentic AR experience.

Frequently Asked Questions About Accounts Receivable Automation

What's the difference between basic accounts receivable automation and AR workflow engines?

Basic accounts receivable automation handles individual tasks like sending reminder emails or generating reports. AR workflow engines orchestrate complex, multi-step processes that adapt based on customer behavior and risk profiles.

They provide intelligent routing, dynamic communication, and risk-based decision making that can reduce manual effort by up to 90%, as demonstrated in verified customer case studies. The difference is between automating tasks versus automating entire processes.

How quickly can companies see results from accounts receivable automation implementation?

With connected financial operations platforms, companies typically see initial results within 30 days, including improved collection efficiency and reduced manual effort. Full optimization usually occurs within 90 days as AI models learn customer patterns and workflows mature.

Multiple customer testimonials document measurable results from accounts receivable automation within the first month, contrasting sharply with traditional implementations that can take six months or more to show value.

What makes an agentic AR experience different from traditional automation?

Agentic AR experience uses AI agents that can make autonomous decisions, learn from outcomes, and continuously optimize strategies without human intervention. Unlike rule-based accounts receivable automation, agentic AR experience systems adapt to changing conditions and make intelligent decisions based on multiple data sources, including customer relationship context and market conditions. They represent the evolution from reactive automation to proactive, intelligent financial operations.