How to Connect Your Finance Data for Real-Time Visibility and Control

Finance teams today rely on a wide range of tools, from ERP systems and CRMs to billing platforms and payment processors. But when these systems operate in silos, teams struggle with delayed reporting, unclear cash visibility, and manual handoffs. Inconsistent data leads to inconsistent decisions.

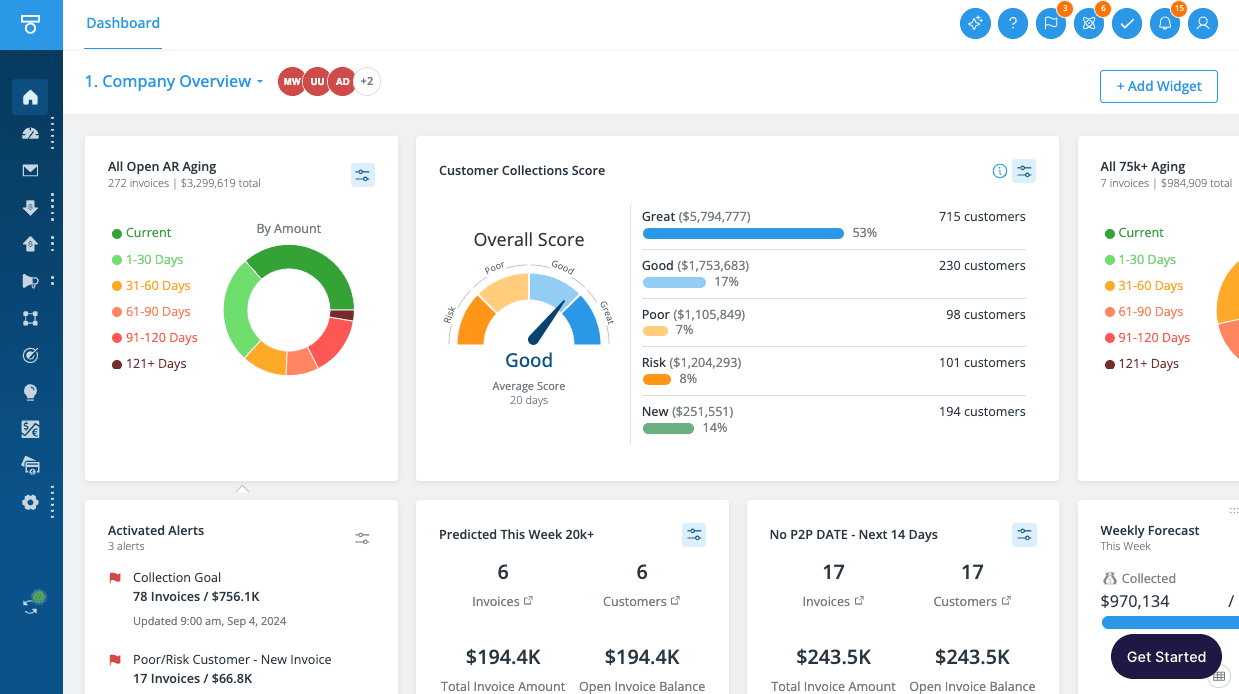

Tesorio solves this problem by acting as the connective layer across your financial tech stack. As the Connected Finance Operations platform, Tesorio consolidates ERP data and surfaces actionable insights across collections, forecasting, and cash flow. It helps finance teams unlock automation, improve team coordination, and drive confident financial decision-making from one unified source of truth.

In this guide, we break down how to connect your finance systems to Tesorio using ERP integration and platform-wide connectivity, and why it matters for your operations.

How Integrations Help Reduce DSO and Improve Cash Flow

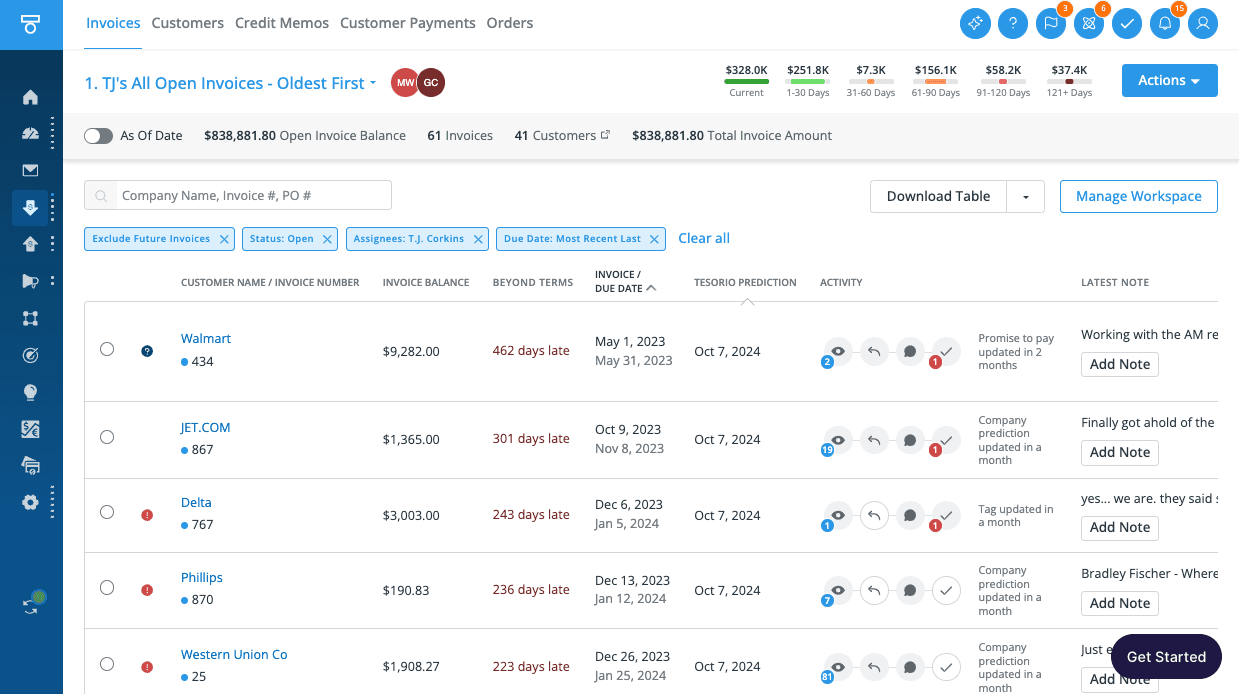

Disconnected systems slow down collections, forecasting, and decision-making. When your ERP, CRM, billing platform, and payments systems don’t speak the same language, the finance team ends up patching data together manually, delaying action and increasing DSO.

Tesorio changes that by unifying your financial data, so workflows like invoice reminders, forecast updates, and payment tracking happen automatically and in real time.

DSO Impact from Integrations:

- Stripe integration enables one-click payments, reducing friction and payment delays.

- Salesforce sync gives AR teams visibility into account health and sales risk.

- ERP integration (NetSuite, Oracle, Workday) provides daily invoice and payment updates for accurate collections campaigns.

When your data is integrated, follow-ups happen sooner, payments are tracked more closely, and high-risk accounts get flagged before they impact cash.

Step 1: Start with ERP Integration for Clean, Centralized Data

Your ERP is the system of record for financial operations. It holds the data that powers invoices, payment status, GL balances, vendor timelines, and more. But without real-time visibility or automation, ERP data alone can’t drive performance.

Tesorio enhances your ERP by connecting directly to the data that matters most—and making it visible, actionable, and dynamic.

Best Practices:

- Connect ERPs like NetSuite, Oracle, Workday, or Sage Intacct using prebuilt connectors.

- Sync open invoices, customer payment history, vendor obligations, and bank feed data.

- Use this data to automate collections campaigns, update rolling forecasts, and manage cash with precision.

Why It Matters: Your ERP holds the data. Tesorio makes that data usable—in real time. Instead of exporting spreadsheets or chasing updates across systems, your team works from a centralized cash performance workspace.

Step 2: Visualize the Value of Seamless Integrations

Tesorio doesn’t just stop at ERP. It connects across your broader finance stack to unify workflows and improve visibility.

From payment processors to CRMs and beyond, our ecosystem of integrations unlocks powerful cross-functional collaboration.

Examples of Integrations:

- ERP: NetSuite, Oracle, Sage Intacct, Workday

- Payments: Stripe (embed one-click payment links into automated emails)

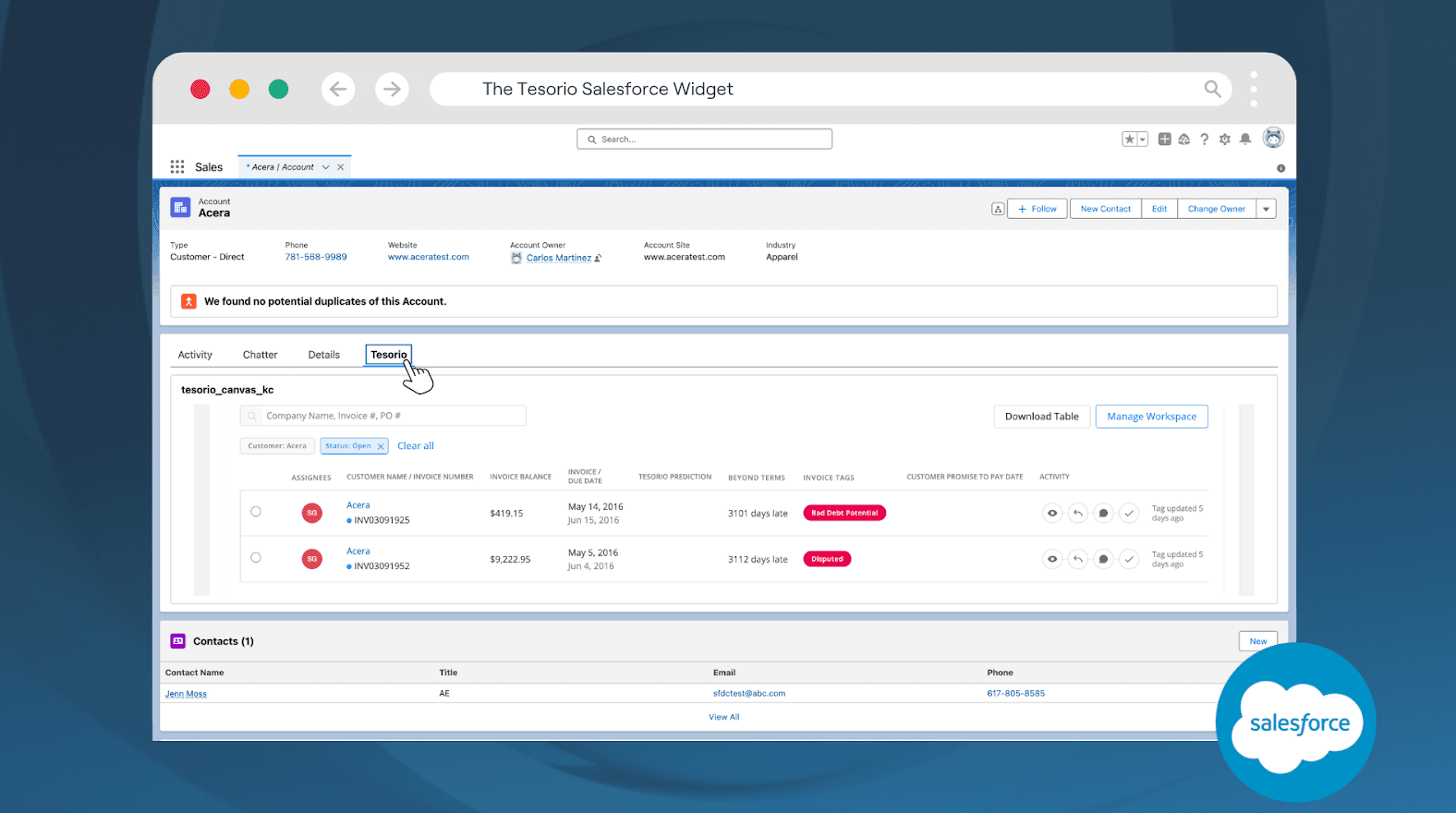

- CRM: Salesforce (sync AR and collections data with account records)

- Collaboration Tools: Slack (alerts for payment delays, risk accounts)

- Authentication: SAML 2.0 SSO providers like Okta, OneLogin, Azure

Why It Matters: Tesorio helps you break down silos by bringing your most critical financial systems together. Sales can see payment history, customer success can respond to risk proactively, and AR can operate at scale, without duplicating work or chasing down data.

Step 3: Turn Connected Data into Cash Flow Impact

Once your ERP is connected and integrated systems are flowing, Tesorio provides more than just data visibility—it delivers real outcomes.

Benefits for Finance Teams:

- Build real-time 13-week cash forecasts informed by ERP and collections data.

- Reduce DSO by automating follow-ups and enabling customers to pay via Stripe.

- Surface at-risk accounts and missed payment trends for early intervention.

- Align AR, FP&A, and Treasury using one platform with a shared data foundation.

Why It Matters: Data isn’t helpful unless it drives results. Tesorio turns static ERP data into dynamic cash insights that drive faster decisions, tighter collaboration, and measurable performance gains.

Real Results: How Tesorio Customers Reduce DSO Through Integrations

Tesorio customers consistently reduce DSO by streamlining workflows, gaining visibility, and triggering proactive outreach through connected systems.

Example Outcome:

A global SaaS company integrated NetSuite, Salesforce, and Stripe with Tesorio to align finance and sales teams. Within one quarter, they:

- Reduced DSO by 29 days

- Automated 70% of collections emails

- Improved forecast accuracy by 25%

Why It Matters: Integrated data shortens the path from invoice to payment, allowing finance teams to focus on strategic planning—not manual follow-up.

Integration Highlights: Built for Scale and Speed

Tesorio’s integrations are enterprise-ready, secure, and designed to deliver value fast.

What You Can Expect:

- Prebuilt connectors for NetSuite, Oracle, Salesforce, Stripe, Sage Intacct

- SOC 2 compliance and SAML 2.0 SSO support (Okta, Azure, OneLogin)

- API flexibility for custom systems and data workflows

- White-glove onboarding with finance-focused implementation support

Why It Matters: Finance teams shouldn’t have to rely on IT for every integration or workflow change. Tesorio gives you flexibility with control.

FAQs

How do integrations help reduce DSO?

Integrated systems allow Tesorio to automate reminders, payments, and forecasting updates. The result is faster outreach, quicker collections, and fewer invoices falling through the cracks, reducing DSO by up to 33 days.

What ERP systems does Tesorio support?

Tesorio supports integrations with major ERPs including NetSuite, Oracle, Workday, and Sage Intacct.

Does Tesorio support Salesforce?

Yes. Tesorio integrates with Salesforce to bring financial data into account views and provide sales and customer success with visibility into payment risk and AR status.

Is the Stripe integration secure?

Absolutely. Tesorio’s integration with Stripe uses encrypted payment links and branded customer portals to ensure secure, compliant transactions.

How long does it take to integrate Tesorio?

Most teams are live with core ERP and CRM integrations in weeks. Tesorio provides white-glove onboarding and prebuilt connectors.

Does Tesorio support SSO and compliance needs? Yes. Tesorio supports SAML 2.0 SSO (e.g., Okta, OneLogin, Azure) and is SOC 2 compliant.

Final Thoughts

Tesorio makes it simple to connect your ERP and finance stack, so you can move faster, collaborate better, and drive smarter decisions. Our Connected Finance Operations platform ensures that finance teams no longer have to choose between visibility and efficiency. With Tesorio, you get both.

Ready to modernize how your systems talk to each other? Book a demo and see how Tesorio helps finance teams gain control over their cash and confidence in their next move.