Best Automated Compliance Monitoring for SaaS: How AI Transforms Financial Risk Management

By the second week of the quarter, the finance team’s already deep in spreadsheets. Audit prep. ASC 606 schedules. Contract mods pulled from Salesforce. Stripe exports that never quite line up with NetSuite.

You know the rhythm: manual checks, late nights, and Slack threads titled “urgent: revenue tie-out discrepancy.”

For SaaS finance leaders, the problem isn’t a lack of control. It’s that compliance hasn’t evolved as fast as your subscription model. Every upgrade, downgrade, and usage charge multiplies your audit surface area. The more you grow, the harder it is to stay accurate in real time.

Here’s what’s actually slowing teams down:

- The Sampling Blind Spot: Manual audits review 5-10% of transactions, missing the other 90% where errors hide.

- The Growth Paradox: Every $10M in ARR adds exponential billing complexity without adding headcount.

- The Visibility Gap: Issues surface months later during audits, not when they actually happen.

- The Human Drag: Controllers spend 60% of their time validating data instead of analyzing it.

Across top-performing SaaS companies, that’s changing fast. AI-powered compliance monitoring now reviews 100% of subscription events in real time: detecting revenue recognition errors, billing discrepancies, and fraud before they ever reach your financial statements.

Executive Summary:

This guide unpacks the systems, workflows, and technologies redefining compliance for subscription-based finance teams.

Our research across $80B+ in recurring revenue data highlights the best automated compliance monitoring for SaaS companies, along with the strategies separating leaders from laggards in speed, accuracy, and audit readiness.

You’ll find:

- A breakdown of the compliance bottlenecks unique to subscription businesses, and how automation resolves them.

- How leading SaaS teams reduce fraud by 60% and cut audit prep time by 38%.

- The right platform fit by ARR stage ($1M-$200M).

- A 6-12 week roadmap for achieving continuous compliance and measurable ROI.

By the end, you’ll see how automated compliance turns audits from a quarterly scramble into a continuous advantage: giving finance teams the control, confidence, and speed modern SaaS growth demands.

What Is Automated Compliance Monitoring for SaaS Companies?

Automated compliance monitoring for SaaS is an AI-powered software that continuously analyzes every subscription transaction: upgrades, downgrades, contract modifications, usage charges to detect revenue recognition errors, billing issues, and fraud in real-time, before they reach financial statements.

Unlike traditional audits that sample 5-10% of transactions months after processing, AI systems monitor 100% of subscription events as they occur, applying ASC 606 rules and pattern recognition specifically trained on subscription business models.

How it works in three steps:

- Connects your subscription infrastructure: Integrates with billing platforms (Stripe, Zuora), CRM (Salesforce), and ERP (NetSuite) to ingest subscription data in real-time

- Applies subscription-intelligent validation: Combines rule-based ASC 606 checking with adaptive anomaly detection trained on subscription patterns

- Routes exceptions automatically: Prioritizes alerts by revenue impact and routes to appropriate team members for resolution

The key difference: Traditional compliance discovers issues during quarterly audits. Automated compliance monitoring prevents issues at the point of transaction, catching a revenue recognition error when a contract is modified, not six months later during audit prep.

Why SaaS Companies Need Automated Compliance Monitoring Now

Manual compliance can't scale with subscription complexity. A SaaS company growing from $10M to $50M ARR sees billing events increase 10x (more customers, products, usage charges, contract modifications), but can't proportionally expand the finance team without destroying unit economics.

The numbers reveal the severity:

- 61% of invoices contain at least one error

- 50-70% of payment delays stem from preventable data errors

SaaS companies under 100 employees pay $6,975 per employee in compliance costs, which is 60% more than larger companies

What makes this crisis particularly acute for SaaS:

Subscription complexity multiplies faster than headcount. Multi-year contracts, mid-contract upgrades, usage-based charges, multi-element arrangements, and contract modifications create revenue recognition scenarios that manual sampling consistently misses.

Revenue recognition scrutiny is intensifying. The SEC filed 583 enforcement actions in fiscal year 2024, securing $8.2 billion in penalties, with increased focus on subscription revenue recognition practices.

Investor expectations are escalating. Material weaknesses in revenue recognition controls can derail IPOs or delay funding rounds by 6-12 months.

Manual vs. Automated Compliance Monitoring for SaaS: Key Differences

Quick Tip: When evaluating solutions, ask vendors to demonstrate how their system handles mid-contract upgrades with revenue recognition implications: the scenario that consumes the most controller time in subscription businesses.

Which Automated Compliance Monitoring Approach Fits Your SaaS Company?

By ARR Stage:

High-Growth SaaS ($20M-$100M ARR, Series B-D):

- Preparing for fundraising/IPO? → Full subscription compliance platform with continuous audit readiness

- Complex multi-product portfolio? → Multi-element arrangement automation

- Rapid growth (40%+ YoY)? → Scalable platforms proven at your growth trajectory

International expansion? → Multi-currency, multi-jurisdiction monitoring

Mid-Market SaaS ($5M-$20M ARR, Series A-B):

- Limited finance team (3-6 people)? → Subscription billing compliance automation (4-8 week implementation)

- Revenue recognition errors causing audit issues? → Continuous audit systems for ASC 606

- Usage-based pricing creating complexity? → AI-powered usage reconciliation

- Billing disputes damaging NRR? → Real-time error detection before invoices reach customers

Early-Stage SaaS ($1M-$5M ARR, Seed-Series A):

- Limited IT resources? → Cloud-based, pre-integrated solutions for early-stage SaaS

- Simple subscription model? → Start with invoice validation and duplicate detection

- Preparing for Series A? → Focus on investor-ready compliance documentation

- Scaling quickly with lean team? → Platforms that grow with you

By Primary Pain Point:

How SaaS Companies Achieve Results with Automated Compliance Monitoring

Financial Services: Transforming Risk Management at Scale

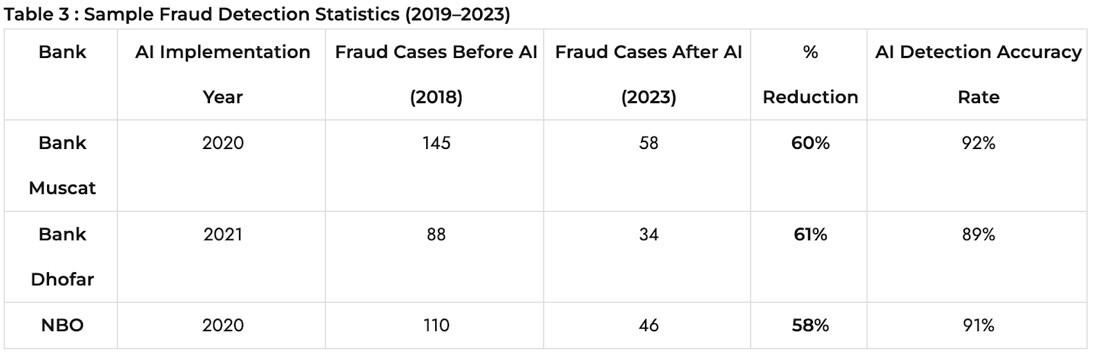

Companies: Bank Muscat, Bank Dhofar, National Bank of Oman

Challenge: High transaction volumes, complex regulatory requirements, sophisticated fraud schemes

Verified Results:

- 60% reduction in fraud cases (343 cases in 2018 → 138 cases in 2023)

- 89-92% fraud detection accuracy

- 38% reduction in audit completion time (45 days → 28 days)

- 92% of reported frauds initially identified by AI rather than human review

- 78% of anomaly cases flagged in real-time before transactions cleared

Mid-Market Technology Company: Scaling Without Headcount Growth

Company: Careem (Uber-owned)

Challenge: 120,000+ invoices annually, manual processes creating bottlenecks

Verified Results:

- 70% reduction in invoice processing time (3 minutes → under 1 minute)

- 332+ hours freed monthly from manual work (equivalent to 2 FTEs)

- 37% more volume handled without additional staff

Enterprise Financial Services: Managing Global Complexity

Company: Oracle's Own Implementation

Challenge: 175+ countries, multiple business units, thousands of daily transactions

Verified Results:

- 20% reduction in audit risks through automated compliance

- 40% faster financial reporting cycles

- $5 million annually saved through fraud prevention

Your 12-Week Implementation Roadmap

Weeks 1-3: Assessment

- Map current subscription compliance processes

- Audit subscription data quality across billing, CRM, ERP

- Select pilot project (usage validation or contract modification automation)

- Document baseline metrics (error rates, processing time, audit prep time)

Weeks 4-8: Pilot

- Deploy AI compliance tools in limited scope

- Run parallel processes (AI + human review)

- Calibrate alert thresholds for your subscription patterns

- Document lessons learned and optimization opportunities

Weeks 9-12: Scale

- Extend automation to additional subscription scenarios

- Implement workflow automation for routine exceptions

- Train finance team on AI-generated insights

- Integrate with SaaS tech stack (Slack, Salesforce, project management)

Expected ROI Timeline:

- Weeks 4-8: Measurable efficiency gains and error reduction

- Weeks 9-12: Working capital improvements visible

- Month 6: Full ROI typically achieved

Evaluating Solutions: The Four Essential Pillars

1. Subscription Technology Excellence

- Subscription-native integration with Stripe, Zuora, Salesforce, NetSuite

- ASC 606 intelligence specifically trained on subscription scenarios

- Subscription data governance with complete audit trails

- Adaptive learning that improves with your subscription patterns

2. Subscription Workflow Intelligence

- End-to-end coverage from quote-to-cash to revenue recognition

- No-code configuration for finance team independence

- Subscription-smart prioritization focused on high-impact activities

- Exception routing based on revenue impact and complexity

3. SaaS Implementation & Usability

- Rapid deployment (4-12 weeks depending on ARR)

- SaaS finance-friendly design using familiar terminology (MRR, ARR, NRR)

- Proven SaaS methodology with similar companies

- Change management support tailored to subscription dynamics

4. Measurable SaaS Outcomes

- Documented SaaS impact with specific customer examples

- Subscription automation rates (target: 85%+ of events automated)

- Revenue recognition precision (target: 95% accuracy)

- SaaS ROI timeline (6-12 months to full return)

Common Questions About Automated Compliance Monitoring for SaaS

Will this replace our SaaS finance team?

No. Automation handles routine subscription validation, freeing your team for strategic work: cohort analysis, expansion revenue forecasting, deal structuring support. The role evolves from transaction validator to subscription strategist.

How long does implementation take for a SaaS company?

Mid-market SaaS ($5-20M ARR): 6-10 weeks. Enterprise SaaS ($50M+ ARR): 12-18 weeks. Most see measurable ROI within 4-8 weeks of pilot deployment.

How does this help with Series B fundraising or IPO prep?

Automated compliance accelerates financial due diligence 40-60% by providing continuous audit readiness, real-time compliance reports, and complete audit trails instantly, rather than weeks of manual compilation.

Can early-stage SaaS companies ($1-5M ARR) benefit?

Yes. Early-stage companies see the greatest relative benefit because they face disproportionate compliance costs while preparing for Series A. Cloud-based platforms make AI accessible without large IT investments.

How does this integrate with our SaaS tech stack (Stripe, Salesforce, NetSuite)?

Modern platforms offer pre-built integrations via API connections that enable real-time subscription data flow without changing core systems. Most mid-market SaaS companies complete integration in 2-4 weeks.

Why SaaS Companies Can't Wait: The Competitive Imperative

Manual compliance that worked at $5M ARR can't scale to $50M ARR without destroying unit economics. Automated compliance monitoring specifically designed for subscription businesses offers a path forward.

Leading SaaS companies implementing these systems report

- 60-90% reduction in revenue recognition errors

- 38% faster audit completion

40% faster fundraising processes

while strengthening financial controls and accelerating fundraising timelines.

But the value extends beyond operational metrics. Automated compliance monitoring enables the strategic shift that modern SaaS CFOs need: from "CF-No" gatekeepers to "CF-Go" enablers who confidently support complex contract structures because they have real-time visibility into revenue recognition implications.

The SaaS companies that will thrive are those that successfully integrate continuous audit systems into their subscription compliance frameworks while maintaining human judgment for complex revenue recognition decisions.

The question isn't whether to adopt automated compliance monitoring. It's how quickly you can implement it to capture the competitive advantage in fundraising, customer acquisition, and operational efficiency.

On G2, 200+ verified reviews (4.7/5) echo the pattern: cleaner rev-rec, fewer surprises, and less time lost to hunting down exceptions, which are all evidence that the shift is already in motion.

Start your transformation

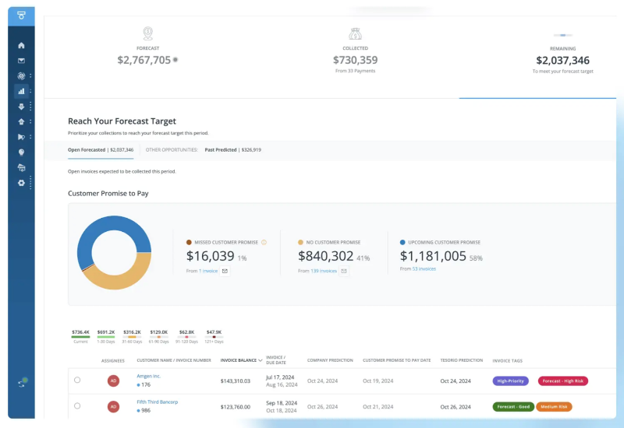

- Size the upside. Open the ROI Calculator to model error-rate reduction, audit-prep hours saved, and working capital impact from continuous monitoring. Many mid-market SaaS teams surface $2–5M in trapped cash equivalent in year one.

- See it in action. Book a personalized demo to walk a real contract-mod scenario (mid-term upgrade, usage recon, multi-element) end-to-end across Stripe/Zuora → Salesforce → NetSuite.

- Explore interactively. Launch the sandbox to test AI-driven event monitoring, anomaly detection, and ASC 606 validation against sample subscription data: no pressure, learn by clicking.

The goal isn’t to swap tools. It’s to turn reconciled, audit-ready data into faster decisions. Do that, and compliance stops being a quarterly fire drill and becomes infrastructure for growth.