Business Credit Reports for SaaS Companies: The Complete 2025 Guide to AI-Enhanced Credit Intelligence

By the time invoices hit 45 days past due, your dashboard starts to feel less like a forecast and more like a warning system. Your sales team swears the customer is “good for it,” your CRM notes are vague, and your finance team is left trying to decide whether to follow up harder, escalate, or extend more lenient terms… all without real visibility into whether the customer can actually pay.

If you run finance at a SaaS company, you know exactly how this goes. Traditional credit reports treat your customers like any other business, ignoring the patterns that actually predict risk in subscription models: renewal behavior, contract expansion, usage volatility, and cash runway tied to fundraising cycles. They weren’t built for ARR-driven businesses, yet SaaS teams are forced to make credit decisions using tools that don’t understand their economics.

Meanwhile, cash flow pressure is compounding. Federal Reserve data shows rising costs are squeezing three out of four businesses, and more than half are struggling just to cover operating expenses. Those macro shifts don’t show up in a standard credit check until it's too late, but they hit your receivables immediately.

Across high-growth SaaS companies, the teams that stay ahead of this volatility share one pattern: they’ve moved beyond traditional credit scores to AI-enhanced credit intelligence that continuously analyzes customer payment behavior, subscription health, burn rate signals, and real-time financial stress indicators.

Executive Summary

Business credit shapes everything from SaaS cash flow to vendor terms to venture debt, yet most finance teams are working with models that don’t understand subscription economics, and credit reports that are often incomplete or wrong.

Our analysis of $80B+ in SaaS receivables shows the impact clearly: software companies collect in 48 days on net-30 terms, carry 30% overdue AR, and have 23% aging past 120 days, where recovery rates collapse.

This guide explains why traditional credit systems miss the realities of recurring revenue, what each bureau actually measures, and how errors in those reports materially affect financing and operations.

You’ll learn the four structural credit challenges unique to SaaS, how to decode PAYDEX/Intelliscore/Equifax scores, how to fix report errors, and how leaders reduce aging through AI-enhanced credit intelligence.

By the end, you’ll have a practical roadmap backed by SaaS-specific data for improving credit health, tightening cash flow, and building a credit strategy that keeps up with the speed of a subscription business.

Understanding Business Credit Reports: What They Are and Why They Matter More for SaaS

A business credit report is a comprehensive record of your company's payment behavior and financial health. Think of it as your company's financial reputation: a snapshot that lenders, vendors, and partners use to decide whether to extend credit, and on what terms.

For SaaS companies, these reports are particularly critical because they determine:

- Access to venture debt that extends the runway between equity rounds. Many SaaS companies use venture debt strategically, and lenders rely heavily on business credit reports to determine terms and availability.

- Vendor relationships with cloud infrastructure providers like AWS, Azure, and GCP. Poor credit means paying up front instead of getting net-30 or net-60 terms, tying up cash that could fuel growth.

- Customer trust from enterprise buyers who increasingly check vendor credit health before signing multi-year contracts. They want assurance you'll be around to support them.

Acquisition readiness when building to exit. Acquirers scrutinize your credit history as a signal of operational excellence.

Unlike personal credit reports, business credit reports pull data from multiple sources: payment history with vendors and suppliers, public records including liens and judgments, company information like industry classification and size, credit utilization and outstanding obligations, and trade references from business relationships.

The Four Critical Credit Challenges Unique to SaaS Companies

Before we dive into how to read and manage business credit reports, let's identify the core challenges software companies face: challenges that are uniquely acute in the SaaS industry and that traditional credit models struggle to assess properly.

Challenge #1: The Subscription Paradox

SaaS companies operate on subscription models, which should provide a predictable cash flow. Yet Federal Reserve data shows that 51% of businesses face uneven cash flows, and software companies are no exception.

Here's the paradox: your MRR looks great on paper, but if customers are 60+ days late on annual renewals, your cash flow suffers. Multi-year contracts with annual or quarterly billing create large invoices that customers delay paying, despite the recurring nature of the relationship.

Couchbase, a NoSQL database company, faced this exact challenge pre-IPO. Despite growing ARR by 100%, they struggled with a DSO/DPO imbalance: paying suppliers faster than collecting from customers. This resulted in constant cash flow pressure that threatened their ability to invest in growth.

After implementing AI-enhanced credit intelligence, they reduced DSO by 10 days and improved their DSO/DPO ratio from negative to parity. Their CFO noted: "We haven't raised capital in three years because we have better cash flow performance and can live off what we bring in." That's the power of understanding and optimizing credit management.

Challenge #2: The Error Epidemic

Rapid growth means frequent changes for SaaS companies: new addresses, entity restructuring, acquisitions, and pivots. Credit bureaus struggle to keep up, leading to errors that compound over time:

- Wrong industry classification (generic "software" instead of specific SaaS category)

- Duplicate entries from entity changes or acquisitions

- Outdated information from pre-pivot business models

- Missing positive payment history from new vendor relationships

According to Nav.com's 2024 data, 23% of businesses with unresolved credit report errors face funding challenges. For SaaS companies in growth mode, this translates to higher interest rates on venture debt, reduced credit lines for working capital, delayed acquisitions due to credit concerns, and lost vendor relationships from perceived risk.

Challenge #3: The Bureau Confusion

Unlike personal credit with standardized FICO scores, business credit has three bureaus using completely different methodologies. Dun & Bradstreet uses PAYDEX (0-100 scale), Experian uses Intelliscore Plus (1-100 scale), and Equifax uses a Business Credit Score (101-992 scale). Each bureau may have different information about your business, and different lenders check different bureaus.

The real problem is that traditional credit models don't understand SaaS economics. A company with $50M ARR, 120% net revenue retention, and negative cash flow (from growth investment) might score poorly despite being an excellent credit risk.

High gross margins but negative cash flow, large customer concentrations from strategic enterprise deals, deferred revenue that confuses traditional scoring models, and rapid scaling that looks risky to traditional algorithms: all of these SaaS characteristics get penalized by credit models designed for traditional businesses.

Challenge #4: The Manual Trap

Traditional credit management relies on manual processes: pulling reports, entering data into spreadsheets, and making gut-feel decisions. This approach doesn't scale when you're adding 50+ new customers per month.

Veeva Systems, a life sciences SaaS company, found its collections team spending 25% of their time, a full day per week, on low-priority accounts. They couldn't identify which accounts actually needed attention and which would pay on their own. After implementing AI-powered prioritization, they reduced this to less than 2 hours weekly: a 92% time savings and cut 90-day aged accounts by 50%.

Finance teams spend 25%+ of their time on manual data gathering instead of strategic analysis. For SaaS companies doubling revenue annually, this manual approach becomes unsustainable. If your collections team is growing 1:1 with customer count, you have a scaling problem that will only get worse.

Decoding Business Credit Reports: The Three Bureaus and What They Measure

Now that you understand why business credit matters and the unique challenges SaaS companies face, let's break down how to actually read and interpret these reports. Understanding the three major bureaus and their different scoring systems is your foundation.

The Three Major Business Credit Bureaus

Dun & Bradstreet is the standard for SaaS venture debt. Most venture debt lenders check D&B first, and your PAYDEX score directly impacts availability, terms, interest rates (which can vary 2-5% based on score), and covenant requirements.

The good news is that D&B understands recurring revenue models better than other bureaus and tracks SaaS-specific metrics like churn and retention. Getting a D-U-N-S Number is free and should be done on day one, as it takes 30 days to appear in the system, and you can't build credit without it.

Experian Business is best for high-growth SaaS companies because their models are more sophisticated and better at understanding companies with negative cash flow. They consider growth trajectory, customer acquisition efficiency, retention metrics, and venture backing as positive signals. This makes them more forgiving of short operating history and better for companies with strong unit economics but negative cash flow.

Equifax Business is particularly good for companies with usage-based billing models and variable monthly charges. They better understand consumption-based pricing, track payment patterns for variable billing, and are useful for infrastructure-heavy SaaS companies with high AWS bills.

Overall, you need to monitor all three bureaus because different lenders use different bureaus. Each may have different information, and errors on one bureau won't appear on others. If the budget is limited, start with Dun & Bradstreet (most widely used), add Experian next (better for growth companies), and add Equifax last (specialized use cases).

The Key Metrics That Determine Your Credit Health

Understanding the bureaus is just the start. Now you need to know what metrics actually matter and how SaaS companies should interpret them. These three metrics, when combined, paint a complete picture of your credit health.

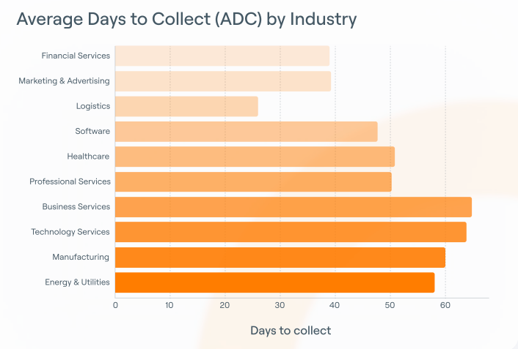

Average Days to Collect (ADC): Your Cash Flow Velocity

This metric reveals how quickly you collect payments from customers. This is critical for SaaS companies because cash flow timing determines runway and growth capacity.

On average, software companies average 48 days to collect. Compare that to Financial Services at 39 days (best in class), Marketing & Advertising at 39 days, Manufacturing at 49 days, and Business Services at 65 days (worst).

Why does this matter? Every day an invoice sits unpaid is a day that cash isn't available for customer acquisition, product development, team expansion, or infrastructure scaling.

For SaaS companies, ADC should be compared to your payment terms. If you offer net-30 and your ADC is 48 days, you're giving customers an extra 18 days of free financing: that's working capital you could be using for growth.

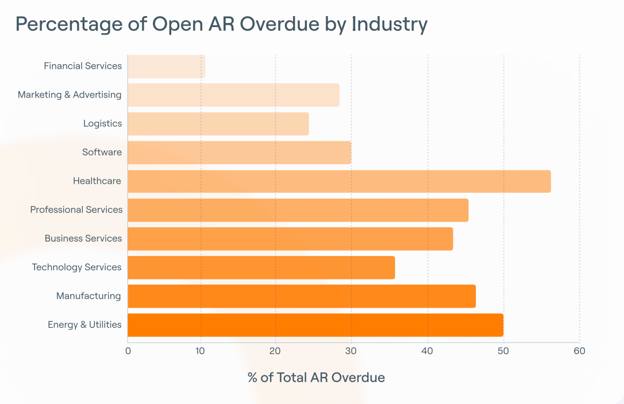

Percent of Open AR Overdue: Your Collections Discipline

This shows what percentage of your total receivables are past due. For SaaS companies with subscription models, high overdue rates signal problems with payment method failures (expired credit cards), customer satisfaction issues, billing system problems, or collections process inefficiencies.

Software companies average 30% overdue rate, compared to Financial Services at 11% (best in class), Marketing & Advertising at 28%, Healthcare at 56% (worst), and Energy & Utilities at 50%.

High overdue percentages tell lenders and vendors that you may struggle to collect from your own customers: raising questions about product-market fit (are customers happy?), collections effectiveness, customer financial health, and churn risk.

Severity of AR Aging: Your Write-Off Risk

This metric reveals how much of your overdue receivables has aged beyond critical thresholds. Research from global trade credit insurers shows that accounts over 90 days past due are collected only 20-30% of the time on average. Once AR ages beyond 120 days, you're looking at 70-80% write-off risk.

Software companies have 23% of overdue AR aged beyond 120 days, compared to Marketing & Advertising at 3% (best in class), Financial Services at 10%, Manufacturing at 21%, and Energy & Utilities at 49% (worst).

For SaaS companies, aging beyond 120 days often indicates the customer went out of business, there's a dispute over service quality or uptime, a billing error wasn't caught early, or the customer churned but the invoice wasn't written off.

The financial impact is staggering. For a SaaS company with $10M in AR and 23% aging beyond 120 days, you're looking at $2.3M at risk. With 70-80% write-off rates, that's $1.6-1.8M in potential losses.

This means companies should implement early warning systems that flag accounts at 30 days past due, not 90 days. By the time an account hits 90 days, your recovery odds have already dropped dramatically. AI-powered predictive analytics can identify at-risk accounts before they age, when intervention is still effective.

Finding and Fixing Credit Report Errors: A Systematic Approach

Now that you understand what the reports measure and why it matters, let's address the elephant in the room: credit report errors are epidemic. Studies show that one in five consumers identify errors on their credit reports, and business credit reports with less standardization and oversight face similar or higher error rates. Here's how to find them and fix them systematically.

Step 1: Pull Reports from All Three Bureaus Quarterly

Don't wait for annual reviews. SaaS companies should check credit reports quarterly, and more frequently if you're actively seeking financing, experiencing rapid growth (50%+ YoY), recently completed entity restructuring or acquisition, or preparing for IPO or strategic acquisition.

The cost is $150-300 for all three bureaus, or $49-99/month for ongoing monitoring. Schedule quarterly credit checks on your calendar (Q1, Q2, Q3, Q4) and assign ownership to your Controller or CFO. Don't let this slip. Errors compound over time.

Step 2: Review Each Section Systematically

Create a checklist to review identity information, payment history, credit accounts, and public records. For identity information:

- verify your business name is correct (including any DBAs)

- address is current

- NAICS code matches your actual business (use 511210 for Software Publishers: wrong classification can hurt your score)

- entity type is correct (LLC, C-corp, etc.), and

- years in business are accurate.

For payment history, check that all reported payments are accurate, there are no late payments that were actually on time, disputes are properly noted, closed accounts are marked closed, and there are no duplicate entries.

For credit accounts, ensure all listed accounts are yours, credit limits are accurate, utilization is calculated correctly, and there are no accounts from acquired companies (unless intended).

Step 3: Dispute Errors Immediately

Each bureau has different dispute processes, but the principle is the same: provide detailed documentation and follow up persistently.

For Dun & Bradstreet, log into your D&B account to submit disputes through their online portal with supporting documentation (invoices, payment confirmations, bank statements), and expect a 30-45 day resolution. Follow up if not resolved within 45 days.

For Experian Business, use their dispute center, provide a detailed explanation and evidence, and they'll investigate and respond within 30 days.

For Equifax Business, file disputes online or by mail, include detailed documentation, and allow 30-60 days for investigation.

Disputes with evidence resolve 3x faster than disputes without documentation. Gather all supporting documents before filing to avoid back-and-forth delays.

Step 4: Prevent Future Errors

Prevention is easier than correction. For SaaS companies, this means:

- notifying bureaus of entity changes (after reincorporation, acquisition, or name change, proactively update all three bureaus: don't wait for errors to appear),

- verifying vendor reporting (ask major vendors like AWS and Salesforce if they report to credit bureaus, and if not, request that they do)

- monitoring after major events (check credit reports 30-60 days after any significant business event)

- maintaining clean records (keep detailed payment records, invoices, and correspondence), and

- assigning ownership (make someone responsible for quarterly credit monitoring).

Choosing Your Path: Credit Management Strategy by Company Stage

Not all SaaS companies have the same credit management needs. Your strategy should match your stage, resources, and goals. Here's how to determine your priorities and next steps.

For Pre-Revenue SaaS Startups (0-$1M ARR)

Your primary focus is on building credit from zero. Get EIN and D-U-N-S Number immediately, establish vendor credit accounts that report to bureaus, apply for a startup-friendly business credit card (Brex or Ramp), and pay everything on time to build positive history.

For monitoring, free credit monitoring is fine initially: check reports quarterly and upgrade to paid monitoring at $500K ARR. For technology, spreadsheets are fine for now: focus on building history, not automation.

Expected outcome: a foundational credit profile that enables vendor terms and small credit lines within 90 days.

For Early-Stage SaaS Companies ($1M-$10M ARR)

Your primary focus is on improving credit scores and establishing vendor relationships. Monitor all three credit bureaus quarterly, dispute any errors immediately, establish payment discipline (target 100% on-time), diversify credit types (cards, lines, vendor accounts), and prepare for venture debt if VC-backed.

For monitoring, invest in paid monitoring from at least one bureau (D&B recommended), do quarterly reviews of all three bureaus, and set up real-time alerts for score changes. For technology, consider basic AR automation if managing 50+ customers, implement automated dunning for overdue accounts, and use accounting software with AR features (QuickBooks, Xero).

Expected outcome: credit scores in "good" range (PAYDEX 70-79, Intelliscore 60-75), access to $100K-500K credit lines within 6-12 months.

For Growth-Stage SaaS Companies ($10M-$50M ARR)

Your primary focus is optimizing credit performance and scaling collections. Benchmark against industry leaders (39-day ADC, 11% overdue), implement AI-powered credit monitoring and collections, connect credit data across ERP, CRM, and customer success platforms, establish real-time cash flow forecasting, and prepare for venture debt or acquisition.

For monitoring, implement real-time monitoring across all three bureaus, set up automated alerts for score changes and customer risk, and conduct monthly credit performance reviews.

For technology, invest in an AI-enhanced credit intelligence platform, implement connected credit intelligence across all systems, use predictive payment analytics, deploy automated collections workflows, and establish real-time forecasting.

Expected outcome: credit scores in "excellent" range (PAYDEX 80+, Intelliscore 76+), 33-day DSO reduction, 3x collections productivity, access to $1M-10M credit facilities within 3-6 months.

For Enterprise SaaS Companies ($50M+ ARR)

Your primary focus is on maintaining excellence while scaling and preparing for IPO or acquisition. Maintain top-quartile credit performance (39-day ADC, <20% overdue), implement connected credit intelligence for real-time visibility, scale collections without proportionally scaling headcount, optimize for capital efficiency (avoid raising additional capital), and prepare for IPO or strategic acquisition.

For monitoring, implement real-time monitoring with executive dashboards, set up automated alerts and proactive risk management, conduct weekly credit performance reviews, and provide board-level reporting on credit metrics.

For technology, deploy enterprise-grade connected credit intelligence, ensure full integration across all financial systems, use AI-powered forecasting and predictive analytics, implement automated collections with personalized dunning, and create executive dashboards for real-time visibility.

Expected outcome: best-in-class credit performance (AR Health Index 0.75+), ability to answer executive questions in minutes, capital efficiency that extends runway or eliminates the need for additional funding.

Your Next Steps: From Understanding to Action

You now have a clear picture of how business credit works for SaaS companies: what bureaus measure, where the biggest errors occur, which metrics matter most, and how AI-enhanced credit intelligence changes the pace and precision of decision-making.

The takeaway is simple: credit isn’t a back-office task. It’s a direct lever on cash flow, capital access, and operational resilience.

The gap between manual credit management and connected intelligence is widening quickly. Teams that modernize are collecting faster, reducing aging, and navigating fundraising or vendor negotiations with far more confidence. Teams that don’t are stuck with the same constraints: slow processes, blind spots, and preventable cash flow drag.

If you want to understand the upside for your own business, here are three practical next steps:

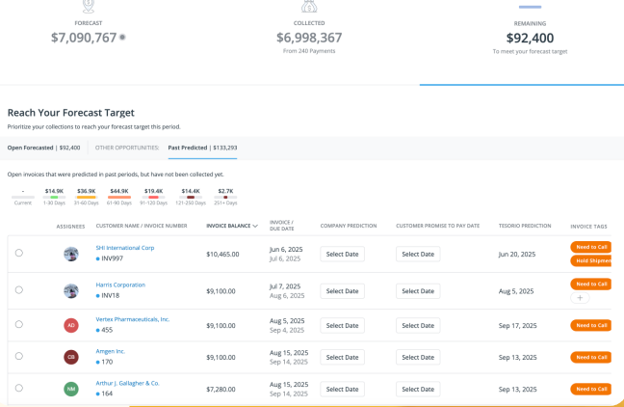

- Size the impact: Use Tesorio’s ROI calculator to quantify how improvements in DSO, overdue rates, and forecast accuracy affect working capital.

- See the workflows live: Book a demo to understand how connected credit intelligence surfaces risk earlier and streamlines collections.

- Pressure-test your assumptions: Explore your data inside the interactive sandbox to see how credit scoring, prioritization, and forecasting adapt in real time.

More than 200 finance teams rate a platform like Tesorio 4.7 on G2, consistently pointing to tighter forecasting, cleaner credit visibility, and less manual reconciliation as the outcomes that move the needle.

SaaS companies that upgrade now gain the 20-30% working-capital advantage that compounds over time. Those that don’t will feel the cost in every delayed payment, every fundraising cycle, and every strained cash forecast.