Put Collections on Autopilot with Tesorio’s AR Automation

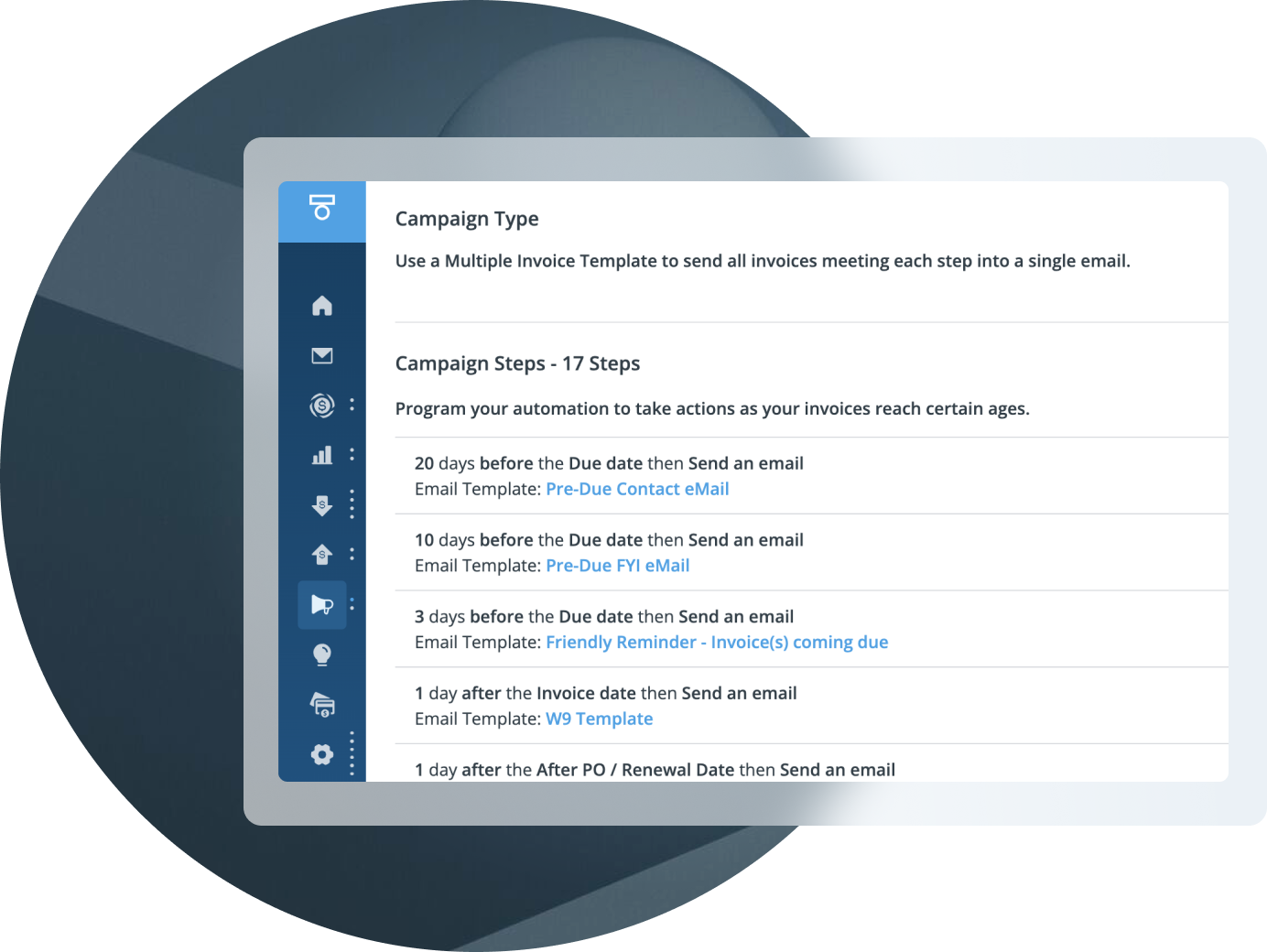

Automated Collections Campaigns

Create tailored email templates in minutes that trigger at the right moment, with easy customer segmentation by tags, types, and invoice age.

Learn More

Take the Tour

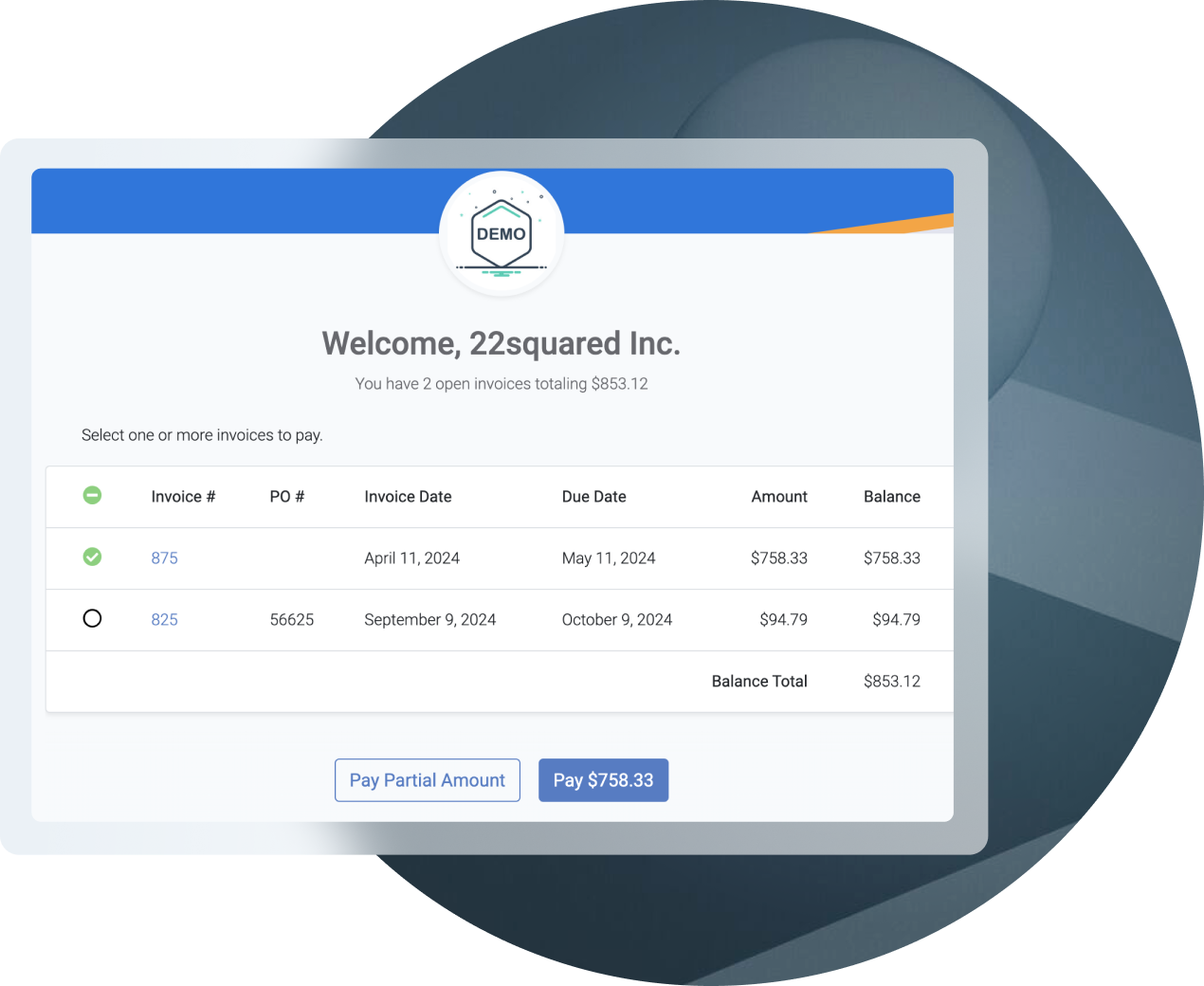

Payment Portal

Enable secure online payments, resolve disputes, view invoices, and track payment history—all in one platform, delivering faster collections and a seamless billing experience.

Learn More

Take the Tour

Cash Application

Speed up the cash application process with automated payment matching, reducing the time spent reconciling incoming payments.

Learn More

Take the Tour

Unlock Savings-Calculate Your ROI with Tesorio's AR Automation

YOUR RETURN ON INVESTMENT WITH TESORIO

1 year Savings

$589,522

Monthly Cost of Delay

$175,863

Working Capital Savings

$21,747,945

Productivity Savings

$588,000

Reduced DSO Savings

$1,522,356

Estimated DSO

73 Days

Calculation Confidence

"Prior to Tesorio, I had to manually consolidate 14 spreadsheets each week. Now with Tesorio, I can simply run an aging report, and trust they’ve received the appropriate dunning campaigns without reviewing each account scenario."

Danica Y.

Director of Collections & Payment Operations at Box

"What do I like best? The ease of implementation and the fact that they listen to their users. We have had countless small updates over the past 1.5 years, making our life that much easier."

G2 Review

"Tesorio has enabled us to fully automate our AR collections process, improving our AR aging and reducing the amount of manual work in heavy excel files."

G2 Review

"Tesorio is an outstanding collection tool that will help drive cash, lower DSO, and help prioritize daily tasks!"

Will Y.

Senior AR Manager at Smartsheet